Here is the SPAC 101 manual: their nature, their popularity, the coming regulations, the end of the party, and where it could really hurt.

Here is the SPAC 101 manual: their nature, their popularity, the coming regulations, the end of the party, and where it could really hurt.

What’s a SPAC?

The Securities and Exchange Commission has an excellent investor bulletin, which explains the nature of SPACs:

- A “SPAC”, or special purpose acquisition company, is a blank check company. This structure is used essentially for private equity investments.

- A PM may raise cash for future private equity acquisitions through a SPAC, even if he doesn’t know quite yet which firm(s) he will be buying.

- He can either ask money from institutional investors, or list the SPAC in the public market.

- In both cases, the cash is generally held in a third party trust account and invested into risk-free assets, until the money can be used for an acquisition.

- When a SPAC raises cash before it has acquired assets, it is simply a shell with no operating activity. investors are then relying on the management team, called a sponsor to find appropriate investment targets. Needless to say, if you invest into such a SPAC, you should be very careful about its content or intended content.

- Once the SPAC acquires a company in an initial business combination, the SPAC and that acquired company can merge, and you end-up with a listed company with regular operations and activities.

- If the SPAC does not make an acquisition, the shareholders get the cash back (minus costs), pro rata of their ownership. In such a cash redemption, you may receive less than the price you paid for! For instance, if the SPAC has an IPO at $10, but you buy your SPAC at $12, at a cash liquidation, you will only receive $10, not the $12 you have paid for the share.

- The market price of the SPAC may fluctuates away from the IPO price, usually $10. That market price may bear no resemblance to the future value of the merged company.

- SPACs typically have 2 years to complete their acquisition. They may have 18 months, or an extension clause. SPACs listed through an IPO must complete their acquisition within 3 years.

- In a SPAC IPO, shareholders often receive also a warrant, allowing the warrant holder to get more share at a pre-agreed price in the future. The warrant may trade separately from the IPO stock after the listing. Investors buying in the open market, should also verify if they buy the stock, the warrant, or the combination of the two.

- The SPAC usually offers its investors the right to redeem their IPO shares instead of becoming investors into the merged companies.

- They may be able to vote into the acquisition of the target company itself. There is then a standard vote through proxies.

- If there is already a quorum of investors in favor of the acquisition (the sponsors may have a majority stake), other investors may only be informed of the acquisition.

- If the SPAC doesn’t require a shareholder vote for the acquisition, they will receive a tender offer – information on the acquisition or your option to redeem beforehand.

- Sponsors often have a better acquisition price into the SPAC than the general public. It means that they will receive a bigger share of the acquired company than regular investors.

- Also, the SPAC may eventually require financing, which is executed with those sponsors. Because the form could include dilution or preferable terms, general shareholders may further lose value in the future acquired company.

The SPAC popularity

Morvillo, Abramowitz, Grand Lason & Anello PC have a good piece on the popularity and regulatory attention of SPACs.

- Blank check companies a chequered past in the 80’s and 90’s. SPACs are a their recent re-invention. They have existed only since the mid-2000s.

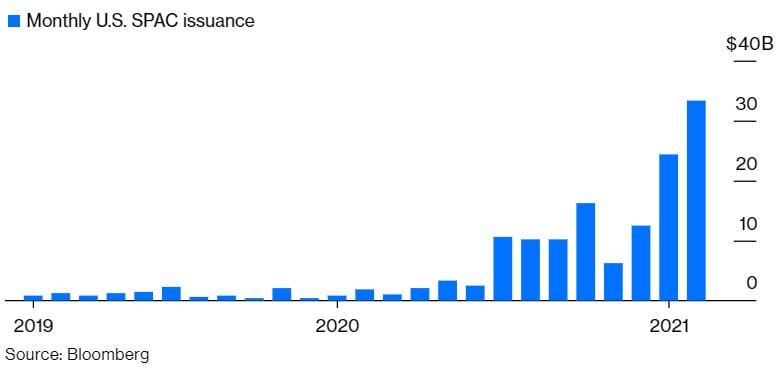

- In 2020, SPACs raised more capital in initial IPOs than at any time in the preceding decade.

- That year, ~20% of the IPOs reviewed by the SEC were actually SPACs.

- They are attracting big sponsor names, like Bill Ackman, former Yankee Alex Rodriguez, and Shaquille O’Neal.

- Investment banks also have issued SPACs. It is a lucrative business for them. They collect 2% at issuance and up to 3.5% when the SPAC acquires a target. It is less than the typical 7% of a regular IPO, but the bank may collect also on the funding and other operations of the SPAC.

- There is also a benefit for the acquired company, as they can negotiate their acquisition price from the onset of negotiations (behind closed doors) instead of waiting for the share pricing at the end of a standard IPO. Companies such as Burger King and Richard Branson’s Virgin Galactic have gone public using a SPAC.

Regulatory scrutiny on the horizon

- In December 2020, the SEC released guidance regarding SPACs’ disclosures. Enforcement is sure to follow.

- Recent SEC enforcement actions make clear that the Agency’s principal concern is opening the flow of information to SPACs’ investors and avoiding conflicts of interest. In 2019, the SEC notably went after a SPAC called Cambridge Capital Acquisition Corporation for insufficient disclosures.

- The SEC is not against SPACs. In September 2020, then-SEC Chairman Jay Clayton stated that SPACs “create competition around the way we distribute shares to the public market,” and affirmed that “competition to the IPO process is probably a good thing.” But SPACs are not a way to get around regulatory procedures or avoid scrutiny.

- The SEC will notably pay attention to:

- the SPACs’ sponsors, directors, and officers disclosure of any potential conflicts of interest,

- the deadline for the acquisition, or the incentives to avoid liquidations,

- the SPAC’s future financing need and agreements,

- the SPAC’s methodology to value the target company, the terms of acquisition, and the special treatment of the sponsors of directors,

- and if the underwriter of the IPO will provide further service to the SPAC.

Is the SPAC party over yet?

While everybody remains generally bull on the future of SPACs, there are clouds on the horizon.

- To start with, there’s probably too much money floating around – an estimated $70 for the start of 2021 already. A recent SPAC was listed under the name Just Another Acquisition Corp (JAAC). A touch of arrogance, maybe?

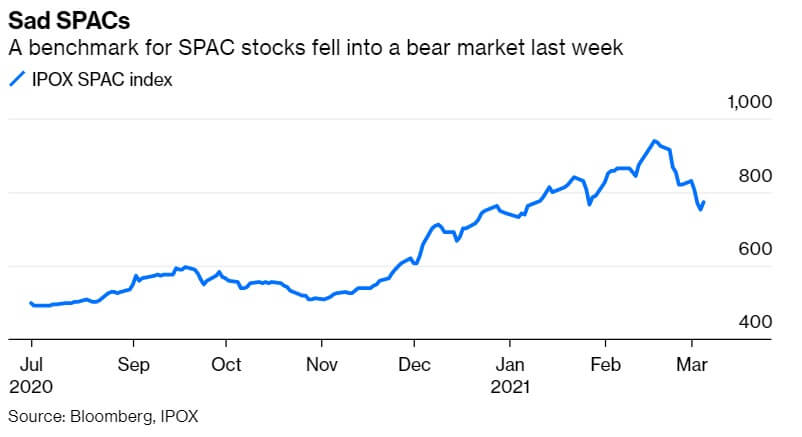

- The rising rates have been particularly unkind to growth stocks, as well as SPACs. And with all bubbles, there are some aftershocks. The SPOX index of SPAC stocks is down 20% this year:

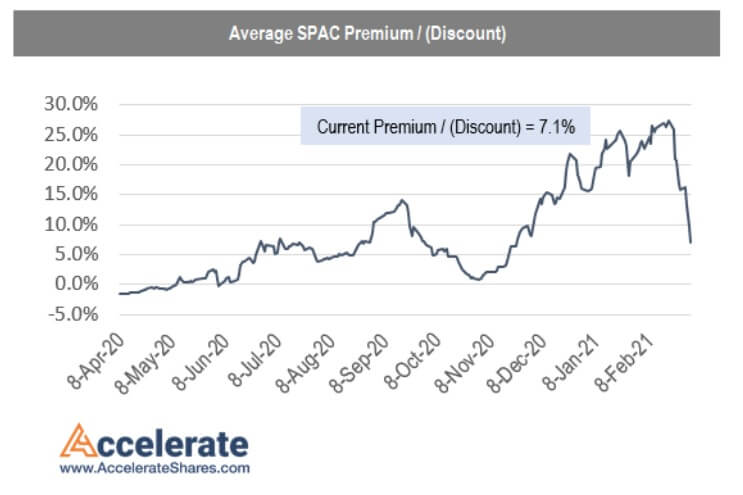

- Dozens of SPACs are now trading below the $10 price at which they were sold. There are still at a 7% premium on average. Churchill Capital traded as high as $65 before it revealed the terms of its deal with Lucid Motors Inc. Its shares have since fallen more than 60%.

- Despite the market crash, SPACs are still able to raise capital, however, their IPOs are no longer massively oversubscribed. Other hedge funds have begun shorting them.

- Former SPACs have also announced disappointing financial results: Nikola Corp., which Hindenburg targeted last year, said it would produce fewer than 20% of the electric trucks it had planned to build this year. I’ve warned before about how the optimistic forecasts SPACs make may lead to disappointment.

- Also, with so much money at hand, SPAC sponsors have become less generous.

The last touch – options and Reddit

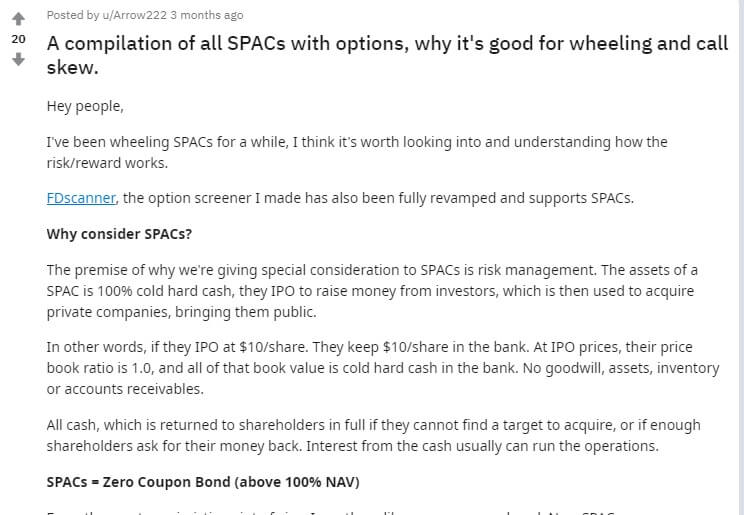

There are now options on SPACs. out of the ~600 SPACs listed on exchanges, ~45 have option chains, allowing retail investors to gain leveraged investments into blank check companies.

Considering how well the public at large understood leveraged ETFs and options on leveraged ETFs, there’s no doubt some traders will receive some unpleasant phone calls at some point… Cash that turns into tech companies. Nobody will ever get that trade wrong, right?

And even better, there’s not only a lot of chatter on Reddit on SPACs, there are even reddit activity on SPAC options. What could go wrong there?

Does it smell like a bubble, or at least too much hope invested in unicorn promises?

7 Responses

Two last things:

– Company warrants are NOT automatic exercise. Do not miss the manual exercise at maturity, and take some time for the operational issues. There have been drastic losses on those.

– Also, they are cash-settled, so you may have an impact if you have a hedge to unwind (the warrant issuer usually has no hedge to unwind).

Hi Ghislain,

I will try to answer your questions – partially

1) 42. It would depend on the terms of that specific SPAC.

2) There are websites dedicated to these SPACs. Some options are pretty liquid. I would use zero rate, no div, maybe some negative repo if the borrow is really high The vol and skew are going to be hard. The vol will always be high pre-conversation no matter what level (options on cash can’t be cheap to carry), but you have a high gap risk. I would imagine the skew inverted (calls more expensive than puts). Normally the warrants are post IPOs, so they would price like any warrant.

3) Multiple reasons could explain this:

a) $10… minus costs

b) Listed mutual funds can have a heavy discount to their NAVs, because they don’t benefit from the creation-redemption process of ETFs. So a parity exists only if/when the conversion process is efficient.

c) Offer and demand, in comparison to b)

PS: This comment is not an investment recommendation…

thanks for your reply Gontran.

On the valuation of warrants, I’ve seen the mark to market value of warrants being substantially below the intrinsic value. My understanding is that there were at least two reasons for this:

i) AFAIK the terms stipulate that the warrant expires worthless if the sponsors fail to acquire a business. This contingency must somehow be priced in, somehow like a credit-contingent option.

ii) upon exercise of the warrant, new shares must be issued at the agreed strike, so the dilution may be substantial if the warrant coverage of the SPAC is large and if the SPAC share value significantly outperforms the strike

As for the negative repo rate, ie large stock borrow rate, I agree it makes sense but probably only post-merger, as the price may start to shoot up and lead to a increase interest from short sellers.

At last, I also read that the warrants were early exercisable from the merger date, so had to be valued like American options. But given the uncertainty related to (i) and (ii) above, I presume these points are irrelevant from a modelling standpoint.

If the warrant is below intrinsic, then there is a probability that the payout is not paid. Company-issued warrants are usually calls (it is for the put warrants that credit comes into play). Here, it looks like there is x% chance that the cash is returned. I let you estimate the x.

You can separate the question in two:

1 A dilution is simply N -> N+n . The strike has no effect on the dilution (as long as the new shares are issued).

2 The new shares are issued at a steep discount, and the warrant holders make a solid gain.

Well, that’s up to the company’s ambition when they declared the warrant and chose the strike…

And up to the investors when they bought the SPAC.

There are pricers for Bermudan options. It’s probably overkill, but it depends on how big your position is.

very nice summary, thanks for that. A few questions\comments

1) you mentioned the dilution effect arising from the financing terms of the sponsors after the acquisition of the target business. How is that dilution effect compares with the one implied by the exercise of the warrant?

2) Interesting to hear that SPAC options trade in addition to the warrants. I was not aware of this. I guess liquidity is pretty thin on these ones and that model based valuation may be challenging (e.g. how would you mark a borrow rate for SPACs?)

3) You mentioned dozens of SPACs trading below $10. Isn’t it then converging back to $10 as the SPAC deadline looms? I assume it does given that the investor may be able to early redeem at $10 on expiration.