Silicon Valley Bank, aka SVB, defaulted on Friday. At $212 bn of assets, it is the largest failure since 2008, and probably one of the fastest – it went from rumor to belly-up in only two days.

Silicon Valley Bank, aka SVB, defaulted on Friday. At $212 bn of assets, it is the largest failure since 2008, and probably one of the fastest – it went from rumor to belly-up in only two days.

Here is an explanation of the events.

The events

As its name indicates, Silicon Valley Bank is a bank for the Silicon valley. Many of its clients are small start-ups, who rely on their investors’ cash to pay their employees and fund their growth. The bank apparently has business relations with nearly half the start-ups of the region.

There are several concomitant factors:

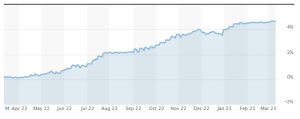

- After a 30% market drop at the start of COVID, the low-rate environment has fuelled a market rally. The S&P went from a low of 2,300 to a top of 4,700.

The restart of the economy caused inflation, and the central bank started to raise rates again. The short-term interest rates have risen, from virtually zero to over 4.8%.

The restart of the economy caused inflation, and the central bank started to raise rates again. The short-term interest rates have risen, from virtually zero to over 4.8%.- The equity markets dropped, dropping to a low of ~3,600 or -25%.

- The rumors of a further rate rise, a further market downfall, and the risks of recession have covered all the headlines.

- Who wants to invest in equities and start-ups right before an economic crash? Investors have stopped funding start-ups – slow down of IPOs and private equity offerings.

- Those start-ups have used their cash, drawing altogether large amounts from SVB. Some failed.

- SVB was using the cash deposit and investing into long-term debt. The thrift was positive last year. It is now negative, due to the recent inversion. The bank was accruing running continuous losses.

- Worse, SVB had to sell those bonds to fund the cash withdrawals. It was forced to liquidate large bond positions.

- Since the long-term rates have also risen, those bonds are sold apparently below their accounting value – generating losses, if not mark-to-market losses. The announcement of the share offering notably had this sentence, mentioning ‘tax losses’:

- The bond sale losses added to the downgrades losses of SVB’s loans (and possible equity investments) in its start-up borrowers.

To maintain its capital ratios, SVB announced a capital raise, which didn’t go too well as its stock price kept on falling. The bank’s stock dropped 60%.

To maintain its capital ratios, SVB announced a capital raise, which didn’t go too well as its stock price kept on falling. The bank’s stock dropped 60%.- It eventually tried to look for a buyer altogether, an effort which failed as well.

- A classic run on the bank followed. Many start-ups pulled their deposits.

- The company became belly-up two days after announcing its capital raise.

The FDIC has now stepped in and taken control of SVB’s assets. The insurer has already created a new bank and transaction facilities, and will keep on honoring up SVB’s transactions and withdrawals to $250,000 per account, starting on Monday.

Any small company or individual with more than this amount will become a first-line creditor in the bankruptcy proceedings. That will not be pleasant for many: uncertainty, delays, and very likely losses down the road.

The FDIC has not yet confirmed the amount, but apparently 90% of the bank’s assets are uninsured.

The questions

A few questions arise

A few questions arise

- Why did SVB wait for so long to raise equity? It is their lack of action in the past, combined with the announcement, which generated the bank run. There’s a Chief Risk Officer who will not get a job anytime soon.

- Why did the sale of bonds create a tax loss? $1.8 bn of tax losses on a $21 bn sales, aka 8.5%, indicates that the bond mismarking were probably much bigger (at 25% tax, the bonds would have been 35% mismarked). A proper valuation would have forced the bank to realize its losses as the long-term yield rose, not when it sold those bonds.

- More importantly, who else will be hurt by the losses? What contagion can we expect?

- Many start-ups will go belly-up.

- Many investment PE/VC funds will have to declare losses. Their investors could have financial difficulties.

- Did SVB owe large sums to other important financial companies? Nobody knows yet.

So far, financial analysts are saying that SVB was unique, and no financial contagion is to be expected. The big banks will not be impacted much.

So far, financial analysts are saying that SVB was unique, and no financial contagion is to be expected. The big banks will not be impacted much.

But Silicon Valley will suffer for sure. Some angel investors will become graveyard gnomes.

PS: The rumor is that $2bn of SVB withdrawals went to Brex, another Silicon Valley bank. That bank may enjoy the new cash flow, but it probably has a bunch of loans with other local start-ups… Bis repetita?

Sources:

- SVB announcement, March 8, 2023: SVB Financial Group – SVB Financial Group Announces Proposed Offerings of Common Stock and Mandatory Convertible Preferred Stock

- The New York Times, March 10, 2023: Silicon Valley Bank Fails After Run by Venture Capital Customers – The New York Times (nytimes.com)

- CNBC, March 10, 2023: Silicon Valley Bank fails to find buyer as run on bank outpaced sale process (cnbc.com)

- CNN Business, March 10, 2023: Silicon Valley Bank collapses after failing to raise capital | CNN Business

- The Verge, March 10, 2023: FDIC shuts down Silicon Valley Bank – The Verge