The SEC will be asking for increased transparency from private hedge funds, a discreet $11 Tn segment of the hedge fund industry, by increasing the content and timeliness of the forms PF requirements.

The SEC will be asking for increased transparency from private hedge funds, a discreet $11 Tn segment of the hedge fund industry, by increasing the content and timeliness of the forms PF requirements.

The form PF and the lack of transparency.

The form PF (PF stands for “Private Fund”) is a quarterly report filed by typically large foreign funds when they sell into the US. The form was formalized in 2009, after the real estate bubble, giving the SEC 10+ years of exceptional insights on the alternative industry.

The filling is quarterly and mandatory, with a 60 day delay. These PF reports are not made public by the SEC – unlike the forms ADV, also filled by all hedge funds, which are available to the general public on EDGAR / the SEC website / Adviserinfo.

Hedge fund privacy is actually an issue for hedge fund industry analysts, as researchers can only work with what hedge funds publicly report, instead of how hedge funds truly are. Practically speaking, hedge funds publicly disclose their returns, AUM and terms to half a dozen companies (Eurekahedge, BarclayHedge, HFR, TASS, Preqin, Morningstar…) on a voluntary basis. The coverage universe of these providers are pretty disjoint, meaning that you need access to all of the providers to have a good picture of the industry. And to make it even more impractical, each provider sells its data with its own information structure and classifications, and generally at a high subscription price.

As a result, obtaining a full picture of the hedge fund universe is costly, difficult, and always partial. A side-effect is that only the SEC has better information of the alternative industry as a whole, and much more insights than the general public or even its participants on their own industry.

The hidden hedge fund world

This being said, there was an interesting research article in 2020 (here and below), where the authors have managed to compare the publicly available data to the SEC’s private data from PF forms during the 2013-2016 period. Here are the main takes of this comparison.

Industry size

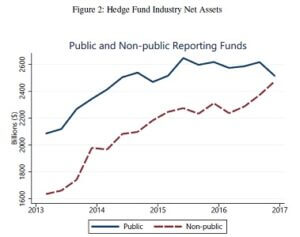

The hedge fund industry is much larger than what is publicly reported – almost twice as large, depending on the period.

The hedge fund industry is much larger than what is publicly reported – almost twice as large, depending on the period.- All investment styles are under-reported.

- This brings the industry’s estimated size (in 2016) to $8.5 Tn, against a typical industry estimate of $3-5 Tn by extrapolating data from the providers. Many foreign funds are still not included in this tally, though.

- That level of assets is significant. For comparison, it represents 85% of the home loan mortgage industry.

- An SEC official indicated that private funds represented $11 Tn in AUM at the end of 2020 (source Reuters).

- The PF forms contain both net and gross assets, and we can deduct that hedge funds are typically 1.6x times leveraged.

Fund comparisons

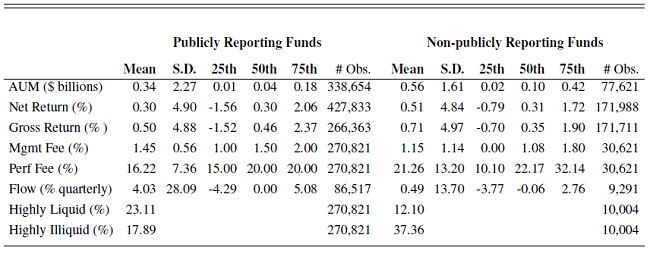

The performance and pricing of funds has some interesting nuggets. Here are the raw statistics :

- Private funds are larger ($560 m average and 1$00 m median) than publicly reporting funds ($340m average and $40m median).

- Private funds have lower management fees (1.15% vs 1.45%), but higher performance fees (21.26% vs 16.22%).

- The private funds are less liquid and have lower inflows.

Performance and risks

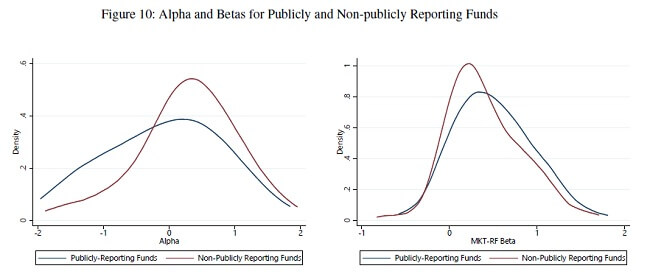

- Private funds have a much higher performance than those that reports, 0.51%/month vs. 0.30%/month on the studied period, but slightly lower betas. Here are their distributions:

- The risk metrics are generally similar across both universes.

- The better performance of private funds is statistically significant across a much larger swath of funds.

- The outperformance is visible across all investment styles.

- It is also persistent over time.

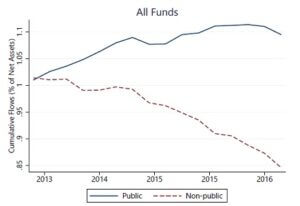

And the extra-performance is not due to inflows. Private funds have actually lower inflows than publicly disclosing funds (negative on the period).

And the extra-performance is not due to inflows. Private funds have actually lower inflows than publicly disclosing funds (negative on the period).

That so much good performance remains hidden certainly contributes to the perception that hedge funds are not greatly performing assets. It probably also confirms that disclosing your returns publicly is a marketing ploy to raise assets, and it certainly seems to work.

The SEC requirement changes

The SEC wants more transparency on the major events of the funds. It is asking the following new requirements in forms PF:

- Losses of 20% or more over 10 days have to be reported within one day.

- as well as large increases in margin requirements,

- default by major counterparties,

- removal of a fund’s general partner or

- the termination of a fund’s investment period.

- The threshold for reporting the form PF would be lowered from $2 bn tyo $1.5 bn.

The Managed Funds Association, the hedge fund industry’s lobby, supports the SEC’s objective of gathering relevant data from market participants in a crisis, but “will study the details to ensure that this proposal is calibrated to collect information at the right interval and granularity without inadvertently capturing routine activity”. We shall see what they truly mean by that.

But if we can understand that family offices wants and should keep some privacy, asset pools open to a much larger public do not deserve the same confidentiality, especially when systemic risk can and do impact the entire economy. So it does makes sense for the SEC to ask for a bit more data.

But maybe the SEC could be more transparent as well? How about giving the general public and investment analysts access to the some of the data in its vault..?

References

- Daniel Barth, Juha Joenvaara, Mikko Kauppila, Russ Wermers, February 2020, The Hedge Fund Industry Is Bigger (and Has Performed Better) Than You Think.

- January 24, 2022, Kobre & Kim, SEC to Vote Next Week on Proposing New Hedge Fund Disclosure Requirements

- Wall Street Journal, January 26, 2022, SEC Seeks More Disclosures From Private-Equity and Hedge Funds

- Reuters, January 26, 2022, U.S. SEC to ramp up hedge fund, private equity fund scrutiny