Few people saw it, but Bitcoin dropped 87% to $8,200 on Coinbase last week. The sudden drop was due to an erroneous trade entry from a trading algorithm, and it didn’t last long. The asset quickly recovered.

Few people saw it, but Bitcoin dropped 87% to $8,200 on Coinbase last week. The sudden drop was due to an erroneous trade entry from a trading algorithm, and it didn’t last long. The asset quickly recovered.

Operational issues like this one are not that rare in the regular markets, but it begs the question of how often operational issues happen, and which world (crypto or regulated) is most exposed.

A bit of research on the pros and cons of crypto markets vs regulated markets lead to the general view below.

Google-search the pro’s and con’s of cryptocurrencies, and you find articles like this one or that one. Let’s start with these well-recognized statements.

Advantages

The stated advantages are repositioned in their wider dimension, before being particular issues are pointed out:

| Advantages | Issue at stake | Comment |

|---|---|---|

| Freedom of payment: crypto spells the end of the “tyranny of governments“. | Someone’s freedom fighter is a someone else’s terrorist. Who gets to decide? Can we agree that some authority is needed? | Cryptos are a benediction for bad actors. Rogue states and international pariahs use Cryptos to flout international sanctions. Do we want to help the North Korea’s government? |

| Wallets are anonymous and protect from identity thefts | Anonymity also hides bad actors and hinders enforcement authorities.

| It is naïve to think that there’s only a few bad apples.

Ransomware actors commit enormous damage.

The whataboutism of saying that there are much more fraud in fiat currencies may be true, but probably not after adjustment by the sizes of the two monetary masses or transaction volumes. Anyway fraud is fraud, and it should not be facilitated. |

| Good luck getting your lifetime savings if you lose your key. | That’s an enormous amount.

This would never happen at a regulated institutions, which would always be able to return your money to you. | |

We don’t know who owns the majority of cryptos.

| Natoshi Nakamoto, the creator of BTC, owns probably 1 million BTC, worth dozens of $ billions at the current level. Natoshi Nakamoto is a pseudonym.

Contrarily to stated democratization objectives, 80% of cryptos are currently held by only 20 wallets (exchanges). DeFi has created its own new giants. What power would these individuals and private entities hold on all of us if we convert, say, 20% of the world’s economy to crypto? | |

| A complex algo cannot be manipulated. | They are not full-proof. They also consumes an enormous amount of resources.

| The day a quantum computer breaks the code, a miner can hack the blockchain. BTC will be worth nothing after that. It will happen in the next decade. Cryptocurrencies have a large negative environmental impact.

|

| A transaction is validated in 10 minutes. | True. But most regulated assets settle T+1 these days. Is the gain worth that much? | A lot of transactions could be moved to virtually instantaneous settlement.

|

| No third party involvement. | Your repository IS a third-party. | An exchange or a repository of crypto like Coinbase IS a third party. You are still exposed to third party risk with cryptocurrencies. If anything, your counterparty risk is actually much higher than in the regulated world.

Needless to say, regulated providers have a much better resilience. More on this in the exchange section below. |

Free/very cheap transactions

| If the transactions themselves are free to operate, the exchanges are not. | The fee structure is actually opaque, and certainly not free.

Worse, transaction fee is only one element of transaction costs. The other are:

|

| No inflation, since there is no government involved. | Yes, governments can issue new dollars. But cryptos are structurally inflationist – their number is limited and the cost of mining them increases over time. | The recent exponential growth price of BTC matches the rhetoric that it can ‘only go up’.

Which is the most stable and reliable? A fiat currency like the dollar in existence for centuries and backed by the power of taxation, or ‘something’ (see the regulatory question) that has no intrinsic value, is not a store of value, is not well defined and whose prices is highly volatile? |

Disadvantages

Those were the advantages. Here are the known disadvantages now.

| Disadvantages | Issue at stake | Comment |

|---|---|---|

| Lack of awareness / the techniques are complex | Awareness is growing fast, but the complexity as well. | Not knowing what sustains the Thai baht currency, or the geopolitical complexity of the Turkish lira, is irrelevant to most individuals – they don’t use those currencies. It is the same for cryptocurrencies.

As a result most people will never use such complex assets as a mean of payment, especially when they are evolving faster and faster. |

Highly volatile in nature

| BTC, probably the benchmark in crypto currencies, has 80% volatility. Can it be a store of value? | A store of value must meet several criteria, like being durable, fungible, verifiable, storable, portable, and divisible. Cryptocurrencies meet many of those. Where it becomes difficult is that a store of value must “retain purchasing power into the future“.

Also, a store of value should be usable for exchange. Just walk around town, your supermarket to start with, and it is pretty obvious. Most of the world’s assets cannot be purchased with Crypto currencies (at this stage).

This being said, cryptocurrencies offer other unique characteristics like

|

Not accepted everywhere

| To a few rare exceptions, cryptocurrencies are not accepted means of exchanges. Will they every be? | A few countries have accepted BTC as a national currency or borrowed in cryptos, but it is more to escape international sanctions than by structural benefit (see our previous note here)

So will cryptocurrencies ever be accepted as means of payment? Elon Musk thinks so, but

Companies may use them, but it will be marginal. At this stage, crypto are not even secure and their legal nature not well defined. |

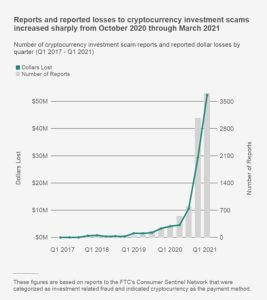

There are many theft and scams.

| OMG, where do we start? |

Maybe just some official statics from the Federal Trade Commission. These numbers are based on self-reporting and are way below reality. |

| No reverse payment or recovery | You have no recourse against another participant. More importantly, the regulatory environment is so weak, that there’s nothing you can do when your money is gone. | See the regulatory section below. It is a pandemic issue, according to fraud, compliance professionals and litigation attorneys. |

| Black market: dark web, fraudulent identities, ransomware… | Self-evident | You have to be blind not to see it. |

| Scaling issue | As the number of transactions increases, the computing power needed to confirm transactions become unmanageable | The world’s computer infrastructure is limited. Energy resources are limited. The more energy you consume, the more you pollute. Simply said, the computational needs to handle cryptocurrencies are already unmanageable.

|

| Not exchangeable with fiat currencies. | Governments can restrict conversions. | Or they can tax transactions. The IRS is actually the best positioned agency to regulate cryptocurrencies in the US.

|

Regulatory issues

There are several areas, where cryptocurrencies are deficient, and certainly less safe than ‘regulated markets’. Let’s start with the regulatory issues.

| Cryptocurrencies are not always securities. |

As a result, the SEC is limited in its rights & competencies to intervene in cryptocurrencies. |

Cryptocurrencies are not commodities.

|

So the CFTC is also limited in how they can intervene in cryptocurrencies |

| Cryptocurrencies are not currencies. | They are at best means of payments. Which means the OCC (Office of the comptroller of the currency) has little jurisdiction. |

| The IRS has some oversight |

|

What is needed

| It is Congress’s job to determine what a cryptocurrency is, and how cryptocurrencies should be handled by the United States.

|

The legal limbo

The legal limbo

The lack of regulatory rules, and a fortiori the lack of a regulator, makes guidance, implementation and corrections difficult. The lack of both rules and jurisprudence makes defining what is right or wrong (aka legal) particularly difficult for all the law professionals.

You will find among the many issues that they face (Freeman Law, World Financial Review):

| Contractual issues | ‘Smart contracts’ rules that are automatically applied when parties transact in a given rule-based cryptocurrency do not fit when in legal framework for contracts. Contract laws also differ from state to state. As a result, any disagreement results in lengthy litigation. |

Jurisdictional / accountability issues

| The blockchains are located nowhere and everywhere. Any miner keeps a copy of it. as a reuslt,

|

| Theft and fraud | Cryptocurrencies promises anonymity to its account holders. Thieves could not hope for a better way to manage their finances. But data also is stolen. When Ledger’s database was hacked, 1 million emails and the entire information from 9,500 customers were stolen. If you are one of those, you have no recourse against the company – there are no laws. If someone hacks your bank account, banks are forced to cooperate with the police. There is no equivalent in cryptocurrency. Demonstrating that an individual committed a crime is much harder in an anonymous world. |

Privacy issues

| Anonymity is a problem for law enforcement. But it is not even guaranteed by the blockchain technology. The technology company Chainalysis can already identify the owners of multiple crypto currencies. Also, blockchain’s distributed peer-to-peer technology may be infringing on confidentiality rules like HIPAA and CCPA. |

| Money laundering | Anonymous accounts are ideal for money laundering. But there are actually techniques (like mixing) to make money tracing even harder or offer deniability to criminals. Interestingly, the mixers themselves also leave traces, leading to famous arrests. |

Intellectual Property

| Industries exposed to counterfeits are interested in the traceability of transactions. It raises concerns of ownerships, enforceability of smart contracts, as well as difficulties with licensing, distribution and exclusivity. NFTs are a quagmire of issues of their own. See our previous piece. |

| No recourse | Most interestingly, if your bank loses the money you have deposited in your account. You can trace it or force the bank to get your money back. There is absolutely no equivalent in a decentralized system. If a hacker depletes your wallet, you are alone. Needless to say, wallet hacking is now a big business, notably through the ubiquitous smart phone – and apparently both common and relatively easy to do. |

Exchanges

Exchanges

Exchanges like the New York Stock Exchanges, the CBOE or the Chicago Mercantile Exchange are well established. They offer safe environment for transacting, raising capital, or for ensuring resilience of the financial markets.

Exchanges in the crypto space, not so much:

As this article started, stock exchanges have automatic stops and suspensions for large moves. Crypto exchanges are barely regulated and rarely have any. Crypto will fluctuate up and down, with no restrictions, including when errors happen.

As this article started, stock exchanges have automatic stops and suspensions for large moves. Crypto exchanges are barely regulated and rarely have any. Crypto will fluctuate up and down, with no restrictions, including when errors happen.- Many platforms have little or no compliance and monitoring. Illicit behaviors are not detected or fought. Pump-and-dump happen daily for instance.

- Capital requirements for participants are low in crypto exchanges. There are no clearers. As a results, exchanges carry and transfer counterparty risks from their losing traders; an exchange may not be able to compensate winning traders!

- Exchanges don’t respect their own rules. The OKEx exchange for instance, suddenly canceled one of its futures. Could you imagine the CME suddenly changing the maturity of a futures? Margin rules also change regularly.

Exchanges are loosely regulated. As a result, security standards are very disparate. Exchanges get hacked, and thieves instantly gain access to your wallet and all your savings. Security is regularly cited as the biggest problem with exchanges.

Exchanges are loosely regulated. As a result, security standards are very disparate. Exchanges get hacked, and thieves instantly gain access to your wallet and all your savings. Security is regularly cited as the biggest problem with exchanges.- Exchanges are often poorly funded, and they cut corners where they can. They often gave little or no customer support, even for major issues.

- Exchanges may suspend fund withdrawals, or tax them with fees or minimums.

Exchanges publish fake volumes to attract participants. It is a rampant issue, as a extensive 2019 report from the SEC indicates that 95% of bitcoin reported volume is fake. It indicates that only 10 exchanges actually have real volumes, which will not improve the solvency of most exchanges.

Exchanges publish fake volumes to attract participants. It is a rampant issue, as a extensive 2019 report from the SEC indicates that 95% of bitcoin reported volume is fake. It indicates that only 10 exchanges actually have real volumes, which will not improve the solvency of most exchanges.- Manipulations by participants: Because volumes are actually meach thiner than indicated, prices are easily manipulated on cryptocurrency exchanges for the benefit of creating profits on derivatives.

- Manipulations by the exchanges themselves: Exchanges themselves are actually suspected of insider trading and market manipulations. Here is another example.

There are good sides in the crypto space, like the benefits of the distributed ledger, aka an efficient outsourcing mechanism. Miners need to be rewarded for this service, and the token needs to have value for this.

There are good sides in the crypto space, like the benefits of the distributed ledger, aka an efficient outsourcing mechanism. Miners need to be rewarded for this service, and the token needs to have value for this.

But it’s pretty obvious to me that regulated market participants hold themselves to much higher standards than the crypto participants, and that there are some serious drawbacks in the overall crypto concept. Not to you?

And it is the general public that suffers from these low standards, not the professionals.

References

- Wired, March 3, 2014: The inside story of Mt. Gox, Bitcoin’s $460 million disaster

- Fortune, January 31, 2018: How to Steal $500 Million in Cryptocurrency

- WSJ, February 20, 2018: Look Out Bitcoin: Venezuela Launches its Own Cryptocurrency

- Cassiopeia Services, February 2018: Challenges and issues in cryptocurrency trading: beyond the controversies

- Finance Magnates, August 2, 2018: OKEx Traders Under Threat From $460 Million Losing Trade

- Science Daily, October 29, 2018: Bitcoin can push global warming above 2 degrees C in a couple decades

- Yahoo FInance, January 4, 2019: Crypto projects promise decentralisation — the data shows that’s far from true

- Bitwise Asset Management, March 250, 2019: Presentation to the U.S. Securities and Exchange Commission

- Finance Magnates, November 19, 2018: Bitcoin Cash Fallout: OKEx Futures Contracts Cancelled Without Warning

- Forbes, June 15, 2019: New Report Illustrates The Problem With Cryptocurrency Exchanges

- Honest Pros and Cons, December 5, 2019: 16 Advantages and Disadvantages of Cryptocurrency

- Geeks for Geeks, May 10, 2020: Advantages and Disadvantages of Cryptocurrency in 2020

- Wired, May 18, 2020: Cryptocurrency Hardware Wallets Can Get Hacked Too

- Coin Telegraph, June 8, 2020: Chainalysis Can Now Track Your ‘Privacy Coins’ Zcash & Dash

- Finance Magnates, July 10, 2020:

- Decrypt, July 20,2020: Bitcoin wallet Ledger’s database hacked for 1 million emails

- WSJ, November 4, 2019: Large Bitcoin Player Manipulated Price Sharply Higher, Study Says

- Nikkei Asia, October 19, 2020: China’s OKEx halts cryptocurrency withdrawals after founder arrested – Nikkei Asia

- The Balance, November 21, 2020: Petrodollars and the System that Created It

- Investopedia, December 17, 2020: Why Does the Price of Bitcoin Keep Going Up?

- Medium, December 29, 2020: Why Bitcoin is a superior store of value

- Cointracker, updated January 11, 2021: 2021 Crypto-Exchange Fee Comparison

- DW, February 16, 2021: Why does Bitcoin need more energy than whole countries?

- BBC, February 27, 2021: How Bitcoin’s vast energy use could burst its bubble

- Navesink, April 22, 2021: Turkish crypto founder vanishes with reported $2bn

- GoBankingRates, April 29, 2021: Will Bitcoin Ever Be Accepted Widely as a Form of Payment?

- Navesink International, May 6, 2021: Crypto-pumps: the widespread pump-and-dumps schemes in cryptocurrencies

- Business Insider, May 19, 2021: The hackers who shut down Colonial Pipeline brought in over $90 million in bitcoin ransoms while in operation

- SEC, May 24, 2019: Economic and Non-Economic Trading In Bitcoin: Exploring the Real Spot Market For The World’s First Digital Commodity

- Navesink International, April 22, 2021: Non-Fungible Tokens in Non-Fungible Markets

- MyBTC.ca, May 15, 2021: Who owns the most bitcoins?

- Federal Trade Commission, May 17, 2021: Cryptocurrency buzz drives record investment scam losses

- Cybercrime Magazine, June 3, 2021: Global Ransomware Damage Costs Predicted To Exceed $265 Billion By 2031

- BBC, June 17, 2021: World Bank rejects El Salvador request for Bitcoin help

- Navesink, June 17, 201: Should Central Banks issue digital currencies?

- Forex.com, June 21, 2021: Currency reserves: what are they and why do they matter?

- Kiplinger, July 14, 2021: How Is Cryptocurrency Taxed? Here’s What You Need to Know

- Built In, July 13, 2021: Store of Value: Why Crypto Won’t Replace Gold

- Benzinga, July 28, 2021: Is Bitcoin (BTC) Safe from Grover’s Algorithm?

- The World Financial review, August 8, 2021: Cryptocurrency and Legal Considerations About It

- Bleeping Computer, August 18, 2021: Bitcoin mixer owner pleads guilty to laundering over $300 million

- CNBC, August 19, 2021: Cryptocurrency traders seek damages from Binance after a major outage cost them millions

- CNBC, August 24, 2019: Coinbase slammed for what users say is terrible customer service after hackers drain their accounts

- CNBC, August 26, 2021: You could be leaving your crypto wallet open to hackers—here’s how to protect it

- Business Insider, September 6, 2021: Bitcoin mining consumes 0.5% of all electricity used globally and 7 times Google’s total usage, new report says

- GoBankingRates, September 8, 2021: Up to $4.2 Billion in Lost Bitcoin Can Be Recovered – Be Wary of Scams

- Vice, September 15, 2021: Major NFT Marketplace OpenSea Admits Employee Did Insider Trading

- Euronews.next, september 18, 2021: US probes possible insider trading and market manipulation at crypto exchange Binance

- Cyberscoop, September 29, 2021: Ransomware gangs are starting more drama on cybercrime forums, upending ‘honor among thieves’ conventions

- Tsay Tuned with Preet, September 30, 2021: Regulating Crypto (with SEC Chair Gary Gensler) [Podcast]

- Bleeping Computer, October 15, 2021: US links $5.2 billion worth of Bitcoin transactions to ransomware

- Kraken, October 21, 2021: Cryptocurrency withdrawal fees and minimums

- Bloomberg, October 21, 2021: Bitcoin Crashed 87% on Binance’s U.S. Exchange Due to Algo Bug