The fall of crypto assets is causing pains all around. And the pain seems to be spreading fast and faster.

The fall of crypto assets is causing pains all around. And the pain seems to be spreading fast and faster.

- Stablecoins like Terra and Luna are digital assets supposed to maintain a peg between fiat currencies and the digital world. Since banks do not admit digital currencies, these instruments were deemed a ‘safe’ process to convert dollars into digitals. In May, they lost their peg ratio under sellers’ pressure.

- Their failure prevented access to other digital currencies and more importantly revealed a critical risk of the digital space: most assets are interconnected, including intermediaries, and you may not be able to sell back into USD even if your assets stand up.

- Last weekend Celsius paused withdrawals, preventing crypto owners from selling their assets. The token of the company itself is down 90% from its high. Babel Finance, another lender, also paused withdrawals on Friday.

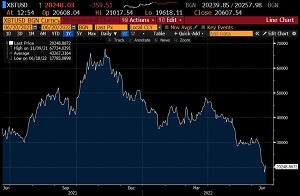

- BTC is now down 70% from its peak, and many other digital currencies have fared worse. If you had any doubt, that is definitely a bear market.

- Many individuals bought cryptos on margin. We don’t know the aggregate situation (loss or risk), since the unregulated industry maintains no statistics, but if leverage is great on the way up, it is not so much on the way down, and the digital world is $big and wide.

- Hedge funds also used leverage. Crypto-invested HFs are now being stopped and liquidated as well (Three Arrows failed during the week, see article below).

- Today, HK-based crypto *exchange* Hoo also halted transactions after heavy withdrawals exhausted the company’s funds. Exchanges are heavily capitalized companies in the regulated world. Not so much in the crypto space.

Systemic risk happens when financial institutions are so connected that the failure of one pushes others into bankruptcies. Think of LTCM or AIG, which were big enough to bring the entire financial system down with them. The contagion was prevented, thanks to groups of other institutions and regulators that stepped in to provide liquidity. Their joint action probably prevented much larger conflagrations.

There is a systemic effect unfolding in the digital space. Unfortunately, the DeFi world is not regulated; there is no restriction on cross-ownership, risk exposures, or minimum capital buffer. There is also no regulator/government to step in.

I’m not sure how this story will finish, but situations with better regulatory environments have not ended too well in the past…

There is a positive side to regulations.

Related articles:

- The pros and cons of crypto markets (vs. regulated markets), October 2021

- Bye-bye, bitcoin: It’s time to ban cryptocurrencies, July 2021

- Should Central Banks issue digital currencies?, Jun 2021

- The state of crypto hedge funds, June 2021