The finance ministers of the G-7 have agreed to a global minimum corporate tax rate of 15%.

The finance ministers of the G-7 have agreed to a global minimum corporate tax rate of 15%.

This is big news, with important consequences.

- Corporations will no longer be able to transfer income from intangible sources like drug patents, software, royalties, intellectual properties into low-tax shelters to avoid the tax of their original country.

- Countries will stop ‘racing to the bottom’ to attract business. Think of Panama and other tax heavens, which offer mailbox offices and incorporations, against a minimum stamp duty. These small countries offer a very low tax rate on the large incomes they attract, which suffice their needs. The only winners in this redirection are the corporations, who are allowed to escape their dues.

- We can also expect a reduction in inversions, where companies change their incorporations address and therefore their tax rates, through M&A operations.

A few numbers

- In 2017, about 40 percent of profits earned by the world’s multinational firms was stashed in tax havens, or more than $700 billion.

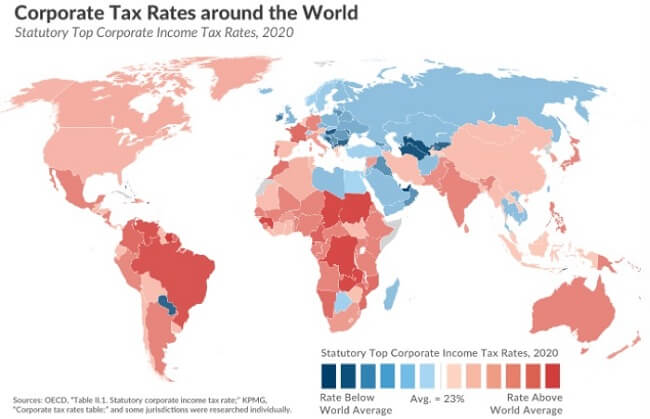

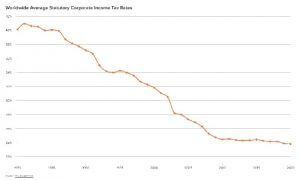

- The decline in corporate taxes worldwide is startling. From 2000 to 2018, 76 countries cut their corporate tax rates, according to the OECD. In 2000, more than 55 countries had corporate tax rates above 30 percent. Now, fewer than 20 do.

- It is estimated that governments miss out on between $200 and $600 billion in annual revenues (around 10 to 15 percent of annual global corporate tax revenues) due to the corporate tax decline.

- US multinationals reported the largest part of their overseas profits in three low-tax countries: the Netherlands, Ireland, and Luxembourg (followed by UK and Bermuda).

- The Irish Central newspaper just revealed that Microsoft’s Irish subsidiary paid no taxes on $315 bn of profits in 2020, because it was a ‘resident’ in Bermuda. The firm nevertheless paid its owner $55 bn of dividends. For comparison, Ireland has a GDP of $433 bn.

The US rate tax cut of 2017

The US corporate tax cut of 2017 has been heavily studied. Its effects support a global tax rate:

- Before the 2017 GOP tax law, the official U.S. corporate tax rate had remained at 35 percent for several decades. But because of expanded deductions and other subsidies, the effective U.S. federal tax rate had fallen to closer to 29 percent before the tax law was passed.

- The GOP tax cut lowered the official rate from 35 percent to 21 percent. The effective rate paid by the largest Fortune 500 companies also fell lower from 21 percent to about 11.3 percent, with 91 of the world’s biggest corporations paying zero dollars in federal taxes.

- Following the 2017 tax cut, the corporate income tax’s contribution to the country’s revenues fell by roughly half, from 2.0 percent of GDP in 2000 to about 1.1 percent in 2019. That alone amounts to roughly a $200 billion annual loss of revenue.

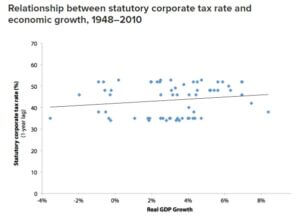

The GDP did not increase as expected after the 2017 tax law: it was 2.4 percent in the eight quarters leading up to the law and 2.4 percent in the eight quarters since the law.

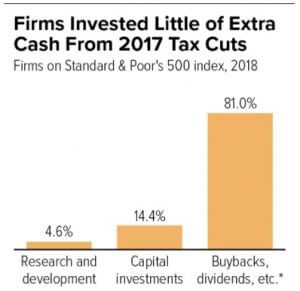

The GDP did not increase as expected after the 2017 tax law: it was 2.4 percent in the eight quarters leading up to the law and 2.4 percent in the eight quarters since the law.- A congressional Research Service report of June 2019 indicated that workers did not see the increase in wages that proponents of corporate tax cuts promised. The one-time bonuses for employees announced by companies after the tax cuts amounted to $28 per U.S. worker, or 2 to 3 percent of the total benefits from the corporate tax cut. Meanwhile, announcements of stock buybacks exceeded a record-breaking $1 trillion in 2018.

Considering the little impact on corporate growth created by the 2017 tax cut, there are very few reasons to believe that increasing the corporate tax would impact the GDP. Actually, some of the country’s highest growth period coincidentally happened at times were the corporate tax were also at their highest.

Considering the little impact on corporate growth created by the 2017 tax cut, there are very few reasons to believe that increasing the corporate tax would impact the GDP. Actually, some of the country’s highest growth period coincidentally happened at times were the corporate tax were also at their highest.- In any case, the additional revenues would be used in an infrastructure program, whose benefits are likely to be an order of magnitude larger than any disincentive effects from the taxes.

The case for a global minimum corporate tax

International corporate taxation has long presented a challenge for tax authorities around the world. The emergence of globalization and intangible capital has made taxing multinational corporations increasingly difficult, and greater international cooperation is needed to make such taxation more effective.

The average tax rate has been constantly declining in the last decades, from 40% in 1980 to 24% today (right).

The average tax rate has been constantly declining in the last decades, from 40% in 1980 to 24% today (right).

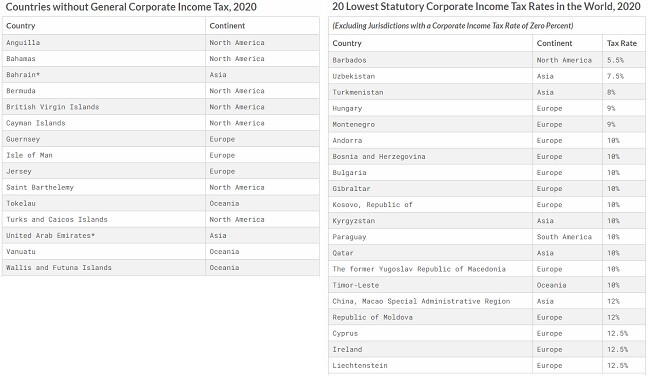

The number of tax havens has increased. In 2021, the British Virgin Islands, the Cayman Islands, Bermuda, the Netherlands, Switzerland, and Luxembourg were ranked the “jurisdictions most complicit in helping MNCs underpay corporate income tax.”

Here are the 20 countries charging their corporations the least, and those who do not charge them at all:

The work in progress.

To address this problem, the Organisation for Economic Co-operation and Development (OECD) and Group of Twenty (G20) have been leading the Base Erosion and Profit Shifting (BEPS) initiative—a multilateral negotiation with over 135 countries, including the United States—since 2013.

To address this problem, the Organisation for Economic Co-operation and Development (OECD) and Group of Twenty (G20) have been leading the Base Erosion and Profit Shifting (BEPS) initiative—a multilateral negotiation with over 135 countries, including the United States—since 2013.

Its Pillar One will described where tax should be paid. The aim is ensure that digitally-intensive or consumer-facing Multinational Enterprises (MNEs) pay taxes where they conduct sustained and significant business, even when they do not have a physical presence, as is currently required under existing tax rules. This pillar would redistribute $100 bn of tax collected globally.

Its Pillar Two would introduce a global minimum tax that would help countries around the world address remaining issues linked to base erosion and profit shifting by MNEs. This second pillar would increase tax collections by $100 bn globally.

Finding the minimum tax rate was not simple.

The Biden administration wants to raise the U.S. corporate tax rate to 28%, and reverse half of the country’s revenue lost in 2017, and it has proposed a global minimum of 21%. The finance ministers from France and Germany indicated were willing to back that level.

The Biden administration wants to raise the U.S. corporate tax rate to 28%, and reverse half of the country’s revenue lost in 2017, and it has proposed a global minimum of 21%. The finance ministers from France and Germany indicated were willing to back that level.

Ireland, whose tax receipts have soared from about €4bn in 2013 to around €12bn in 2020 thanks to its low 12.5% tax rate, has resisted European Union attempts to harmonize its tax rules for more than a decade. It opposed a minimum rate higher than its own.

Ireland, whose tax receipts have soared from about €4bn in 2013 to around €12bn in 2020 thanks to its low 12.5% tax rate, has resisted European Union attempts to harmonize its tax rules for more than a decade. It opposed a minimum rate higher than its own.

Hungary, whose corporate tax rate was cut from 19% to 9% in 2017, calls the global tax rate proposal a “violation of sovereignty.”

Hungary, whose corporate tax rate was cut from 19% to 9% in 2017, calls the global tax rate proposal a “violation of sovereignty.”

At the end, the OECD and the G-7 agreed to a rate that could be accepted by those who found it too low and also those who wanted it higher. The rates also assumes that participants will not only agree to the framework, but also implement it.

The implementation will be difficult

Low-tax countries will face pressure to increase their rates to this new minimum.

If they do not, other countries will be allowed to levy additional taxes on the overseas earnings of their firms. For example, Hungary could maintain its existing 9 percent corporate tax rate even after the new 12 percent minimum is enacted. But under the OECD agreement, France could collect taxes on the income earned by French companies in Hungary amounting to the difference between Hungary’s corporate tax rate and the 15 percent global minimum — a measure known as a “top-up” tax. Hungary would lose the attractiveness of its low-tax rate, and will be better off taxing to 15% itself.

Implementing it will be incredibly complicated, not because of the definition of the tax rate, but that of revenues. What counts as taxable income and which deductions should be included? Can countries enforce this? How would a country know the income declared in a tax haven?

Other items still to be negotiated include:

- whether industries like investment funds and real estate investment trusts should be covered,

- when to apply the new rate and

- ensuring it is compatible with the 2017 U.S. tax reforms aimed at deterring tax-base erosion.

The first reactions

It will be interesting to see the reactions from corporations, tax advisors, and governments. We shall see those in the coming days, or at the formal G-7 summit a week. So far:

- Asked whether Amazon and Facebook would be covered by the proposal, Yellen said: “It will include large profitable firms and those firms, I believe, will qualify by almost any definition.”

- Facebook’s Head of Global Affairs: “We want the international tax reform process to succeed and recognize this could mean Facebook paying more tax, and in different places.”

- Google: “We strongly support the work being done to update international tax rules. We hope countries continue to work together to ensure a balanced and durable agreement will be finalised soon.”

- German finance minister Olaf Scholz said the deal was “good news for tax justice and solidarity and bad news for tax havens around the world”.

- Yellen also saw the G7 meeting as marking a return to multilateralism: “What I’ve seen during my time at this G7 is deep collaboration and a desire to coordinate and address a much broader range of global problems”

- Cyprus, with a 12.5% tax rate, will oppose any European directive on global minimum tax.

- Rishi Sunak, UK Finance minister and meeting host, after stating the historical importance of this agreement, added: “This is the first step, this is agreement reached at the G7, we still have to go to the G20 and reach agreement with a broader group of countries so it’s hard to say where the final deal will land.”

- OXFAM: “It’s absurd for the G7 to claim it is ‘overhauling a broken global tax system’ by setting up a global minimum corporate tax rate that is similar to the soft rates charged by tax havens like Ireland, Switzerland and Singapore. They are setting the bar so low that companies can just step over it.

References

- Economic Policy Institute, June 4, 2013: Corporate tax rates and economic growth since 1947

- Tax Policy Center: Key Elements of the U.S. Tax System

- Tax Foundation, December 9, 2020: Corporate Tax Rates around the World, 2020

- OECD: December 10, 2020: International community renews commitment to address tax challenges from digitalisation of the economy

- Washington Post, March 15, 2021: Yellen pushes global minimum tax as White House eyes new spending plan

- Center on Budget and Policy Priorities, May 25, 2021: Corporate Rate Increase Would Make Taxes Fairer, Help Fund Equitable Recovery

- Atlantic Council, April 7, 2021: The case for a global minimum coporate tax.

- Reuters, April 14, 2021: Explainer: What is a global minimum tax and how could it affect companies, countries?

- New York Times, May 20, 2021: U.S. Backs 15% Global Minimum Tax to Curb Profit Shifting Overseas

- Irish Central, June 4, 2021: Microsoft’s Irish subsidiary pays no corporate tax despite posting multi-billion dollar profits

- Reuters, June 5, 2021: Reaction to the G7 minimum tax agreement