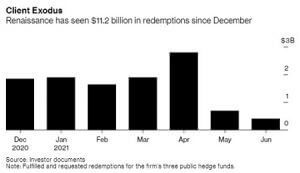

Bloomberg reports that Renaissance suffered another large outflow in April, bringing the total to $11 bn since December.

Bloomberg reports that Renaissance suffered another large outflow in April, bringing the total to $11 bn since December.

This being said, not all Renaissance Technology funds are equal:

- The fund which manages the money from Jim Simons and the employees only, Medallion, was up 75% in 2020 and is flat this year. It saw no redemption.

- RIEF, RIDA and RIDGE, which manages the assets from every other investors, which were down 20-30% last year and are slightly up in 2021. That’s where the redemptions were.

- The three funds’ AUMs are now 25%, 50% and 43% lower respectively, after the combined effects of the underperformance and the redemptions.

Sure, most quant funds didn’t do so well recently, and there has been an estimated $170 bn of redemptions in the segment, but investors don’t like very much that their fund underperform the management’s fund…

4 Responses

Apparently the funds which lost are using the “Same” model as the Medallion Fund. Sometimes I wonder if the Medallion Returns are even true. How can there be such a large dissonance from Medallion to the rest – Weird.

Curious where you saw Medallion is flat for the year? Thanks.

In the Bloomberg article