Do you remember the cryptocrook mentioned in our February 2021 article? He was then awaiting sentencing, and the sentence just came out: 7½ years of jail.

Do you remember the cryptocrook mentioned in our February 2021 article? He was then awaiting sentencing, and the sentence just came out: 7½ years of jail.

The sentence deserves to be explained and replaced in its general context.

The fraud

Stefan He Qin was a smart trader, who claimed he had found quantitative arbitrage techniques in cryptocurrencies, allowing him to make continuous profits. He started a market neutral hedge fund called Virgil Capital, with great returns (only one down month). He gained visibility, went on TV, was cited in the press as the new wizard. That media presence allowed him to raise $90m from retail investors. Not bad for a 24 yo kid from Australia.

Unfortunately, the return numbers were fake. His hedge fund was a Ponzi. Mr. Madoff Junior squandered most of the investor’s money with his stylish lifestyle. He eventually tried to syphon a second fund to pay for redemptions of the first one, which lead to the fall of the Ponzi.

100+ investors were scammed. $65m was lost for good. The receiver has located only $5m.

Sentencing

He was awaiting his sentence in February, after having returned to the US. The outcome of the judgement just came out. In short:

He was awaiting his sentence in February, after having returned to the US. The outcome of the judgement just came out. In short:

- Federal guidelines call for 15½ to 20 years imprisonment.

- His attorneys claimed a chaotic childhood, adolescence bullying, etc. They pleaded for 3 years.

- What probably played in his favor was that his voluntarily return from South Korea to face justice in the US. Upon arrival, he immediately admitted guilt and expressed remorse.

- The prosecutors asked for 8 years.

The judge adjudicated for 7½, stating that the guidelines were draconian, but that white collar fraud still needed to be severely punished for deterrence.

Stefan Qin still has to return $54m…

The perspective

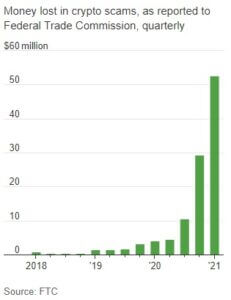

The FTC’ Bureau of Consumer Protection, which collects statistics on frauds, sees a continuing increase in crypto-related scams. There were $82m worth of frauds reported in 2020Q4 and 2021Q1, 10 times the amount of the 6 month period before. The number of cases was 12 times higher. The median loss is about $1,900, also 10x more than the previous period and ~5x times more than non-crypto scams.

The FTC’ Bureau of Consumer Protection, which collects statistics on frauds, sees a continuing increase in crypto-related scams. There were $82m worth of frauds reported in 2020Q4 and 2021Q1, 10 times the amount of the 6 month period before. The number of cases was 12 times higher. The median loss is about $1,900, also 10x more than the previous period and ~5x times more than non-crypto scams.

Unfortunately, these numbers are due to self-reported cases, and the frauds are probably several orders of magnitude higher.

CipherTraces, a blockchain analytics firm, also sees higher numbers on the first 2021 quarter ($83.4m of pure fraud from January to April 2021) at double the amount of the entire 2020 year. They estimated $4.1 bn of crypto crime altogether for the year of 2019.

With the continued rally in BTC and other currencies, the lure of riches make many investor drop down their guards and reduce their due diligences. Crooks follow the money as well. The NASAA (North American Securities Administrators Association) warns that crypto currencies are now the second largest source of threats to investors.

Crypto frauds are not going to disappear any time soon… Regulators have difficulty catching up. Keep watching.

References:

- WSJ, September 15th, 2021: Ex-Cryptocurrency Fund Manager Sentenced to 7½ Years in Prison (below)

- Soouthern District of New York, September 15th, 2021: Founder Of $90 Million Cryptocurrency Hedge Fund Sentenced To More Than Seven Years In Prison

- WSJ, June 7th, 2021: Crypto Frauds Target Investors Hoping to Cash In on Bitcoin Boom

- Washington Post, May 18, 2021: Cryptocurrency scams rose 1,000 percent in the past year and cost consumers at least $80 million, FTC says

- NASAA, March 2021: NASAA NASAA Announces Top Investor Threats for 2021

- Navesink International, February 8, 2021: Cryptocrook.