You want to use options for your next insider trading idea? Think again.

You want to use options for your next insider trading idea? Think again.

- The good news is that options don’t use much cash, so you can execute your purchase with low amounts of capital.

- In other words, options offer higher leverage. Provided that the event doesn’t take too late (aka after the options’ expiry), you will end up with a nice little profit.

- The bad news is that the SEC will know. You are not the first one to think about it. They know the trick.

- Actually, it’s easier to drown a fish in a big pound than in a thimble. Your intent is obvious. Good luck explaining to a jury how you suddenly invented yourself as an options trader, why you selected a stock whose calls are illiquid, and how lucky you were that the stock suddenly gapped up on a take-over announcement right after you traded these DOTM calls. Dumb luck, right?

- The stick will hurt more. Because you are using leverage, the fines and jail time increase.

Case in point

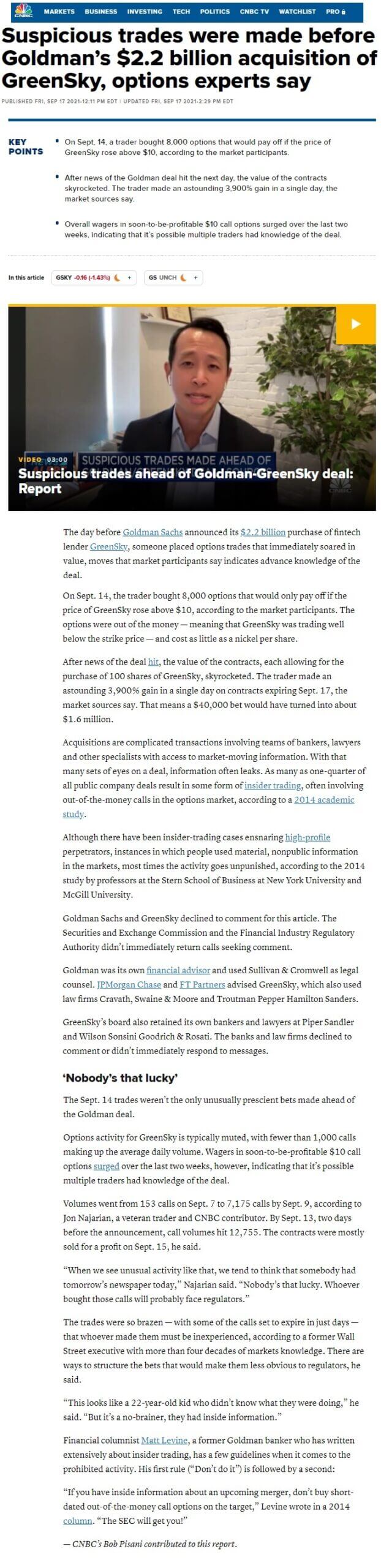

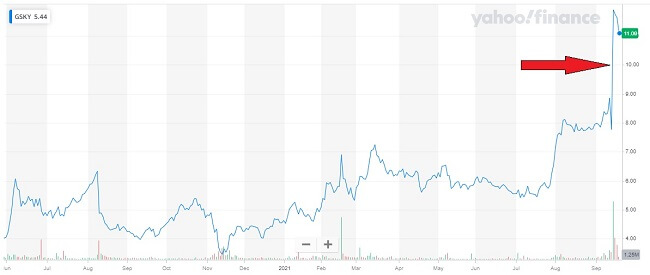

Somebody (or several people) traded $10 front month calls on GreenSky in the days before the stock gapped up to $12.

A few facts:

A few facts:

- On September 15th, Goldman announced the acquisition of GreenSky Inc, in a $2.25 bn deal.

- In the five days before the announcement, 36,000 contracts changed hands, while the ADV (average daily volume) is ~1,000 lots.

- Most of the volume was in the front-month, OTM calls ($10 strike vs ~$8ish). These options are ideal for taking advantage of sudden rises. Actually, that’s pretty much their only benefit.

- The trader(s), probably had an estimated 3,900% return on their purchases.

On the same day of the Goldman announcement, law firms were already advertising litigations against the target company, notably

- WeissLaw LLP, September 15th, 6:10 PM: The announcement does not mention any options trading, only breach of fiduciary duty.

- Bragar Eagel & Squire, P.C., September 15th, 4:50 PMU The announcement mentions an agreement unfair to shareholders.

But we will have to see what arguments they will put forward, or if the cases are even related to the option trades. We also have to look at all the facts – there’s notably a significant increase in earnings consensus in the month before – but it is very possible that some of the buyers had some non-public information. It will probably not finish well for them.

Is it that rare?

Insider trading is still pretty frequent. A 2014 academic study of 1,859 unexpected takeovers between 1996 and 2012 indicated that:

Insider trading is still pretty frequent. A 2014 academic study of 1,859 unexpected takeovers between 1996 and 2012 indicated that:

- 25% of takeovers have abnormal option trading volumes.

- The trading patterns often indicate that the traders use directional positions on the stock for the target and play volatility on the acquirer.

- That behavior has less than one in a million to be by chance.

- At least 13% of the cases cannot be associated with any public information.

- Unfortunately, the SEC doesn’t have the resources to follow many of the cases. They seem to have investigated only 8.28% of that 25% of cases.

Subsequent articles indicate that insider option trades have decreased following the SEC’s subsequent aggressive enforcement. This may not be the case in other countries though.

The regulatory consequences

Insider trading is seriously punished in the US, with both civil and criminal penalties. They include

Insider trading is seriously punished in the US, with both civil and criminal penalties. They include

- Disgorgement of profits, forfeiture

- Penalties: the greater of $1 million or 3x profits

- Fines: up to $5,000,000 or 2x profits

- Disbarment, as a director or as a broker-dealer/investment advisor

- Up to 20 years imprisonment

The regulatory direction

The SEC has little patience for insider trading, and the enforcement pressure will increase.

Here is the experienced view from Mark Strauss, a former investigative journalist and a successful anti-fraud attorney with more than twenty years of experience in complex civil litigation (more details at Mark Strauss Law). Mark is a leading attorney in Securities, qui tam and whistleblower actions:

“It looks like the SEC is going to get much more aggressive at policing insider trading under the new chair Gary Gensler.

Over the summer, Gensler signaled that they’re taking a hard look at stock trading plans for corporate insiders—so-called 10b5-1 plans—to see if they’re being abused to effectively disguise insider trading. And I think they’re going to find that those plans frequently are abused through, for example, ad hoc changes and modifications .

The SEC also launched an enforcement action, the Panuwat case, testing a new legal theory—namely, liability for “shadow trading” which is when a corporate insider uses their access to material non-public information about their own company to trade the stock of a totally different company. In the Panuwat case, an insider at a company called Medivation bought call options on the stock of a competitor after learning the fact, which was non-public, that his own company was being acquired. He bet that the competitor’s stock price would go up too because the market would view it as a potential acquisition target as well, and he was right. The SEC, however, has taken the somewhat aggressive position that the employee committed an insider trading violation by using Medivation’s confidential information for personal gain.“

References

- CNBC, September 17, 2021: Suspicious trades were made before Goldman’s $2.2 billion acquisition of GreenSky, options experts say.

- Yahoo Finance, September 17, 2021: Well-timed trades in GreenSky options ahead of Goldman deal raise eyebrows

- Yahoo Finance, September 16, 2021: GreenSky (GSKY) Moves 53.2% Higher: Will This Strength Last?

- WeissLaw LLP, September 15th, 6:10 PM: GreenSky, Inc. Investigation

- Bragar Eagel & Squire, P.C., September 15, 2021: GreenSky, Inc.

- Patrick Augustin (McGill University), Menachem Brenner (New York University) and Marti G. Subrahmanyam (NYU), May 2014: Informed Options Trading Prior to M&A Announcements: Insider Trading?

- Elements of Insider Trading, CalSTRS.com