Why isn’t Bitcoin/Blockchain Russia’s salvation from the sanctions, or Who is left holding the turd?

Why isn’t Bitcoin/Blockchain Russia’s salvation from the sanctions, or Who is left holding the turd?

Many people are posting that Bitcoin and blockchain are somehow a solution for sanctions. Below are reasons for why that line of thinking is not realistic.

Features of the chain

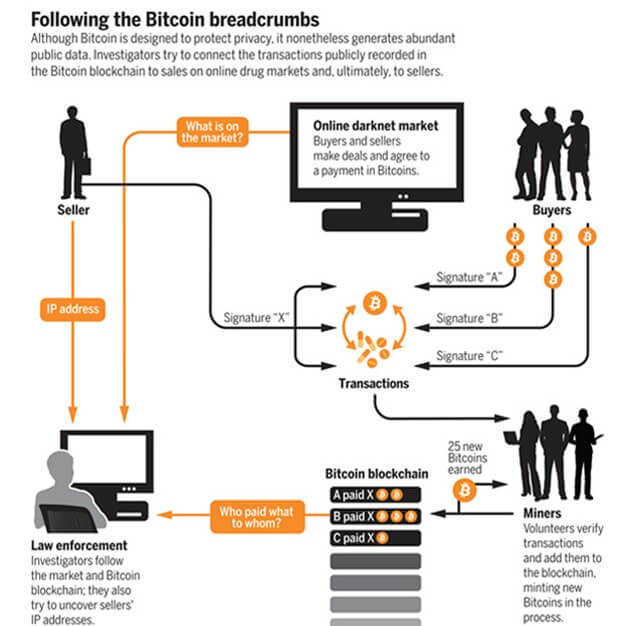

One of the features of the Blockchain s that all transactions are public, and stored publicly forever.

Tokens are specific items; each has a unique identifier and every transaction a Token is involved with for its life is available in the public domain.

Each transaction is between a buyer’s wallet and a seller’s wallet and these wallets need to be “whitelisted” to satisfy regulation in most regulated jurisdictions (US, UK, Eurozone, and others).

What is whitelisting?

Just as the name suggests, whitelisting is the opposite of blacklisting, where a list of trusted entities such as applications and websites are created and exclusively allowed to function in the network.

Just as the name suggests, whitelisting is the opposite of blacklisting, where a list of trusted entities such as applications and websites are created and exclusively allowed to function in the network.

Whitelisting takes more of a trust-centric approach and is considered to be more secure. This method of application control can either be based on policies like file name, product, and vendor, or it can be applied on an executable level, where the digital certificate or cryptographic hash of an executable is verified.

What is blacklisting?

Blacklisting is one of the oldest algorithms in computer security, and it’s used by most antivirus software to block unwanted entities. The process of blacklisting applications involves the creation of a list containing all the applications or executables that might pose a threat to the network, either in the form of malware attacks or simply by hampering its state of productivity. Blacklisting can be considered a threat-centric method.

Whitelisting is a higher standard as each regulated entity must prove they are dealing with “good actors” as defined by the regulatory authority.

For the life of the Token it is possible for all actors/wallets to be tracked and subject to “Asset confiscation, or Asset forfeiture”, which refers to the legal process of confiscating assets or property that are linked to criminal activities, if the token is transacted and held in a wallet in a regulated Jurisdiction by the regulator. In simple words, a regulator can track a bitcoin down and confiscate it from you if its origin is not from a demonstrated good actor.

So how does Bitcoin or Blockchain help Russia evade the sanction, when they will not be able to satisfy a white listed wallet status?

For those on LinkedIn who think Blockchain/Crypto is a solution for Russia to combat sanctions, please note how hard it would be to circumvent sanctions and the risks to counterparties. No Regulated Bank is going to risk being unsure of the Whitelisted status of a wallet. Shady and fringe players in the crypto world will be shut out quickly. May even cause a huge selloff in crypto as institutional users become even more wary.

Cash Fiat Currencies are a better hiding place for avoiding sanctions, fortunately for regulators they are cumbersome and hard to get in significant quantity, but they are not easily traceable.

I am confident many unsophisticated users will be caught in some sort of Crypto fraud or scam, thinking they are safe from enforcement, only to find out later, that regulators are very hard to trick.

References

- Manage Engine, Whitelist vs blacklist

- KLawyers and Accountants, December 29, 2020, What is Asset Confiscation and Why Does it Matter So Much?

- Science, March 9, 2016, Why criminals can’t hide behind Bitcoin