Transfer pricing is an accounting practice that represents the price that one division in a company charges another division for goods and services provided. For instance, transfer pricing would permit a US media company to create and distribute all its intellectual property from Ireland, a low-tax jurisdiction. As a result, the company pays little tax overall.

Transfer pricing is an accounting practice that represents the price that one division in a company charges another division for goods and services provided. For instance, transfer pricing would permit a US media company to create and distribute all its intellectual property from Ireland, a low-tax jurisdiction. As a result, the company pays little tax overall.

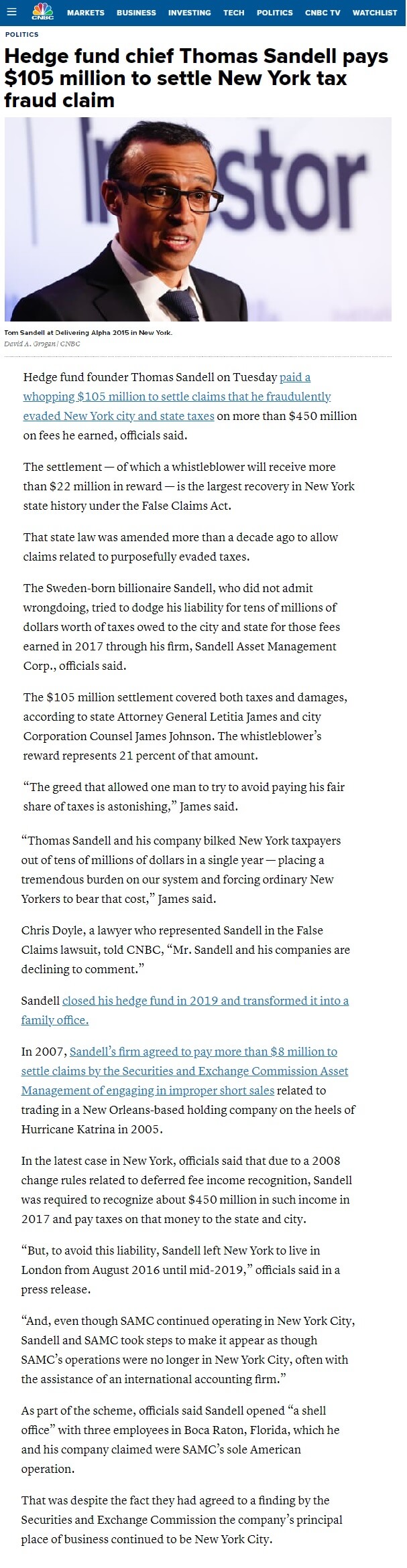

Thomas Sandell, owner of Sandell Asset Management Corporation, tried its hedge fund equivalent by transferring its activity from NY City to Florida, hence defrauding both NY State and NYC taxes .

It didn’t work too well.

The case history

Due to rule changes in 2008 (federal) and 2010 (in NY), Sandell was eventually forced in 2017 to recognize $450 m of deferred income – under threat of forfeiture. The income had been generated in New York State during the 1998-2008 period and was therefore taxable in both NY State and NY City.

Sandell had a different opinion, though. Between 2012 and 2018, he listened to tax advisors, including one of the Big 4, suggesting that he could reduce or eliminate his liabilities by removing his physical presence in NY prior to the recognition.

And so, he created a ‘shell office’ with only three employees in Florida, to which his firm was supposed to have relocated its entire US operations in late 2016. He used a locally established subsidiary to handle the payroll management, to pay staff, and to pay rents for the entire firm.

And so, he created a ‘shell office’ with only three employees in Florida, to which his firm was supposed to have relocated its entire US operations in late 2016. He used a locally established subsidiary to handle the payroll management, to pay staff, and to pay rents for the entire firm.

He then declared to the IRS and to the SEC that Bocca Raton was the sole location of its US operations and its official location. Finally, he established his personal residency in London from 2016 to 2019. Having no activity in New York at the time of the recognition, he claimed having no tax obligations in his 2017 tax declaration.

But Bob was not meant to be his uncle. The story became difficult to believe when

- the SEC did an audit for an unrelated matter (unrelated, right?) and found a fully operational office still in New York in 2017.

- Sandell admitted to it.

- The tax preparer (“Accounting Firm A”) also knew of that admission while filing the taxes in 2017.

- Worse, Accounting Firm A also knew that the usual tax preparer (“Accounting Firm B”) had confirmed the liability, would not sign the tax returns and expected correction and penalties.

- Sandell also ignored the warnings of his own accountants.

According to the settlement with the NY attorney General, Sandell is now obligated to cut three checks: $57 m to NY State, $26 m to NY City… and $22m to an anonymous whistleblower. To add insult to injury, those losses are clearly stated as not tax deductible. They will not protect Sandell from any action from municipal or federal action, and they cannot be eliminated by bankruptcy. But he is lucky after all; he did not admit guilt.

A few more interesting points

The case came out when a whistleblower filed a False Claim Act on behalf of the State of New York. Obviously, someone was well informed…

The case came out when a whistleblower filed a False Claim Act on behalf of the State of New York. Obviously, someone was well informed…

The whistleblower chose his attorney well. He was represented by Randall Fox from Kirby McInerney, the founding chief of the taxpayer protection bureau of the New York attorney general’s office. Unsurprisingly, the NY AG took the case and followed up.

The $22 m whistleblower award is now the largest WB payment in the state’s history. Wouldn’t that make the settlement also the largest contingency award for WB attorneys in NY too…?

New York is the only state allowing recollection under the FCA for anything other than Medicaid fraud. Do the other states really believe there is no fraud whatsoever but Medicaid in their jurisdictions…? So why not legislate around this? Any lobbying or election donation to look into?

Meanwhile, NY state is supposed to miss $10 bn of tax every year simply by lack of appropriate collection. It is worse at the federal level. The IRS is estimated to miss at least $400-700 bn (!) of tax collection every year. See our previous note on this: Defund the IRS? Done

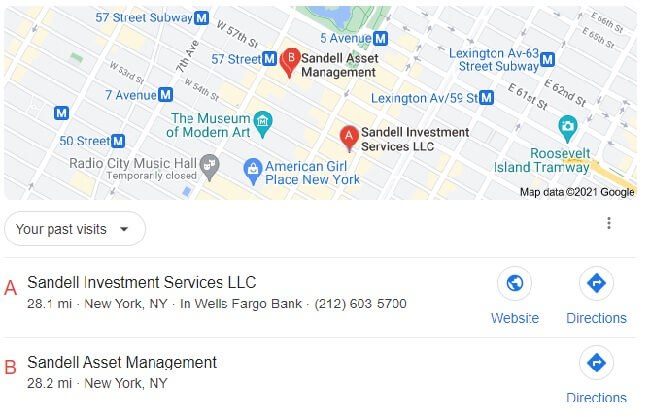

A quick SEC search shows that Sandell Asset Management Corp filed its last 13F in Q4 of 2016. What happened to the activity after that if the company still had activity in its NY office? It disappeared into the magician’s hat?

Here is Google’s guess:

Sandell returned investors money in 2019 and converted in a family office. Could that be related?

Sandell returned investors money in 2019 and converted in a family office. Could that be related?

Forbes ranks his wealth at 1.3 bn. Those tax bill are completely payable. Plus, his cottage in the Hamptons can probably cover it:

References:

State of New York vs Thomas Sandell, Settlement agreement ref 101494/2018