Previous articles have already shown the limits of the Robinhood model – hidden costs, heavy marketing, improper disclosure of risks…

Previous articles have already shown the limits of the Robinhood model – hidden costs, heavy marketing, improper disclosure of risks…

New research now shows additional side effects: major tax headaches, suicide, addiction, anxiety, withdrawal symptoms…

And an IPO.

Trading on Robinhood may cause major tax headaches

Your trading profit isn’t necessarily your economic profit; other factors come into play. Morningstar’s article, as well as Forbes’ article on the same day, both point to a 30-year-old day trader earning $60,000/year in his regular job, who started trading stocks actively. Very actively.

- His initial $30k deposit was leveraged 3x by Robinhood to $90k.

- He traded 10-50 times a day, for an average daily volume $200k-$2m volume.

- In total, he traded $45m of notional in 2020, always trading the same headline-grabbing stocks: Tesla, GameStop…

- He generated $45k of trading profits over the period (0.1% margin average, IMO good for a stat-arber, but very poor for an investor).

The story became tragic when the trader filed his tax return: he owed $800k to the tax man, and his accountant could not help him.

The story became tragic when the trader filed his tax return: he owed $800k to the tax man, and his accountant could not help him.

The wash sale rule says that you can offset your gains with your losses ONLY if you have held the security for more than 30 days. You also cannot replace it with a similar or equivalent security, etc. The trader used his Robinhood account, which is not exempt from such considerations.

=> the trader was taxed on his gains, not on his net profit. For an income of $60k per year and probably $30k savings, a tax bill of $800k is a trading activity’s dreadful conclusion.

Outcome:

Outcome:

Outcome:

Outcome:We don’t know the end of the story yet for that trader. This being said, he may get a partial remission and a payment plan, but he will not get a free card. He is likely to be on the hook for many years worth of salary.

Nota #1: You can’t waive a tax lien with a Chapter 7 bankruptcy.

Nota #2: He’s probably not the only one. Statistics anybody?

Nota #3: Did Robinhood ever advertise those tax consequences as much as the fun of trading? That’s what I thought.

Trading on Robinhood may cause suicide

You may have heard the sad story of Alexander Kearns, the student who took his life after seeing a loss of $730,000 in his account. Most people don’t know that the loss number was actually erroneous and that Robinhood never replied to his requests for help. Here are the facts:

- Alex was a joyful trombone-playing college student.

- He used his $5k life-long saving to open an option trading account.

- In June 2020, his account showed an unexpected negative balance of $730k.

- He did not understand. He was trading put spreads and should never have been exposed to such a loss.

- He emailed Robinhood ‘s support several times, but the company never replied except for automated emails. Robinhood had no phone support.

- Then an automated email called him on a $170k margin. He also received a trading suspension.

- Unable to face the financial consequences, and scarred of dragging his family into ruin, he ended his life.

- His suicide note included

“Please understand that this decision was not made lightly. You could fill an ocean with the amount of tears I’ve shed typing this. Please, please take care of yourselves. The amount of my guilt I feel as I commit to this is unbearable—I did not want to die.”

“Please understand that this decision was not made lightly. You could fill an ocean with the amount of tears I’ve shed typing this. Please, please take care of yourselves. The amount of my guilt I feel as I commit to this is unbearable—I did not want to die.”

- The next day, an automated email from Robinhood said that the problem had been resolved and the account was unfrozen. It was a miscalculation. There never was a loss. “We’re happy to help!”

Outcome:

Outcome:

Outcome:

Outcome:Alex’s parents are now suing the company for “wrongful death, negligent infliction of emotional distress and unfair business practices”.

The company’s CEO has so far declined to comment or answer questions. The firm has “committed to improving the user interface“, as well as to “expand customer phone support.”

Jay Clayton, the head of the SEC, confirmed that the commission was looking into disclosure improvements. I would suggest also looking at the requirements to qualify for option trading, as well as the ease at which Robinhood permitted Alex to manage such an exposure.

A few comments about retail trading collected here and there afterwards:

- Terreance Odean, UC Berkeley professor and a day trading specialist: “you don’t commit suicide because you lost your play money.” “It wouldn’t be horrible to give people five minutes of education.”

- Charlie Munger of Berkshire Hathaway: “I regard that [day trading] as roughly equivalent to trying to induce a bunch of young people to start off on heroin. It is really stupid.”

Trading on Robinhood may cause addiction

“Addiction” is the inability to stop consuming a chemical or pursuing an activity although it’s causing harm. Excessive trading is a form of gambling addiction. I didn’t invent this. This statement is a scientific conclusion, published in scientific papers. The Addiction Center gives similar warnings.

A few interesting comments, notably from Maker’s article on the topic:

A few interesting comments, notably from Maker’s article on the topic:

- Many human activities have stopping cues (the end of a chapter, the end credits of the movie, etc.). Modern activities like casinos, Facebook and Netflix are engineered to have no end. Robinhood is in that category, with marketing techniques like tapping 1,000 a day to advance, confetti’s for transactions, a candy crush interface, constant updates of stock related articles, phone notifications…

- The app’s design is drawing young users to the riskiest forms of trading like options. It also highlights more risky investments like cryptocurrencies with dazzling neons.

- Through its design, Robinhood induces dopamine rushes (pleasure neurotransmitter).

- Men trade more than women, and unmarried men trade more than married men.

- Investors with a large differential between their existing economic conditions and their aspiration levels hold riskier stocks in their portfolios.

- BTW, 12% of all trading activity is from day-traders, yet day-traders are only 1.6% of all profitable traders.

Would Robinhood engineer this behavior on purpose? Robinhood received $18,955 from trading firms for every dollar in the average customer account. Schwab only received $195 for the same deal. That looks like a good incentive, IMO.

Outcome?

(A) Many inexperienced traders have jumped into day trading.

(B) There are endless warnings about an impending crash (but also fundamental reasons for market to keep on climbing).

(C) Stock market crashes are linked to upticks in suicide.

(A) + (B) + (C) = A market crash will lead to many inexperienced traders jumping to their deaths. That should be a serious health warning sign, if not a cue for authorities to act.

Trading on Robinhood may cause anxiety

Robinhood’s low-cost trading model (see PFOF article), its efficient marketing and the gamification of stock trading, the COVID stimulus payments, as well as the forced confinement for the country’s entire population have engendered a soaring popularity for day trading and Robinhood. The examples above show that the trading aspiration has not turned so good for many. Six months after Alex Kearn’s death, the firm’s commitment to expanding customer phone support still has a long road ahead.

This WSJ’s article, dated April 28, 2021 indicates:

This WSJ’s article, dated April 28, 2021 indicates:

- Opening an account takes hours. Trading takes second. Getting an account problem fixed can take weeks.

- The firm has regular outages. The trading restrictions have also attracted over a dozen lawsuits & class actions already.

- Mr. Mesa, the company’s head of customer experience said: “If you, overnight, have an increase of 350% of volume, there’s just not enough humans to throw at the issue to be able to deliver effective support.” Wouldn’t that qualify the problem as a ‘structural issue’ then?

- One of Robinhood’s customer wanted to transfer her positions to Fidelity. The transfer didn’t take “five or seven days” to complete, but two weeks. By that time, her GameStop stocks had plunged.

- A trader needed his tax forms, and was promised that they would come by February 17. “To this day”, he his still waiting.

Other issues mentioned in the press:

- Accounts locked for more than a month.

- Robinhood hiring Dan Gallagher, a senior lobbyist from the SEC and with Republican access… to smooth the issue with authorities (Bloomberg)? How about spending money on solving the issues?

- Robinhood expanding into options and cryptocurrencies, even more risky assets, as well as offering the possibility of borrowing money.

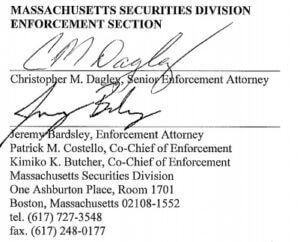

Trading on Robinhood may cause withdrawal symptoms

Massachusetts’ regulator started the process to revoke the Robinhood’s broker-dealer license. The petition mentions the firm’s

Massachusetts’ regulator started the process to revoke the Robinhood’s broker-dealer license. The petition mentions the firm’s

- ~500,000 customers in the state, as well as 68% of the state’s entire option-approved population,

- targeting of younger individuals with little or no investment experience,

- failure to prevent or answer to outages and disruptions,

- encouragement to users to purchase securities without any consideration to suitability,

- incentive to trade frequently (dozens of trades per day per user, resulting in thousands of trades overall, confetti for every trade),

- failure to supervise the review and approval of option trading in customer accounts with an automated process,

- and a swath of argument about failure to meet fiduciary duties.

The state regulator’s administrative action requests censure, loss restitutions to investors, disgorgements, and fines. It calls Robinhood’s behavior “a complete rejection of responsibility to their customers.”

The state regulator’s administrative action requests censure, loss restitutions to investors, disgorgements, and fines. It calls Robinhood’s behavior “a complete rejection of responsibility to their customers.”

Needless to say, that action maybe only at the Massachusetts state level, but it has teeth. Should it be enforced, the case would incentivizes other states to follow suit.

Outcome:

Robinhood naturally decried the move to revoke its license as “elitist and against everything we stand for,” and filed its own lawsuit in state court seeking to invalidate the fiduciary rule, arguing it “exceeds its authority under both Massachusetts state law and federal law.” Somebody

Robinhood is filling for an IPO

On March 23rd, 2021, Robinhood announced in this press release that it was filing for an IPO. In economic terms, it means that the owners of the company are selling part or all of their firm to other investors.

On March 23rd, 2021, Robinhood announced in this press release that it was filing for an IPO. In economic terms, it means that the owners of the company are selling part or all of their firm to other investors.

Interestingly enough, they are doing so by filling a confidential IPO, arguing that they do not yet know how much of the firm they will sell. This process, fully allowed since 2017, means that company owners can keep some information longer than normal. That confidentiality covers notably directors’ compensations, as well as the timing of the issuance.

The firm, which sought a capital infusion during the GameStop crisis, has been valued ~$12 bn. In the current low-rate, high-tech appetite period, the IPO would probably value the company at $20bn. On average, company prices rise by 36% on their first trading day.

Let me try to understand this:

- the firm sees exponential growth, thanks to the current COVID environment,

- targets unexperienced customers with an aggressive marketing,

- its customers end up with enormous tax losses,

- and are so frighten by what they have done, that they sometimes kill themselves.

- Meanwhile, the firm has received dozens of lawsuits for its outages.

- The firm has such shoddy regulatory practices, that a state is going after its broker-dealer license.

- The firm is a regulated broker-dealer. All litigations against the firm must be handled through FINRA.

- FINRA arbitrations are private. We don’t know the extent of those litigations, and won’t know for the 2-4 years after filing.

Outcome?

The owners are selling their company at a peak growth time. Nothing wrong there. Considering the issues the firm is facing, the timing is better than just selling at the right growth opportunity; doing it now looks very much like passing on the hot potato.

At this stage, the current owners would end-up selling their stock at a 20/12 = 65% premium from the current valuation. Early traders allowed to participate in the IPO would gain a additional statistical 35% on day one. After that, traders/investors would pay the price available at the time. At least in the short-term, that price will be based on the premium-adjusted current valuation, aka based on the current perennity assumptions for the business and its future cash flows, as well as its hidden legal liabilities.

Let me ask this. Who will bear the cost of that premium, that perennity assumption, those legal liabilities, that potential broker-dealer revocation, and the follow-up revocations if things don’t turn out as great as announced? The retail traders who will buy the stocks.

That wouldn’t be out of synch from the management, wouldn’t it?

References

- Addictive Behaviors, January 2017, Volume 64, pages 340-348: Excessive trading, a gambling disorder in its own right? A case study on a French disordered gamblers cohort

- Maker, Jun 23, 2020: Robinhood Has Gamified Online Trading Into an Addiction

- Financial Times, July 2, 2020: The lockdown death of a 20-year-old day trader

- Reuters, December 8, 2020: Exclusive-Trading app Robinhood hires Goldman Sachs to lead IPO -sources

- CBS News, February 8, 2021 Alex Kearns died thinking he owed hundreds of thousands for stock market losses on Robinhood. His parents have sued over his suicide.

- Quartz, March 24, 2021: Why Robinhood is keeping its IPO filing confidential

- MorningStar, March 26, 2021, Can you owe $800k Tax on a profit of $45k?

- Forbes, March 26, 2021, Robinhood Trader May Face $800,000 Tax Bill.

- April 28, 2021: Robinhood Has a Customer Service Problem

Related articles from Navesink International:

- December 21, 2020: Robinhood’s $65m SEC penalty and the ‘gamification’ of trading

- December 22, 2020: A History of Day trading: Regulators, Congress and Robinhood

- January 7, 2021: Most Robinhood day traders lose money

- Jan 27, 2021: The revenge of the retail trader

- Jan 31, 2021: The Sherwood Forest of financial markets

- February 11, 2021: The high price of free trade

- March 17, 2021: The Tesla and Bitcoin lures