Two articles coincide into a disappointing conclusion. The financial markets will lure a chunk of the stimulus money into bad investments.

Two articles coincide into a disappointing conclusion. The financial markets will lure a chunk of the stimulus money into bad investments.

Elm Partners: do not concentrate your assets as Elon Musk does

An interesting article, Bigger Is The Enemy of Better Investing, has just been published in Bloomberg by Victor Haghani and Richard Dewey of Elm Partners. It shows that Elon Musk’s rapid wealth increase, coming from the meteoric rise of Telsa, is actually a bad example of asset allocation.

The concentration of wealth into a single asset may generate impressive successes but usually doesn’t. Today’s Redditers may count self-made millionaires, but “keeping the faith in your favorite stock” isn’t the best way to get there, far from it. The authors conducted an experiment, where individuals can grow an initial gift of $25 with a biased coin of 60/40 chances of double-or-lose-your-bet. Surprisingly, 30% of participants lost their entire wealth in a few bets, despite the outcome being in their favor. Very few thought of diversifying their bets, which almost guarantees to reach the win cap.

Even if the odds are in your favor, concentrating your bets often leads to bankruptcy. You are much better off diversifying into various bets, even if their winning rates are lower. Researchers as far back as the 18th century have demonstrated the existence of an optimal bet size. In the 1950’s, when Markovitz did his seminal work on portfolio construction, investors’ median portfolios had only two stocks.

Concentrating your portfolios not only decreases your chances (utility function) of enriching yourself. It also conducts to a more unequal society (another article from Elm). WallStreetBets and Reddit have not quite learned that Markowitz lesson yet.

Americans will pour $40bn of stimulus into Bitcoin and stocks

Coincidentally, Dan Dolev at Mizuho securities has just published an interesting article analyzing what Americans will do with their coming stimulus money:

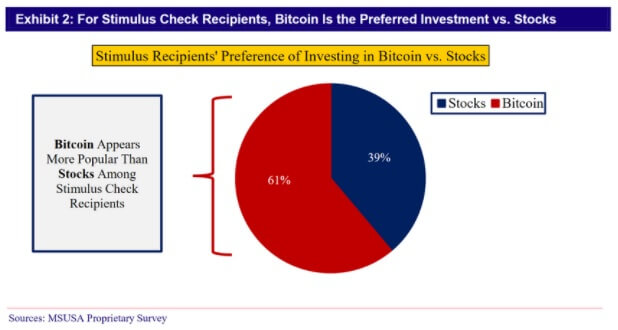

- Two out of five recipients will invest some of their stimulus into stocks and bitcoin.

- To be more precise, the retail investors will place together ~10% of the $380 bn overall incentive.

- 60% of that $40 bn should go into Bitcoin, representing 2-3% of its current $1.1 Tn market value.

- Among the stocks that should benefit are Square, Paypal, Mastercard, and Visa.

How will that money impact the market?

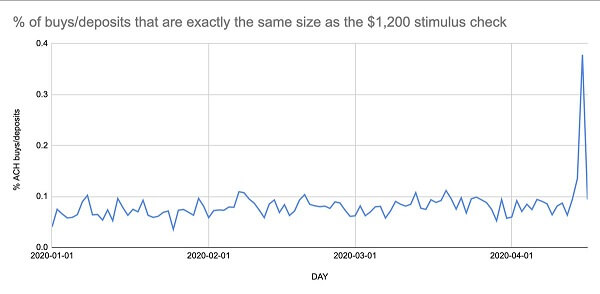

- In April last year, Coinbase CEO Brian Armstrong had tweeted that the exchange had received a significant amount of $1,200 of the last incentive, so it is very likely that more stimulus money will get into BTC:

- 1-2% seems a bit small in comparison to the BTC market cap to have an influence, but the average daily volume is much lower – around 60,000 units, or $3.6 bn at the current levels. An inflow of $24bn, or ~7 days of trading volume, is far from negligible. Even more volatility to come for bitcoin, then?

- $40 bn x 40% would represent $16 bn invested into stocks. That’s not much, considering that $380 bn of institutional money is expected to be sold from equities before month-end.

But American retail investors still haven’t learned much of the benefit of diversification, and they will gamble a part of the stimulus money. Some actually say that it is desperation, which leads them to get into the casino market – the odds of becoming financially stable in regular life are just too bad. Even the Wall Street Journal is suggesting that taxing trading could generate enough friction to avoid extreme financial market gambling.

PS: Warren Buffett’s recommendation on how to best use your stimulus money? Pay off your credit card debt.