There has been some sudden movements in the global rates recently:

There has been some sudden movements in the global rates recently:

- Rates rose ~0.50% – 10Y, US, UK, Canada… or caanounced changes in policies,

- the curves actually flattened rather than steepened, and

- inflation reappers after 20 years of inexistence.

As a result, hedge funds are raking large losses.

A few numbers:

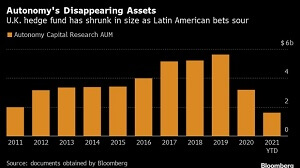

Autonomy lost 22.5% year to date, and its assets are down 75% from its 2019 peak.

Autonomy lost 22.5% year to date, and its assets are down 75% from its 2019 peak.- Rokos lost 11% in October. It is now down 20% year-to-date.

- Alphadyne lost $1.5 bn (10%) in July on rates. It is now down 17% year-to-date.

- Exodus lost $400m, and October was 2% in the red

- Millenium is down 0.4% for October and 10.9% for the year.

- Point72 also took losses in global macro.

More bad numbers to come?

References

- Pensions & Investments, August 4, 2021: Alphadyne loses $1.5 billion in short squeeze

- Business Insider, August 4, 2021: A hedge fund reportedly lost $1.5 billion in a bond market Yahoo Finance (from Bloomberg), October 29, 2021:short-squeeze as bets on rising rates turned sour

- Yahoo/Bloomberg: october 29, 2021: A Wrong-Way Bet on Bond Yields Triggered Rokos, Alphadyne Losses

- Market Watch, October 29, 2021: Hedge funds seen facing heavy losses amid wrong-way Treasury bets ahead of Fed tapering, traders say

- Bloomberg, November 2, 2021: Balyasny, BlueCrest, ExodusPoint Ground Traders Over Losses

- NY Post, November 3, 2021: Wall Street’s smartest hedge funds are now getting smacked by inflation

- BNN Bloomberg, November 4, 2021: London Autonomy Hedge Fund Loses 75% of Assets From 2019 Peak

One Response

And Element lost $1bn = 6.7% in October too.

https://californianewstimes.com/element-capital-hit-with-1bn-loss-in-bond-market-shake-up/586352/