The party is still going, but the band’s tune has changed.

The party is still going, but the band’s tune has changed.

Buy Now Pay Later (BNPL) is an interesting concept. An app gives consumers instant credit while they are paying at the till. The amounts are small, and they pay the amount back in a few installments over the following months. It is used for Christmas shopping, electronics… Users tend to have very low credit quality.

The difficulty in the concept is that there are many hidden fees. The APR is extremely high – way more than the credit risk of the users. More importantly, lenders are not disclosing the true costs. If you miss one payment, the fees are sky-high, and your credit score is severely impacted.

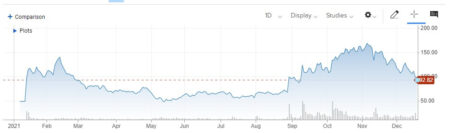

BNPL lenders are very profitable companies. They created the products and soon went IPO. Their stock prices went through the roof. M&A activity ensued, with top investors pooling for positions.

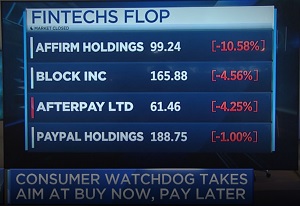

Regulators had frowned their eyes on the technology so far. Although the UK forbade it, the US permitted it. A regulatory intervention was expected in the US, and valuations went down over the last few months (example below – AFRM). The CFPB has just announced an investigation, and the stocks lost 10-20% on the announcement.

Past reference articles:

- Navesink International, March 15, 2021: Buy Now Pay Later, the new payday loans

- Navesink International, September 17, 2021: Why is Goldman getting into BNPL?