An interesting story for your Friday:

An interesting story for your Friday:

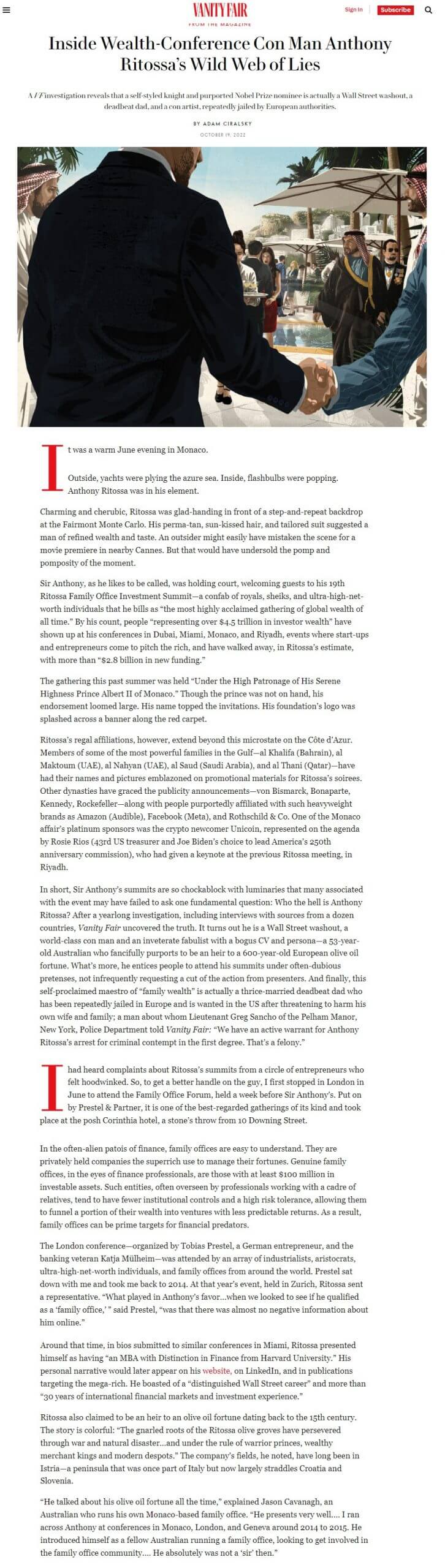

Anthony Ritossa has been organizing eye-catching family office summits, where fund seekers can approach the wealthiest and most prestigious investors, thanks to his own personal wealth and influential network. Several times a year, participants meet in the plushiest hotels of the major wealth centers – Dubai, Riyadh, and Monaco.

The admission tickets are in line with the millions of available capital, with entries ranging from $18,000 to $200,000 per person. And so what, some will say? A $50,000 charge for a $100 million loan is only a 0.05% rate increase… a small price to pay to launch your new company.

Except that the investors are rare and have no cash to invest. Fund seekers rarely find the coveted monies. The organizer has been lying to his teeth for years, about his own background, about the benefits to participants, and about everything else.

The journalist brings to light a laundry list of deceptions, from a first-class con artist:

The journalist brings to light a laundry list of deceptions, from a first-class con artist:

- ‘Sir’ Ritossa, who appears on the covers of CEO magazines, has fake diplomas, no family wealth or history, and has purchased his titles. Is the Nobel nomination real, then?

- Instead, research shows decades of brushes with justice, missed court appearances, arrest warrants, and a few prison stays, drugs and alcohol, an abandoned wife who sought court protection to prevent children kidnapping and violence, followed by ruin and foreclosure thanks to unpaid child support. Lovers and a love child.

- It is a story where respectable investment professionals, have their reputations abused by false advertisement, while those who doubt the Potemkine village receive legal threats.

- The summits are “Stargaze” conferences: swank settings, glittering names, large ticket prices, and even larger commission fees. They are likely regulatory reporting breaches and advertisement fraud.

As one regretful aspiring participant states it: “Ritossa puts on fake family office events where a lot of people turn up who don’t have capital to invest — but very much want people to think they do — while genuine entrepreneurs and fund managers are being hustled into giving Ritossa and his company fees.”

As one regretful aspiring participant states it: “Ritossa puts on fake family office events where a lot of people turn up who don’t have capital to invest — but very much want people to think they do — while genuine entrepreneurs and fund managers are being hustled into giving Ritossa and his company fees.”

All that glitters is certainly not gold.

Click at this link for the rest of the story: Inside Wealth-Conference Con Man Anthony Ritossa’s Wild Web of Lies | Vanity Fair

One Response

Clearly the old phrase “A fool and his money are easily parted” is highly relevant in this particular instance.