The 2-and-20 fee structure dates back to Alfred Winslow Jones, who created the first hedge fund in 1949. Like the first Phoenician sea captains who kept of fifth of the cargo proceeds for their successful voyages, he charged his investors a fifth of the profits. Nowadays, only a third of hedge fund still charge that structure, but the expression has remained.

The 2-and-20 fee structure dates back to Alfred Winslow Jones, who created the first hedge fund in 1949. Like the first Phoenician sea captains who kept of fifth of the cargo proceeds for their successful voyages, he charged his investors a fifth of the profits. Nowadays, only a third of hedge fund still charge that structure, but the expression has remained.

Another thing that has definitely remained is the high compensation of portfolio managers, and the inadequacy of their compensations to the investors’ interests.

Recent press articles say that hedge fund portfolio managers rarely add value, and that the faltering 2-and-20 will doom the hedge fund industry. Some highly compensated PMs are indeed losing assets, but I beg to differ overall. It’s paradise in hedge fund land.

Current hedge fund fee structures

Hedge fund portfolio managers still charge

- a management fee, a fraction of the money deposited, no matter what the performance is, say 2% per year, and

- a performance fees, a share of the performance of the assets, say 20% of the profits.

That’s the nature of the “2 and 20” fee structure, but several changes have appeared:

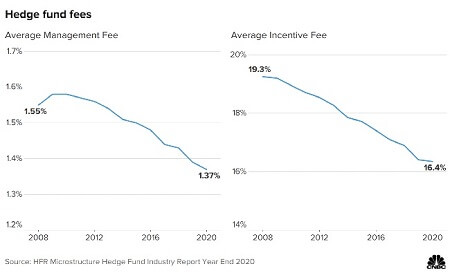

- The first change is that the levels are much lower. Statistics vary among providers and strategy types (illiquid assets and private equity are more expensive, etc.), but the general trend is clear. The levels are way lower and keep on decreasing. The fairer expression today is probably “1-and-15”:

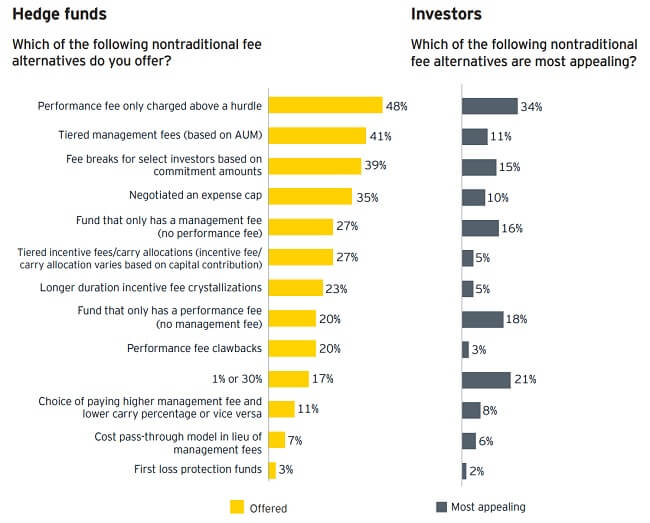

- Also, a multitude of clauses or alternative structures have appeared (a few explanations below):

Hurdles: the performance fee becomes conditional. Usually, the portfolio manager can charge performance fees only when the fund’s performance has beaten a benchmark or a minimum level of performance.

High water mark: In a variation on the hurdles, the PM is not compensated until he has caught up with previous recent losses; he charges his 20% only on the performance above the previous peak.

Fee breaks, fee crystallizations: the PM reduces his fees for a larger investment, or for long-term investments (5, 10 years, or more).

1% or 30%: the manager is paid the highest of the 1% management fees and and 30% performance fees, but the 30% is assessed only on the alpha (performance adjusted for market exposure). Also, the 1% management fees of previous years are removed in following years of high performance. Long-term, this compensation is aligned to 30% of Alpha.

The issues with hedge fund fee structures

You can make some fair criticism of hedge fund compensations, and of the hedge fund industry that lives by it.

- The fees are high, very high. James Simons of Renaissance Technologies is probably the highest at 5% and 44% fees on his $75 bn Medallion fund (of which he is the largest investor). To his defense, the fund has generated 40% performance net of fees over 30 years. To his criticism, external investors are given access to funds of much poorer performances.

- Investors agree that hedge funds may bring good performance, but rarely after fees. Warren Buffett famously won his $1 m wager against Protégé Partners. The Fund-of-Funds had selected its best picks. The overall performance eventually underperformed the S&P 500 after fees, by a lot, as Buffett had bet.

Worse, fees may be insidious. Here are some examples.

Worse, fees may be insidious. Here are some examples.

- The net performance be calculated with which investor’s fee, the lowest fee or the highest fee? A published performance calculated with the investor’s lowest paying fee would appear much better than the realized performance. Any other investor is actually collecting far less.

- Which of the expenses (normally covered by the management fees) are actually charged to the fund and its performance? The PM pays only 20% of expenses allocated to the trading fund.

- If a fund was launched net of fees for its first two years, won’t future fees be much higher than the historical fees? etc.

And so, the performance fees that hedge fund investors actually pays is not lower, but actually much higher than the eponymous 20% statistics. A recent academic paper from Ohio State University indicates that effective performance fees are 50%. Investors collect only 36% of the asset growth overall, once all the fees, costs, reporting gimmicks and investors’ mismanagement are taken into account. Portfolio managers take the rest. The discrepancy from the stated level comes essentially from the asymmetry of fees (PMs’ don’t pay investors back in bad years), return-chasing behavior and underwater fund closures. “Heads I win, tales you lose.”

The manager of the largest hedge funds are paid serious money. Just compare the highest comps below to the US’s median income over the same 2018 period ($31,133):

At the societal level, the management fee is taxed as income, but the performance fee is taxed as capital gain, aka at a much lower tax rate. Actually, if the portfolio manager keeps his performance compensation in the fund, he never materializes his income and is never taxed.

At the societal level, the management fee is taxed as income, but the performance fee is taxed as capital gain, aka at a much lower tax rate. Actually, if the portfolio manager keeps his performance compensation in the fund, he never materializes his income and is never taxed.

This is called the carried interest exception. It brings managers a lot of wealth, notably in private equity. Various administrations have talked about going after this tax anomaly, but the issue still survives…

The flip side of the coin of the ‘good PM hunting’ game is that finding the golden-goose manager is fraught with difficulties, costs, as well as costly mistakes. Due diligence and portfolio construction are intense exercises, and investors often find what meets their appetite… until they look backward on the decade.

Unsurprisingly, there is a cottage industry of service & advice providers, whose methodologies are often backward-looking. What’s the point of looking at realized Sharpe for a systematic option seller? The Sharpe doesn’t represent the risks taken. See our articles on Malachite Capital or Allianz. These two funds had fantastic metrics…

The alignment of hedge fund performance to the managers’ compensation is still a work in progress… Wall Street is pretty good at pricing assets, not so much at pricing people.

The ever-growing hedge fund industry

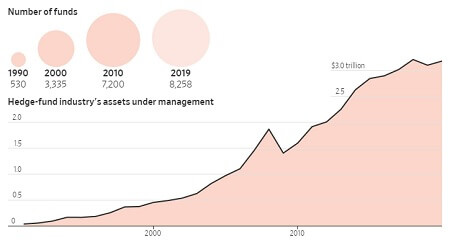

Those high compensations have not inhibited investors from allocating assets to hedge funds.

Actually, the industry is still growing strong, both in AUM and in number of funds:

This being said, there is value in looking with more granularity.

- Hedge funds overall have underperformed the S&P in the last decade:

- The growth of assets is accompanied with a concentration into the few funds with the best resources (or the strongest brands).

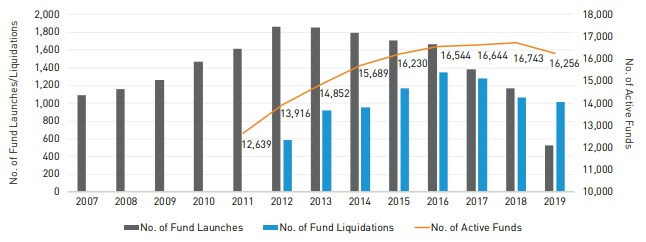

- The concentration exacerbates a high attrition rate, and the number of hedge funds is reaching a plateau.

- The US still represents the lion’s share of the industry.

Why, but why, invest in hedge funds?

So why would investors still invest in hedge funds, considering all this?

- It’s uncorrelated. Even if the performance is lower than other assets, the de-correlation brings optimization benefits, notably a consistency of results over the long-term.

- There is a wide choice of asset classes, strategies, approaches and quality. The dispersion of performance is high.

- There is therefore true value in some hedge funds, and you will be hansomely rewarded if you find the pot of gold at the end of the rainbow. This being said, some studies show that younger and smaller funds outperform their peers. Big institutionals can’t reach those, unless they hire the right PMs themselves.

- Hedge funds are skilled at incorporating the most recent technologies, reducing costs, finding new alpha and reinventing themselves continuously. Some funds are better at it than others. Some funds will be better at it than others.

- Portfolio managers have a tendency to say that they have found the holy grail. Allocators, also. Unfortunately, the confirmation of those ambitious statements is backward-looking and takes 10 years. Call that false hope, at best.

- Outsourced CIO can’t justify their fees by comingling assets into large investment vehicle. They need to find top managers.

- In a low-rate environment, finding performance is hard. Investors are better off investing in risky hedge funds than even riskier assets, like government bonds. Sic.

- Last, but not least, it’s sexy. Hedge fund marketing surely doesn’t miss that point.

Where will it go?

Unsurprisingly, the younger generation of investors is not as interested in hedge funds as the previous ones.

Let’s rephrase this: the younger generation, incarnated in the WallStreetBets activists and the RobinHood day-traders, despises hedge funds, precisely for these high and one-sided compensation structures.

But many of those individuals make their investing teeth by investing in GameStop, AMC and cryptocurrencies, aka assets that are likely to be worthless in the long-term. The system will auto-regulate. Many of those day-traders will be meeting hard investing lessons and enormous tax bills (wash sales anybody?).

Hedge funds portfolio managers, on the other hand, will likely benefit from the reversion of these assets, from the benefit of low correlation, from the hunger for yield, and from the stubbornly high fee structures… The weather is beautiful in hedge fund land.

“Performance comes, performance goes. Fees never falter.”

Warren Buffett, Berkshire annual report, 2017

References

- Ernst & Young: EY 2020 Global Alternative Fund Survey

- Albourne Partners: The Texas Teachers’ “1-or-30” Fee Structure

- Prequin: 2020 Prequin Global HedgeFund Report

- The Hedge Fund Journal / Agecroft Partners, February 2014: Top 10 Hedge Fund Industry Trends

- Wall Street Journal, October 27, 2019: Twilight of the Stock Pickers: Hedge Fund Kings Face a Reckoning

- Agecroft Partners, December 12, 2019: Missing the Mark: CFA Hedge Fund Performance Standards

- Institutional Investor, January 2, 2020: Hedge Fund Fees Plummeted Further in 2019

- Markets Media / Agecroft Partners, January 7, 2020: Top Hedge Fund Industry Trends for 2020

- GCM Grosvenor, February 2020: Hedge Fund Startegies Market Commentary & Outlook

- Ohio State University, Fisher College of Business, June 2020: The Performance of Hedge Fund Performance Fees

- Institutional Investor, January 4, 2021: How Low Will Hedge Fund Fees Go in 2021?

- Bloomberg, February 16, 2021: Democrats’ Bill Targets Private Equity, Hedge Fund Tax Break

- CNBC, June 28, 2021: Two and twenty is long dead. Hedge fund fees fall further below one time industry standard.

- CNBC, June 28, 2021: Head of the second-largest U.S. public pension fund says active managers rarely added value

One Response

Public pension funds ,who are fiduciaries have been criticized in PA for excessive fees and underperformance when compared to plain vanilla 60/40 stock/bond models. This issue has become political which the choice of investment managers.