When you lift an offer on an exchange, you pay an execution fee to the exchange – that’s how the exchange pays for its systems and makes money as a for-profit company.

When you lift an offer on an exchange, you pay an execution fee to the exchange – that’s how the exchange pays for its systems and makes money as a for-profit company.

To attract liquidity, aka to make sure that somebody entered that offer in the market, exchanges pay market-makers to enter their quotes (it is written somehwere in their complicated fee schedule)

To attract liquidity, aka to make sure that somebody entered that offer in the market, exchanges pay market-makers to enter their quotes (it is written somehwere in their complicated fee schedule)

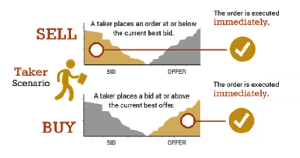

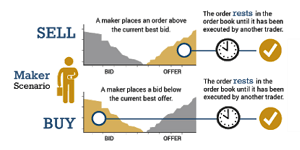

That’s what is called the “maker-taker” model.

- Market-makers get compensated for entering prices.

- Market-takers pay for the service.

But when the options were illiquid and in high demand (meme stocks), the exchange paid more for the market-maker than they were charging the market-taker. What do you think happened?

-> People traded with themselves. They entered quotes on illiquid securities and bought them through another account. Net, they had no position, except for the extra fee.

-> They eventually created fake accounts to increase the volume.

The SEC has punished the actors for ‘painting the tape‘, aka creating trades without economic interest. Isn’t arbitraging dumb exchanges a pretty decent economic interest?

Reference

- Reuters, September 27, 2021: U.S. SEC charges individuals in ‘meme stock’ options trading scheme