UBS got flack for recommending VIX ETFs to its clients.

UBS got flack for recommending VIX ETFs to its clients.

This case has much larger ramifications than a simple suitability issue.

The VXX ETF and its drawbacks

The VXX ETF (in its real name, the “iPath® Series B S&P 500® VIX Short-Term FuturesTM ETN”) is issued by iPath/Barclays and tracks the VIX index.

The VXX ETF (in its real name, the “iPath® Series B S&P 500® VIX Short-Term FuturesTM ETN”) is issued by iPath/Barclays and tracks the VIX index.

That instrument happens to invest in futures as the VIX index is not tradable directly. Unfortunately, due to the structural demand for long-dated S&P options, these VIX futures are usually in contango. As a result, its rolling is a continuous and high cost and the two frictions generate more costs that the product is really worth. This expensive structural cost, comes on top an already expensive expense ratio (management fee) of 0.89%, as well as some additional friction costs in its construction and calculation.

Barclays and its structurers knew the problem well, and have insured themselves with surprisingly strong risk language in the product summary and its Pricing supplement. The disclaimers notably include the following statements (their bold, my underlines):

- “The ETNs are intended to be trading tools for sophisticated investors“

- “The ETNs may not be suitable for all investors and should be used only by investors with the sophistication and knowledge necessary to understand the risks inherent in the relevant Index, the futures contracts that the relevant Index tracks and investments in volatility as an asset class generally.“

- “You May Lose Some or All of Your Principal“

- “Because the ETNs are subject to an investor fee and other applicable costs, the return on the ETNs will always be lower than the total return on a direct investment in the index components.”

- “The ETNs are riskier than ordinary unsecured debt securities and have no principal protection.”

- “Your ETNs Are Not Linked to the VIX Index.“

- “The nature of the VIX futures market has historically resulted in a significant cost to “roll” a position”

- “The ETNs are only suitable for a very short investment horizon.”

- “The long term expected value of your ETNs is zero.“

- “If you hold your ETNs as a long term investment, it is likely that you will lose all or a substantial portion of your investment.”

The defunct XIV reverse VIX ETF (Velocity/Credit Suisse) also had some similarly funny language in its prospectus:

- The ETNs are “intended to be trading tools for sophisticated investors.”

- They may “not be suitable for investors who plan to hold them for longer than one day.”

- “The long-term expected value of your ETNs is zero.“

Needless to say, these instruments are not suitable for all (or probably any) retail investors. Many law and compliance professionals are even wondering why such products are in the market altogether.

UBS’s suitability failings

For several years, UBS had recommended this ETN to customer discretionary accounts through one of its IA program. The product ended up in the account of many investors, causing serious suitability issues. Some of which lost 80% of their investments… And the product stated in its description that this would happen.

What makes the problem worse compliance-wise, is that UBS’s own ETF desk made the opposite investment recommendation. at the same time UBS was recommending it to its clients.

What makes the problem worse compliance-wise, is that UBS’s own ETF desk made the opposite investment recommendation. at the same time UBS was recommending it to its clients.

Unsurprisingly, the SEC slapped the firm with a fine ($8m) and a Cease-and-Desist order for those poor investment recommendations.

The release also indicates additional difficulties

- insufficient procedures and written policies around product recommendations (we expected that one),

- and that the firm even failed to monitor its only distribution restriction – the 3% concentration limit.

The problem highlighted by the UBS case has much deeper roots.

ETFs nature and brands.

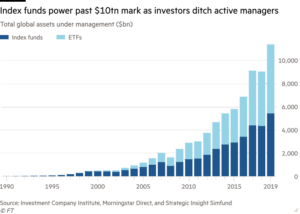

ETFs have been around for 28 years. They represent over $5 trillion in assets, more than mutual funds, and are still growing fast. The industry has a long history of innovation, a wide diversity of instruments and many applications.

ETFs have been around for 28 years. They represent over $5 trillion in assets, more than mutual funds, and are still growing fast. The industry has a long history of innovation, a wide diversity of instruments and many applications.

And that remarkable growth comes with pains. Many players, including the exchanges themselves, have not coped well with the growing diversity of these instruments. The first ETFs were basic mutual funds, and so industry players classified them as “Equities” in their reference data. That was perfectly fine at the time, but it is not appropriate anymore.

With over 7,500 different ETFs, today’s instrument diversity is the source of difficult taxonomy issues. Besides the diversity of assets, payouts, locations, listing, there is also a fundamental diversity in the nature of the instruments. For instance, in the US alone, there are actually 13 different legal instrument natures, which are all labelled under the same “ETF” appellation. Many “Exchange Traded Funds” are not funds at all; you have “commodity pools”, debt instruments…

The growing diversity and fast evolution of the ETF industry (itself the consequence of intense competition and the creativity of financial markets) is one of the fundamental factors underpinning this difficult classification situation, but it is not the only one. The 1st amendment and the regulatory framework are two others.

The Investment Act of 1940 defines the nature of the mutual fund industry. It has been codified into SEC rules. The SEC’s 35(d) rule specifies the naming process and requirements for mutual funds.

Unfortunately, since most ETFs are not mutual fund anymore, they are not covered by this rule, and investment managers can chose the name of their companies as they wish. They can for instance call themselves “The XYZ doing this or that ETF“. The choice of names is driven by marketing and branding issues, not by transparency and compliance. Is “iPath Series B S&P 500 VIX Short Term Futures ETN” easier to market than “VIX ETF”? You get it. And so, using the word “ETF” in the branding of the company/instrument makes things much easier to understand and to sell than very complex names. The word “ETF” is therefore often used when it shouldn’t be.

And because companies are persons, they are entitled to and have enforced their 1st amendment rights to free speech. The SEC is now forced to accept their chosen company name as indicated in their S1 filing. Hence you end-up with instruments officially branded by the SEC and exchanges as “funds” which are not funds at all.

The consequences of the mis-classification

Due to the historical and marketing issues, many ETFs have now flown into security masters as stocks all around the country. They maybe classified as ETFs sometimes, which is better, but most “ETFs” are not mutual “funds” anymore as we just saw. After 28 years, there is now an endemic problem of misrepresentation of securities in security masters.

Due to the historical and marketing issues, many ETFs have now flown into security masters as stocks all around the country. They maybe classified as ETFs sometimes, which is better, but most “ETFs” are not mutual “funds” anymore as we just saw. After 28 years, there is now an endemic problem of misrepresentation of securities in security masters.

And if a product is not correctly labelled in a security master, then it cannot be correctly managed. Stocks are recommendable to many. Options and complex exotics are not. Because of the improper classification of instruments as stocks, retirees ended-up with complex exotics in their 401(k) and disasters eventually happen.

Option trading is not for everybody. The VIX is way more complicated than vanilla calls and puts. It is not directly tradable, and can only be invested into with futures. The consequences of the VIX futures term structure and its repo are understood by professionals only. Complex payouts, on complex assets, with complex behaviors and complex trading issues are not suitable for moms and pops. And hence, the UBS case.

The deeper signification of the UBS case

There is more than a suitability issue in the UBS case.

Upgrading security masters is an expensive and challenging issues; many broker dealers do not have the resources to address the need. Many don’t even have estimates for the upgrade costs, or are even aware of the existence of a problem.

And so you can bet that there will be more situations were investors are recommended unsuitable “ETF-like” products. The financial markets are ripe for such litigations. The UBS case is likely to be the first in a long series of litigations.

It is actually telling that the SEC took this case. UBS is a broker-dealer, regulated by FINRA, not by the SEC. So the SEC jumped in to handle a case that should not be within its remit. That’s unusual.

What is usual, though, is that the SEC expresses itself through its litigations. If $8m maybe pocket change for the large broker-dealers (except that they are very tired of those…), it is an omen of much larger and more frequent actions for the entire brokerage industry; you should expect many more litigations and enforcements coming from regulators, private individuals and the large plaintiff firms.

And if broker-dealers don’t address their security masters problem soon (and they won’t), then the long term expected value of their ETNs business may be zero as well.

Navesink International

Navesink International offers expert witnessing and legal consulting services related to financial markets. We cover a swath of topics and cases through our in-house experts and a large network of industry executives.

ETFs, leveraged ETFs, complex financial instruments, listing and notice issues of ETFs are among the areas where we provide top-ranked expertise and court-experienced industry talents.