Nigeria has introduced its CBDC (Central Bank Digital Currency) called the eNaira. It had banned all crypto usage in the country earlier this year.

Nigeria has introduced its CBDC (Central Bank Digital Currency) called the eNaira. It had banned all crypto usage in the country earlier this year.

The economy and cryptocurrencies

- With 211 million citizens and a GDP of $480 bn for 2021, Nigeria is Africa’s largest economy.

- Economic development has been hindered by years of public corruption, military ruling and mismanagement.

- 30% of its economy comes from farming. Oil represents 40% of the GDP and 80% of the governements income. Remittances represents the country’s second source of foreign exchange.

- Organized crime is substantial, notably financial crime and money laundering.

- The population is growing fast. It is diverse and divided. International observers consider that the lack of education is driving Nigeria into a failed state.

Also, 62% of the Nigerian population is 24 or younger.

Also, 62% of the Nigerian population is 24 or younger.- Unsurprisingly the country ranks 6th in the world for cryptocurrency adoption, but it is also one of the world’s least “banked” economies.

- The digital platform Paxful is the leading system used in Nigeria, with 1.5 million users (and 7 million globally).

- The new currency will become the second largest CBDC in the world, after the Chinese Remnibi.

- It is expected to increase the economy by $29 bn (6%) over the next 10 years.

- The eNaira is pegged to the national currency, which was twice devalued this year and suffered years of underperformance.

The deployment had some glitches.

The deployment had some glitches.

- The new CBDC was deployed by Bitt, which also managed the East Caribbean digital currrency DCash.

- The launch was delayed from October 1st (Nigeria’s independence day) for technical reasons.

- The Android app failed on the day after after the launch and was removed from the Google App store after 100,000 downloads.

- The Central Bank immediately indicated that it would not be liable for any loss.

- Attorneys believe that the waiver has limited power, since the introduction was organized under teh name of the Central Bank, not by a commercial institution.

Nigeria forbade cryptocurrencies

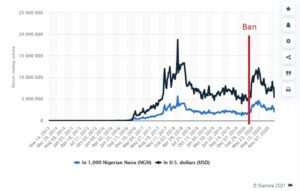

- In February, the Central Bank had banned all banks and commerce from accepting or facilitating cryptocurrencies operations. It considered cryptocurrencies as a threat to the financial system.

- Among the reasons, we can probably see:

The national currency has lost 30% of its value against the USD over the last 5 years. Remittances tended to be sent in crypto, to prevent the risk of a loss in savings. As more remittances were converted into cryptocurrencies, the purchase of the local currency decreased, which amplified its fall.

The national currency has lost 30% of its value against the USD over the last 5 years. Remittances tended to be sent in crypto, to prevent the risk of a loss in savings. As more remittances were converted into cryptocurrencies, the purchase of the local currency decreased, which amplified its fall.- Nigeria is rocked by civil unrest. The government cracked down and notably prevented a feminist coalition of 13 women to raise funds. The coalition managed to raise $150,000 nevertheless thanks to cryptocurrencies. That financial power scared the political class.

The cryptocurrency volumes kept on growing nevertheless. Trades went underground, aka harder to monitor and less safe. Platforms started to use peer-to-peer approaches or moved abroad. Others started to declare the cryptocurrencies as regular currencies to circumvent the regulations.

The cryptocurrency volumes kept on growing nevertheless. Trades went underground, aka harder to monitor and less safe. Platforms started to use peer-to-peer approaches or moved abroad. Others started to declare the cryptocurrencies as regular currencies to circumvent the regulations.

- Criticism of the ban was heavy

- With a labor force 27.1% unemployed, 28.6% under-employed and very underbanked, eliminating a mean of commerce didn’t go too well with the Nigerians.

- The Central Bank was accused of collecting greater control.

- This being said, preventing money laudering is probably one of the reasons why the country introduced its CBDC.

Unlike developed countries, emerging countries have more to benefit from a mode of payment which is available on a cell phone and doesn’t require a bank account.

In the case of Nigeria, inflation and protests probably were the key reasons for the crypto ban and the later introduction of a CBDC, but no country can afford or will relinquish the control over its currency.

In the case of Nigeria, inflation and protests probably were the key reasons for the crypto ban and the later introduction of a CBDC, but no country can afford or will relinquish the control over its currency.

I suspect more countries will follow Nigeria’s path.

References (Navesink International)

- Navesink International, June 17, 2021: Should Central Banks issue digital currencies?

- Navesink International, October 25, 2021: The pros and cons of crypto markets (vs. regulated markets)

References (Public domain)

- BBC, October 1, 2020: Nigeria turns 60: Can Africa’s most populous nation remain united?

- The Conversation, October 25, 2020: Why Nigeria can’t fix its development agenda: and where the solutions lie

- Quartz Africa, March 17, 2021: Nigeria’s crypto startups and traders are still at the mercy of its central bank

- The Guardian, July 31, 2011: Out of control and rising: why bitcoin has Nigeria’s government in a panic

- Foreign Policy, September 10, 2021: Buhari’s Authoritarian Twitter Ban Continues to Silence Nigerians

- Bitcoinist, October 24, 2021: Nigeria Prepares To Launch Digital Currency eNaira On Monday

- TRT World, October 25, 2021: Nigeria launches its central bank digital currency eNaira

- Al Jazeera / Bloomberg, October 25, 2021: Nigeria becomes first African nation to roll out digital currency

- Punch, October 28, 2021: After 48hrs, eNaira app removed from Google Store amid criticism