Lot of rumors during the weekend of a major bank going bust in a new Lehman instant. The fingers are pointing at Credit Suisse.

Lot of rumors during the weekend of a major bank going bust in a new Lehman instant. The fingers are pointing at Credit Suisse.

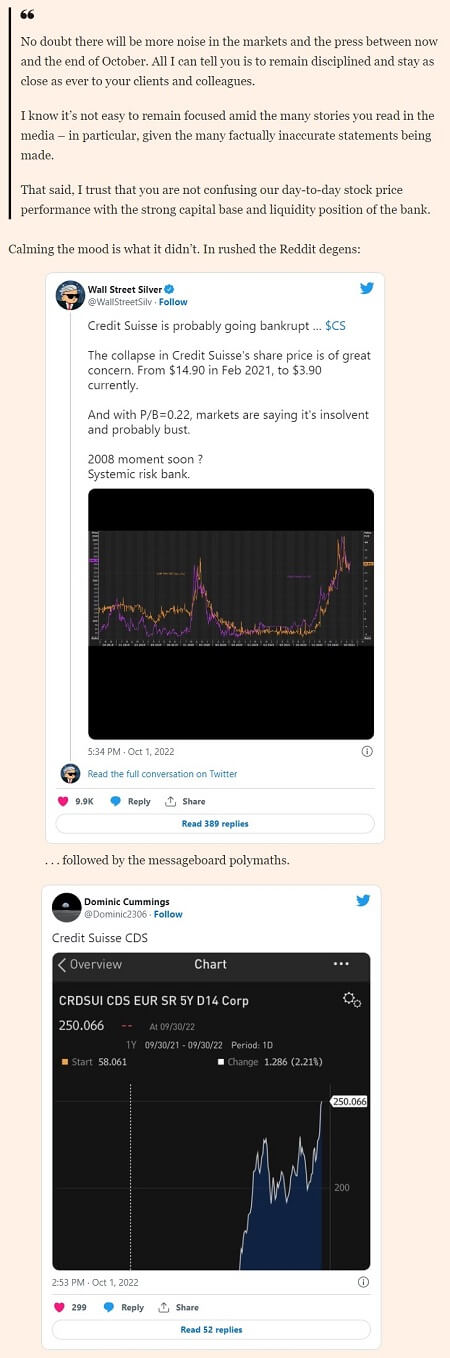

The Swiss bank has been suffering of bad revenues, large losses, credit issues and endless reputational & regulatory mishaps (see our past articles referenced below). The CDS of the bank has jumped up to new highs, while the stock price has gone down to new lows.

No smoke without fire

Many people says there can’t be smoke without fire. Here are the main arguments:

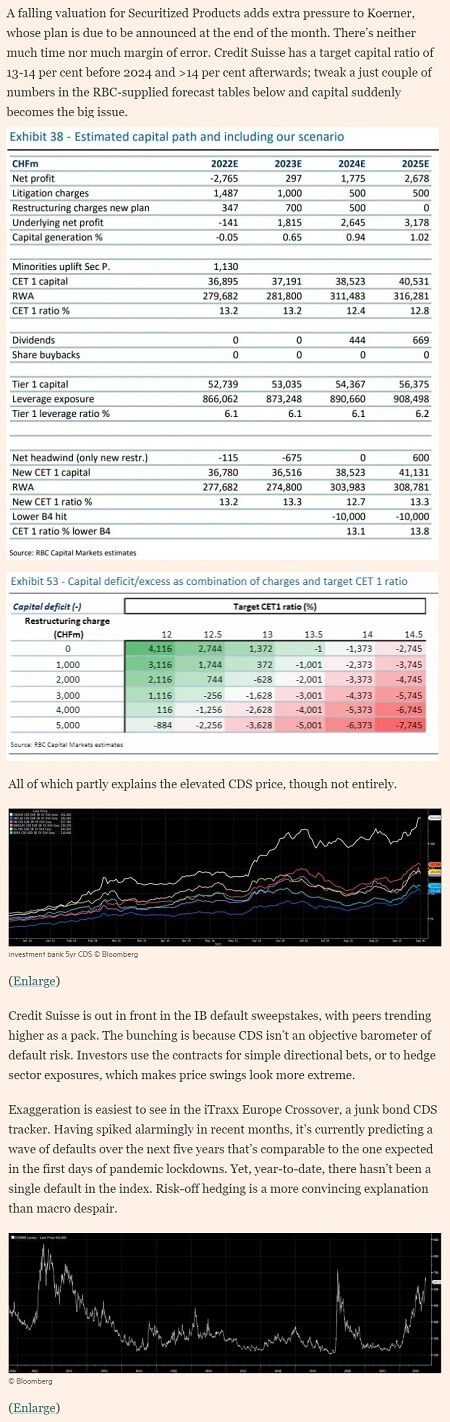

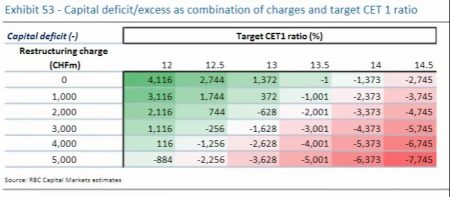

- On Friday 9/30, KBW issues an article indicating that Credit Suisse needs to raise Swiss Fr. $ bn to reach its target capital ratio CET1 of 14 before 2024.

- ABC Australia reported that a ‘credible source’ indicated that one major bank is on the brink of disaster.

- That same day, Credit Suisse’s CEO sent an “internal” memo to the entire bank, demurring the rumors.

- The memo naturally attracted more gossip. The CDS is indeed at its 2008 levels, while the stock price is way cheaper than it ever was..

The Financial Times article

But we may not be at the a default yet. The Financial Times has a few good points:

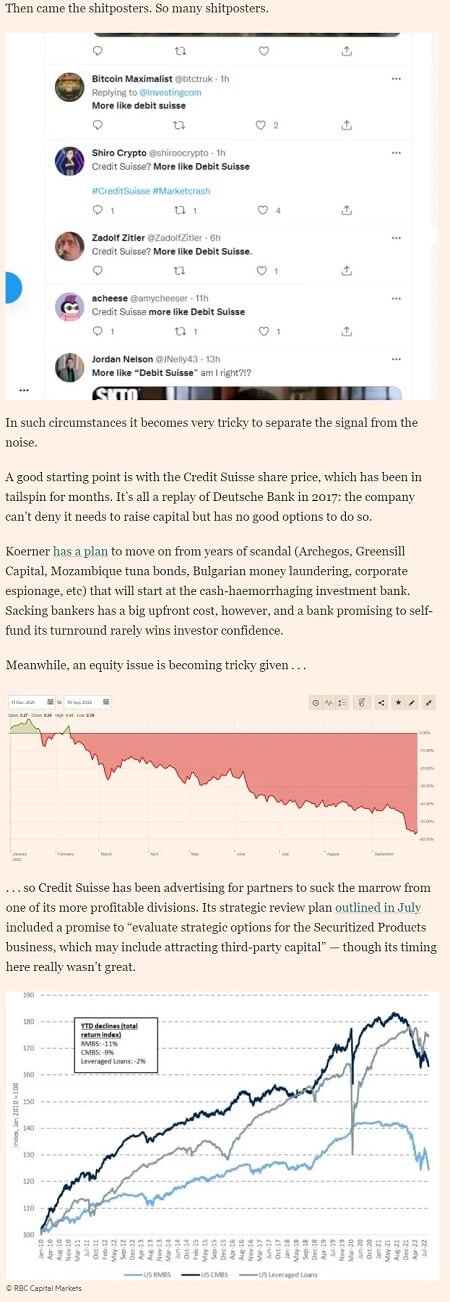

- Yes, the low stock prices makes it hard to raise capital.

- The investment bank is hemorrhaging money, but the Private Bank is doing well.

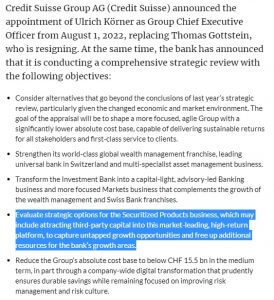

- The firm outlined in July 2022 that it may be looking for an external investor for its securitized products, but the timing wasn’t just right

- The CEO’s plan for this business is expected to be announced at the end of the month, but it has to work if the company is to reach its CET1 ratio before 2024. Any restructuring charge would bring its capital down:

- Hence, the high CDS.

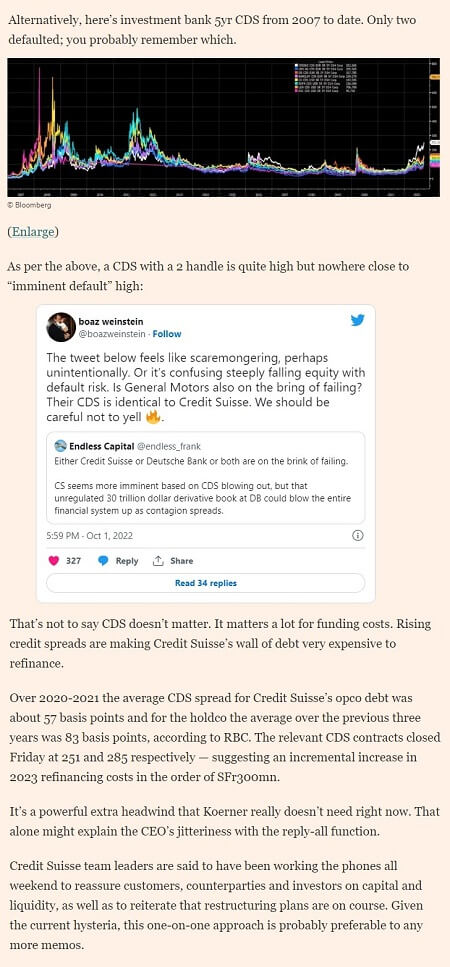

- This being said, you probably need even higher CDS levels to reach default-level. Lehman and Bear Stearns passed the 500 mark.

- Boaz Weinstein indicates that General Motors is also at 250.

There’s no doubt that in the current period of uncertainty and stress, the bankruptcy of a major bank would not support equity markets, and every one is scared of doom and gloom prophecies right now. Conversely, poor markets and low confidence, are making life difficult for banks, especially Credit Suisse, which has a poor hand right now. But if it’s getting hot, we are not at bankruptcy level quite yet.

Look, il n’y a pas le feu au lac… (Swiss proverb)

Sources:

- Navesink International, February 9, 2021, How to compound your regulatory problems | Navesink International

- Navesink International, February 22, 2022, The world’s dirtiest money, welcomed by Credit Suisse. Again. | Navesink International

- Navesink International, March 2, 2022, Credit Suisse destroys evidence of oligarch yacht loans | Navesink International

- Markets Media, July 27, Credit Suisse Names Ulrich Körner New Group CEO – Markets Media

- Reuters, September 30, 2022: Credit Suisse has strong capital base and liquidity -CEO memo | Reuters

- The Financial Times, October 2nd, 2022, Credit Suisse and the CDS Streisand effect | Financial Times (ft.com),