The ARRC has just accepted the CME’s SOFR term structure calculations as benchmark. It is a big thing.

The ARRC has just accepted the CME’s SOFR term structure calculations as benchmark. It is a big thing.

This article explains SOFR’s lack of term structure and how the CME will calculate term rates from the SOFR futures.

SOFR misses some LIBOR qualities

The SOFR rate is calculated from large numbers of overnight treasuries repo transactions (representing close to a trillion dollar everyday).

The way this new benchmark was created – using real-world overnight trades – generates headaches for professionals. It is notably a cash rate of very short duration (one day), not tradable and backward-looking. Here is what this means:

- It is a cash rate: it only tells you where the rate on an overnight basis, not for a period of, say, 1 week or 1 month. If you need a term lending, like for borrowing money for one month, then you are in bad luck. SOFR doesn’t tell you that.

LIBOR used to give you those terms. When you were looking at LIBOR rates, you were actually looking at various durations. You could chose at the overnight rate (the rate from today to tomorrow), the tom-next (the overnight starting tomorrow to the day after, not starting today), then the one week, then two weeks, then 1 month, then 2 months, etc. That is called a “term lending“.

Also, you could trade at the LIBOR rate for a given period. You just picked up the phone, talked to your rate trader, and asked him to borrow $750m at the next LIBOR for three month. He would lend you the cash at the quoted LIBOR rate. He would in turn execute the borrowing on the interdealer market, and that would be even easier for him if he was one of the banks who was setting the rate.

Also, you could trade at the LIBOR rate for a given period. You just picked up the phone, talked to your rate trader, and asked him to borrow $750m at the next LIBOR for three month. He would lend you the cash at the quoted LIBOR rate. He would in turn execute the borrowing on the interdealer market, and that would be even easier for him if he was one of the banks who was setting the rate.

Once again, tough luck. Not only you can’t lock for one month, but you can’t even lock for the day with SOFR. That’s because SOFR is a volume-weighted rate. It is the average rate of all the transactions executed over the day. You may trade over the day, but your specific trade might be at a price that is very different than all the other trades, and therefore end-up with a very different rate than SOFR. (you wouldn’t be too far, but the spreads add-up…)

- It is backward-looking: It is only at the end of the period (of the day) that you know the rate for the period in question. If there was a one-month SOFR, it would only tell you what rate you had over the last month, not the rate you will get over the coming month.

This explain why, despite all its weaknesses, professional dealers have difficulties migrating to SOFR. It does not answer many of the traders’ needs.

But the problems actually go further.

What is a term structure?

The problems explained above already impact a lot of rate users, who need to either lock rates for more than a day.

The problems explained above already impact a lot of rate users, who need to either lock rates for more than a day.

Compounding is not a solution for them. Yes, you can place money every day again and again for the whole month, and that will give you a rate for the month (adjusted for costs, bad executions…), but that rate calculation is not lending money at a fixed rate for a month.

Also, even if you could lend money for a month with SOFR, you still wouldn’t know at the start of the month what the rate will be. You can only know the compounded rates at when you have all the daily rates, at the end of the month. That forward-looking feature would be key if you are buying a house, or even worse building a very expensive bridge.

To know what the rate will be in the future, you need what is called a term structure, aka a forecast of rates for future periods. A term structure answers questions like:

- “at what rate can I lock my borrowing for the next month?”, or

- “at what rate can I lock my borrowing for the month starting in one month?”, or

- “at what rate can I lock my borrowing for the month starting in January next year”, etc.

Such a term structure is critical for a lot of rate users. Let’s take the example of a bridge/highway operator, who builds a highway and several bridges; he is borrowing a large sum to pay for their construction and he needs to know how much he will have to pay interest on that loan. He has a fixed amount of car users and he can’t change the toll price. As a result, a large rate increase would mean bankruptcy for him and his lenders. That operator needs forward-looking term rates.

Such a term structure is critical for a lot of rate users. Let’s take the example of a bridge/highway operator, who builds a highway and several bridges; he is borrowing a large sum to pay for their construction and he needs to know how much he will have to pay interest on that loan. He has a fixed amount of car users and he can’t change the toll price. As a result, a large rate increase would mean bankruptcy for him and his lenders. That operator needs forward-looking term rates.

So where to find that term structure? Term structures are typically found in derivatives. The forecasts are either traded explicitly, like in a futures or a swap, or implicitly available in a wide range of other types of derivatives. In that last approach, you need to analyze the price of the instruments to extract the rate forecast. To do this you need systems, methodologies, prices (of the derivatives) and sometimes also assumptions (if the derivatives relates to other assets or use parameters). In other words, implicit rates are not obvious to the onlooker. So let’s concentrate on the explicit derivatives.

Various exchanges offer SOFR futures, notably ICE and the CME in the US. These futures allow you to trade (and therefore hedge) the explicit value of the future SOFR level over a coming period. You could for instance trade at 3.50% through the futures of next January.

Interestingly, the exchanges offer two tenors, 1 month and 3 months. These tenor differ by the duration of the exposure, aka what would be the rate for a locked period of 1 month, or a locked period of 3 months, in both cases starting say in that January next year. And no, trading for 3 months, is not necessarily equal to trading three times for one month. (PS: 3 months maturities are based on the IMM calendar, while 1-month maturities are using the regular monthly calendars, so the periods do not overlap.)

Futures still do not allow you to borrow/invest the cash! They only tell you where people believe the SOFR 1 month will be, and give you money if that expectation changes. It is what is called a “variation contract“, as it pays the variation on that estimation, not the estimation itself.

On an example: if you trade a futures with a rate of 3.5%, and the futures rate is now 3.75%, the future exposure will pay you the 0.25%, but not the 3.50% or the 3.75%.

Futures hedge the change in rate, but does not allow you to ‘place the money’ (which you can’t even do with SOFR). You will still have to figure out how to do that when January next year comes.

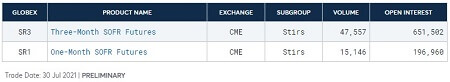

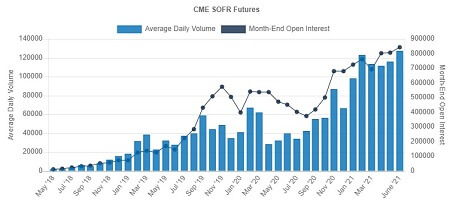

But at least you can protect yourself against variations. And as the industry is forced to migrate towards SOFR, volumes of SOFR futures have been growing:

SOFR issuance in general has been growing, not just the futures.

The need for official term structures – what the AARC selection means

Now, if you are that bridge and highway operator, you are not interested in trading futures. What you want is to borrow $10 bn, get the cash in your bank account to pay your contractors and lock the rate exposure on that loan. To do that, you can either borrow floating and lock the rate with a swap, or borrow at a fixed rate. Let’s assume that you borrow at a fixed rate of 3.93% from a big bank.

Now, if you are that bridge and highway operator, you are not interested in trading futures. What you want is to borrow $10 bn, get the cash in your bank account to pay your contractors and lock the rate exposure on that loan. To do that, you can either borrow floating and lock the rate with a swap, or borrow at a fixed rate. Let’s assume that you borrow at a fixed rate of 3.93% from a big bank.

That bank on the other side will also borrow the $10bn, from the market. It will work with two types of counterparties. There are cash lenders, who typically work on a floating rate basis (like SOFR + 1.25%) and there are swap traders, who will exchange floating rates for fixed rates (like LIBOR 3M vs 1.24%).

The problem is that swap traders are not interested in overnight mumbo-jumbo. They exchange fixed rates against term rates, like that Libor 3 months of the old time. Unfortunately, that LIBOR 3 month doesn’t exist anymore, so they need some kind of a SOFR 3 month.

That’s where the problem is. How will anybody calculate what the 3 month SOFR is now or will be in January next year? The swap trader will pay/receive that coupon, and needs an accurate measurement. We could look at the futures price now, but that price keeps on ticking; it changes all the time! What about if that swap trader has protected himself with an option on that rate? How could he calculate the volatility of that rate? He would need the history of daily prices of that rate.

So what we need is a reference price for that 3 month rate. A reference price that everybody can attest and agree with. That is what the CME is doing. The CME is calculating ONE single price everyday for that 3 month SOFR rate.

So what we need is a reference price for that 3 month rate. A reference price that everybody can attest and agree with. That is what the CME is doing. The CME is calculating ONE single price everyday for that 3 month SOFR rate.

In the next paragraph, we will explain how that calculation takes place. It is not straightforward. What is important (as explained in the Reuters article below) is that the ARRC, the committee which oversees the transition from LIBOR to SOFR, is recommending using the CME methodology and the CME’s numbers going forward. We now have a methodology to calculate term rates. That decision will impact how trillions of interest rate derivatives contract will be created and valued.

How the CME will calculate daily SOFR term structures

The CME is offering a methodology to calculate SOFR term structures reference prices from SOFR futures.

The videos at this link explain this methodology, but since the topic is a bit technical and the videos are fast, I will explain what they mean.

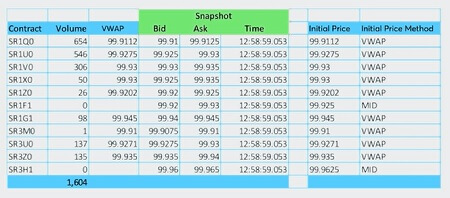

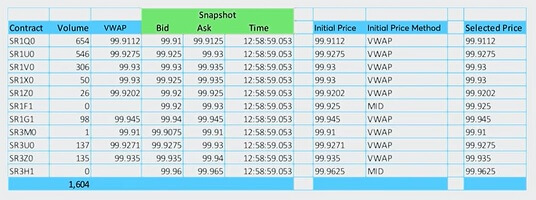

- The day is split into 14 time buckets of 30 minutes.

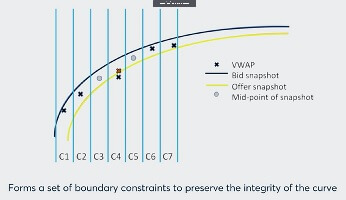

- During each of these time buckets, the CME defines a reference price for each futures, usually based on VWAP, but it could be a mid-market if the future has not traded. The volumes also include the volumes of strategies (calendars, butterflies, etc). The CME also looks at the bid-offer during the period, using randomized times (so that nobody can post fake bids or offers).

- In each of the time buckets, it then fits a curve that matches all these prices.

- The curve is fitted to be close to the reference prices, but remain in the randomized bid-offer, while matching appropriate coherence criteria.

- The 14 curves are then averaged, using the trading volumes of the entire curve for each of these buckets.

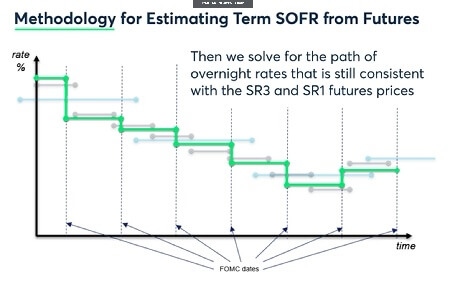

- The exchange then calculates a likely path for the SOFR rate using both the 1 month and 3 month term structures, the calendar of FOMC meetings (the SOFR rate is assumed constant on average between FOMC meetings, and can gap the days after FOMC meetings). That methodology is Fed-approved.

- The CME then calculates 1, 3 and 6 month terms from that path, and distributes the values around the world.

That methodology is

- resilient – it works all the time,

- robust – it can’t be manipulated, and

- coherent – the curve and the term structure make sense.

That great idea is not free.

The good news is that you can then use that methodology and its result for free up to December 2026 for cash market products.

The good news is that you can then use that methodology and its result for free up to December 2026 for cash market products.

The bad news is that the use of that methodology after 2026 for cash markets will NOT be free. Its use for derivatives is not free from day one. Lastly, historical data aren’t free either. You need to talk to the sales rep to know all these prices…

That the ARRC is recommending the CME methodology is good, as it establishes a benchmark going forward. We will all benefit from it. But it will probably also be great for the CME’s pocket.

Will it be as much as the VIX for the CBOE? We shall see…

References

- Federal Reserve Bank of New York, ARRC Formally Recommends Term SOFR

- Federal Reserve Bank of New York, SOFR definition and rates.

- Federal Reserve Bank of New York, Forward Looking Term SOFR and SOFR Averages

- CME: CME Term SOFR Reference Rates

- James Kyprios, Navesink International, LIBOR: the most important number in the world is going away