Norges Bank, the world’s largest sovereign fund, manages $1.3 Tn and owns 2% of every stock in the world. It announced last week that it will unwind its entire Russian assets.

Norges Bank, the world’s largest sovereign fund, manages $1.3 Tn and owns 2% of every stock in the world. It announced last week that it will unwind its entire Russian assets.

It turns out, the fund is not the only one to do so. Many asset managers are doing the same.

Stock removals happen

Meanwhile the Russian stock exchange is closed, and so MSCI froze Russian assets in its indices on Thursday. It consulted with its clients about what to do. The answer is that “an overwhelming majority confirming that the Russian equity market is currently uninvestable and that Russian securities should be removed from the MSCI Emerging Markets Indexes.” And so MSCI (and FTSE Russell) will remove Russia from its indices. As a result, any index tracker, or any body who is benchmarked against an MSCI index that contains Russia, has to sell Russia.

When single stocks are removed from indices, all those “index trackers” have to follow their removal at the same time. The market’s liquidity is often insufficient, and the impact of such rebalances is usually important (it has compliance consequences). Even if there are non-trackers who are interested in buying those equities, stock can easily lose 5-10% on such announcements and in the following days.

Usually investors have to re-invest the proceeds into other member of the index, or into larger indices. Initially, India was expected to be the highest beneficiary, since it is the largest index in the group of indices.

Russia’s index removal

But here, everybody wants to sell and the impact could be much more significant.

And so, MSCI will remove the Russian index at ZERO!

It is extremely rare for a single stock to be removed at zero (only for defaults), let alone for an entire country. By doing so, MSCI is saying that the equity market of the entire country is worth nil.

And actually, it is:

- When asset managers started to sell their shares to follow the global restrictions, Russia froze the stock exchange. As of Wednesday, the exchange is still frozen. It is already the longest suspension of the exchange ever.

- In the meantime, Russia prevented the sale of stocks by implementing sales controls. Russian brokers are NOT allowed to sell shares from foreigners. Technically, it’s not looking good for stocks, and asset managers tend to avoid those kind of exposures.

- Now, foreign stock exchanges are moving to freeze or delist those stocks. NYSE/NASDAQ are in the process of doing it. ICE is delisting bonds, and so the liquidity is drying up even more, scaring buyers even further.

- Even worse, western governments could make owning Russian shares illicit in future rounds of sanctions. Assets managers would have to sell, by law.

- So who could buy? Russian magnates could be interested in such discounts, but they don’t have cash (their wealth is stuck in stocks). Also, they are also about to be hit with sanctions – their assets are about be frozens, if not confiscated(!). Abramovich is actually organizing a firesale of all its assets, including the Chelsea football club (with the proceeds supposedly ‘going to a charity’), GBP 200+ m of UK houses, and his GBP 1.2 bn collection of floating and flying toys.

- So foreigners have to sell Russian stocks between themselves, and the assets are toxic for absolutely everybody. There is no buyer.

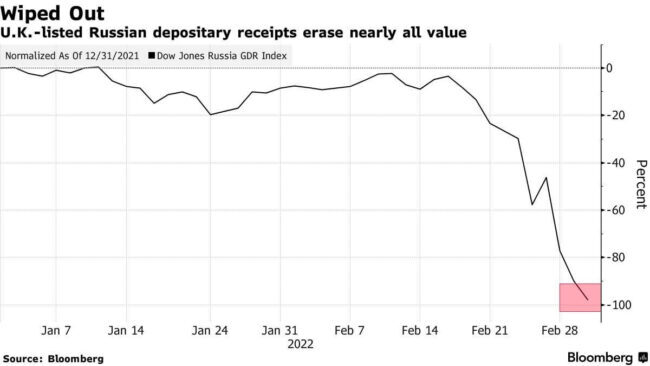

Interestingly enough, the biggest Russian companies are listed abroad in the form of depositary receipts. These are shell structures, which contains a few stocks, before being listed. There are some a bit everywhere, notably in London where they still trade. So we have an indicative price for Russian stocks. And they are down 98%.

- Sberbank is down 99%

- Gazprom is down 98%

- Lukoil is down 99%

There is an index of UK-listed Russian stocks, and its down 98%.

Which would explain why BP wrote off – not sold – its $25bn Join Venture in Rosneft last week. By-the-way, BP’s departure is a psychological tsunami in Russia. Not only many jobs will go, not only will the technological know-how flee as well, but BP was the first Western corporate to invest in Russia after the fall of the Soviet union. Its clean gas stations offering Danish pastries became a cultural center point when they started to appear. They are the symbol of Russia’s opening to the free world, a relation based on cultural and economic exchanges. All this is gone now.

It’s not a good time to be Russian these days. And the effects of the sanctions are only beginning.

References

- Navesink International, February 23, 2021, Should index providers have oversight?

- Reuters, February 28, 2022, BP quits Russia in up to $25 billion hit after Ukraine invasion

- Money Control, March 1st, 2022, Removal of Russian stocks from MSCI to divert about $600 mln inflows into India: Edelweiss

- South China Morning Post, March 1, 2022: Russia faces fund exodus as ICE removes sanctioned debt from indices, MSCI reviews investability amid Ukraine fallout

- Daily Mail, March 2, 2022, Fire sale of Roman Abramovich’s London assets, writes the oligarch’s biographer DOMINIC MIDGLEY

- Bloomberg, march 2, 2022, MSCI Removes ‘Uninvestable’ Russia From Emerging-Market Indexes

- Bloomberg, March 2, 2022, Russian Stocks in London Wipe Out 98% of Value in Two Weeks