Here is the trading issue:

Impact of the time difference on the hedge

Let’s say that a US investor wants to gain exposure to the EAFE (MSCI Europe and Far East) index through a swap. Like all global indices, EAFE meets the problem of time differences.

The Earth rotates from Europe towards Moscow (like military secrets), and it is always later in the East. Because of the time differences between the US and the main regions of the index,

- if the investor wants to trade at the open of the US Markets, Europe is still trading, but Asia is already closed,

if the investor wants to trade at the close of the US markets, then the index is entirely closed.

As a result, if the investor asks for a swap from a bank, the trader offering that swap cannot hedge himself immediately. That’s a risk that a swap trader will generally not accept – his margin is too thin for the risk.

The T+1 execution

The solution is that the client gives the instruction to the trader to execute his hedge at the close of the next day. The trader then executes his hedges on each of the Asian/European countries, then calculates the resulting price at which the client’s swap will begin. That approach is the standard “T+1” departure of the swap. The client bears the risk that the market becomes more expensive (if he buys the swap).

What Goldman was doing (a T+0 execution) takes advantage of how global indices are calculated.

How the index managers calculate a swap with closed countries

Indices are always calculated on official prices. When the US market is open, The Dow Jones index calculation uses the ‘last’ traded price for all its components. After the market hours, the index remains frozen at the closing price, until the market reopens the next day. If there a war starts in Europe during the night, the Dow Jones will not change that published price until the market reopens. We instinctively understand that the official price will not be a true representation of the world (it should be much lower) until it starts ticking again.

In the same manner, the calculators of global indices ‘freeze’ the price of a country when it is closed. They use the close of that day, until the market reopens, and therefore do not take into account what has happened since the close for that part of the index. Since there is always a part of the world that is not trading, a truly global index like the MSCI World is never fully open. Its published price is always in part lagging behind what happens in the real world. Practically speaking, it means that the published prices of these global indices never reflect the true reality of the world. In a bear market, the published price is too high. In a bull market, the published price is too low. And so is EAFE, whose price is often lagging behind its true worth.

More interestingly, because the US economy and markets are much larger than the rest of the world, what happens during US hours will have a strong effect on Asian/European prices the next day, at least statistically.

- If the US market has gone down, it is very likely that European and Asian markets will be lower the next day than where they have closed. In other words, the Asian & European parts of the index will likely be lower in “T+1” than today’s “T+0” official price. And so will the swap trader’s executed hedge. By looking at how the US market moves, the swap trader can estimate where the EAFE will be in T+1.

- Actually, there is an ETF trading in the US, which tracks that EAFE index. It is called the EFA. The EFA represents the consensus of where the ‘true’ MSCI EAFE probably is at any time. If the US markets are down, the EFA ETF is very likely to also trade at a discount to the officially published MSCI EAFE prices.

- In theory, our swap trader could hedge himself on the EFA and immediately lock the difference to the published price, but there is a caveat. The EFA has limited liquidity, so the trader could not execute a $100m hedge on that ETF. He could only trade a few $ millions before the EFA starts to move quite a bit. It would be a partial hedge only. The trader would still have to execute the largest part of his hedge overnight, but he has a good indication of where T+1 will be tomorrow.

Goldman’s trading strategy

Goldman’s trading strategy

On those days when the markets were moving a lot, and only on those days, Goldman’s swap traders were strongly pushing clients to trade in T+0, aka using the stale prices. They knew that their T+1 hedge would be very different from the T+0 price, and they would pocket that difference.

The difference can be significant. If the US markets are down 1%, it is likely that the Asian markets would be also down, say maybe by 0.75%. On a $100m swap, that price difference represents $100m x 0.75% = $750,000. That amount of profit is very relevant when you compare it to the margin of those trades, which counts in a few bps, say 0.05% or $50,000. Repeat this every other day, and you have a ludicrously lucrative trading desk.

Risk bidding?

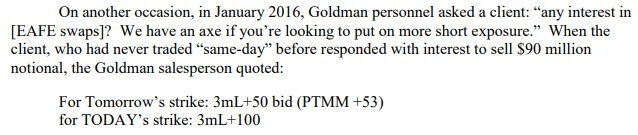

The CFTC’s enforcement report indicates that the Goldman traders were passing some of that benefit to the clients. They would quote two prices, one for T+0, and one for T+1:

Quote explanation:

- Swaps are quoted as premium on the interest leg. “3mL+50” means that the buyer of the swap must pay 0.50% over 3-month Libor for the notional of the trade.

- The trade indicated here is Goldman’s bid on the swap. The trader is ready to PAY 1% over Libor, rather than 0.53%. The client wants to sell exposure.

- Very likely, the markets have gone up that day, and Goldman is paying up on the rate knowing that the sale of the hedge will be at a much higher level in T+1.

What is relevant here, is that the improved price of 0.47% is way less than the likely benefit of the market move. Also, Goldman never explained to his clients WHY they were paying more for a T+0 execution.

The sanctions

For nearly every T+0 swaps executed in 2015-16, Goldman never disclosed to the clients the benefits that Goldman was collecting on the equity leg (the benefit of the improved hedge). They were only explaining to the clients the benefits of the interest rate leg.

It is true that Goldman was taking a risk of execution, as the market could have gone the other way. but then Goldman should have disclosed its risk and approach to its clients, as well as why Goldman was bidding more aggressively.

Implicitly, they lied to their clients. That is what the CFTC concluded.

Outcome:

Goldman was fined $15m by the CFTC for this.

Unfortunately, we do not know the names of the traders and sales involved. It would be interesting to see if a few employees in those teams lose their jobs in the coming days or weeks.

Small advice to clients: Timeo Danaos, et dona ferentes. If a bank is very aggressive with its prices, there is probably a reason. It’s a good exercise to try to figure out why…

Sources:

- CFTC Press release, April 10, 2023, CFTC Orders Goldman Sachs to Pay $15,000,000 for Violations of Swap Business Conduct Standards

- CFTC order, April 10, 2023, Order