Momentus Technology is being acquired by a SPAC. A small step for man, a big step for mankind?

Momentus Technology is being acquired by a SPAC. A small step for man, a big step for mankind?

The SEC and private litigation firms are jumping in to tell the truth. There are serious issues around that deal. Actually, it’s rotten from the core.

The situation highlights the underlying problems with SPACs. The executives make great money; the investors not so much.

Basic facts

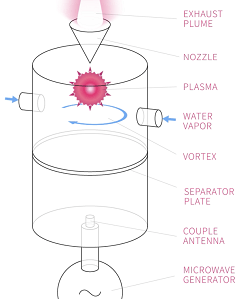

Momentus is a space technology start-up founded in 2017. It promises to help satellites accomplish the last mile, based on a water engine (not kidding) called a microwave electro-thermal (MET) thruster. The technology has great applications and cost-benefits.

Momentus is a space technology start-up founded in 2017. It promises to help satellites accomplish the last mile, based on a water engine (not kidding) called a microwave electro-thermal (MET) thruster. The technology has great applications and cost-benefits.- The company is American but its founder, Mikhail Kokorich, is Russian.

- The SPAC is called Stable Road Acquisition Corp (ticker SRAC). It was created in November 2019 and listed in January 2020. It is lead by Brian Kabot and is sponsored by SRC-NI.

- The SPAC announced the acquisition of Momentus in October 2020, initially for $1.2 bn.

The SEC has pursued and punished Momentus, its founder, the SPAC, its CEO and its sponsor. The settlement announcement was released on July 13th, 2021.

What is a SPAC

SPACs are the new blank check companies. These empty shells are created then listed on an exchange, aka offered to the retail public without any intrinsic economic activity. Their only to purpose is to raise cash through the IPO in order to facilitate a future acquisition. That future acquisition is not announced, and actually not even known, at the time of listing. In other words, investors in the SPAC IPO give money to the manager, without knowing what he will do with it.

The sponsor (the listing agent), as well as the SPAC executives have preferential treatment if/when an acquisition happens down the road, like a lot of free shares. Regular SPAC investors do not. The sponsor also collect fees during the product’s lifetime. Needless to say, it is lucrative to be a SPAC CEO or sponsor.

When the SPAC makes an acquisition, the target company and the SPAC actually merge. The target becomes a listed stock overnight, without ever going through the IPO process and its scrutiny. The target has the additional benefit of negotiating its acquisition price, which the long and tenuous IPO process can never guarantee. Both sides benefit tremendously. The SPAC has typically 18-24 months to make an acquisition, or it must return what is left of the cash.

SPAC volumes have exploded in recent years. They now represent one in every 5 dollars of stock listing. SPAC typically trade at a 10-25% premium to their cash, although that average premium has recently fallen [Note in case of redemption that premium is lost to investors]. Some will say, that investors essentially purchase the lure of a private equity unicorn.

SPAC volumes have exploded in recent years. They now represent one in every 5 dollars of stock listing. SPAC typically trade at a 10-25% premium to their cash, although that average premium has recently fallen [Note in case of redemption that premium is lost to investors]. Some will say, that investors essentially purchase the lure of a private equity unicorn.

The SEC warned investors about SPACs in December 2020. The agency isn’t against the process, but it will not tolerate squirting regulatory procedures or insufficient disclosures.

BTW, there are options on the 45 most liquid of the 600 or so SPACs… What could go wrong with that?

More on SPACs in our previous articles SPAC, off-the-shelf dream? and SPAC or SPAM, the aftertaste is sour.

Why the SEC charged Momentus Space and its SPAC

In its release, the SEC has described the reasons for and the outcome of its legal charge:

In its release, the SEC has described the reasons for and the outcome of its legal charge:

- Misleading claim: The space start-up stated that it has “successfully tested” its propulsion technology in space. Actually, the only space-test was a failure. The micro-satellite was supposed to complete 100 bursts of one minute. It completed only 3, and started only 23 times. The satellite was eventually lost 3 months into its 6-month mission.

- National security concern understatements: The Russian CEO is suspected of sharing the technology with Russia and was not allowed to receive technical information from his own engineers. He over-stayed his visa. The investigation concluded to the CEO being a national security threat and led to his resignation.

Lack of licenses: Meanwhile, the company never received its license from the Federal Aviation Administration, nor the chance to any of the governmental contracts it needs to become profitable. The company lost half of its merger valuation with the SPAC when the fact was announced. The SPAC lost 60% of its market value as well.

Lack of licenses: Meanwhile, the company never received its license from the Federal Aviation Administration, nor the chance to any of the governmental contracts it needs to become profitable. The company lost half of its merger valuation with the SPAC when the fact was announced. The SPAC lost 60% of its market value as well.- Insufficient due diligence: The SPAC stated it has “conducted extensive due diligence” on the acquisition. In reality, it never reviewed the engine test results, never perceived its failure, and never received enough document from Momentus to assess the CEO’s security issues. Wouldn’t that count as gross negligence, at best?

The defendants consented to

- Fines: $7m for Momentus, $1m for Stable Road and $40k for Kabot, its founder.

Forfeitures: SRC-NI and the executives will forfeit their 250k founder shares, should the combination be successful. They would have been worth $200m at full merger price.

Forfeitures: SRC-NI and the executives will forfeit their 250k founder shares, should the combination be successful. They would have been worth $200m at full merger price.- Permanent injunctions, penalties, disgorgements of all fund received and a directorship disbarment against the Momentus CEO, Mikhail Kokorich.

- Returning fees of the PIPE subscribers.

- Enhanced compliance, etc.

In an unusual move, the SEC Chair Gary Gensler issued a statement:

“Stable Road, a SPAC, and its merger target, Momentus, both misled the investing public. The fact that Momentus lied to Stable Road does not absolve Stable Road of its failure to undertake adequate due diligence to protect shareholders.”

The follow-ups

A lot has followed. Nothing is too surprising, but all is worth mentionning for whoever believes in the next moon trip:

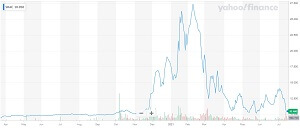

The SPAC reached $29.18 at its highs in early 2021. It lost 20% on the CEO’s resignation. It went down to a low of $10.58 on July 14th, 2021, the day after the SEC announcement. That’s a plunge of 64% in a few months.

The SPAC reached $29.18 at its highs in early 2021. It lost 20% on the CEO’s resignation. It went down to a low of $10.58 on July 14th, 2021, the day after the SEC announcement. That’s a plunge of 64% in a few months.

Momentus hired a new CEO, the day after the SEC’s announcement, an Under-Secretary for Defense for Policy, no less. That should give the firm some national security creds. It’d be interesting to know his compensation package. He probably did his due diligence well, and he’s probably leveraged and motivated enough to solve that regulatory conundrum…

Momentus hired a new CEO, the day after the SEC’s announcement, an Under-Secretary for Defense for Policy, no less. That should give the firm some national security creds. It’d be interesting to know his compensation package. He probably did his due diligence well, and he’s probably leveraged and motivated enough to solve that regulatory conundrum…

Mikhail Kokorich now works on a new space company from his new home in Switzerland. Good luck on raising capital.

The SEC obviously will enforce its warning about transparency and regulations on SPACs. IMO, this case won’t be the only one.

The actors may have escaped the regulator alive, but if the companies still have some cash, it will surely be dented by the plaintiff law firms; they are pretty good at enforcing laws.

The actors may have escaped the regulator alive, but if the companies still have some cash, it will surely be dented by the plaintiff law firms; they are pretty good at enforcing laws.

Robbins Geller filed a class action against the SPAC two days after the SEC release. You will find in the claims that

- The SPAC failed to reached its investment objectives, both in quality and deadlines.

- The real purpose of the Momentus acquisition was the 20% of the target that the sponsor and the executives would collect personnally in the acquisition. Actually, their founder shares would have expired worthless in the absence of a deal 18 months after the IPO [January 2nd, 2020].

- Momentus was heavily public in advertising the success of its engine test and its technology. It promissed the first commercial test soon after the fusion, as well as a solid calendar of launches. [Their Twitter account surely shows so].

- Scienter of the SPAC in its poor disclosures. Comparing what the actors have joyously published everywhere and the true reality, that one shouldn’t be too hard to prove.

Kirby McInerney, Levi & Korsinsky, as well as Bragar Eagel & Squire have also announced their class actions and are calling for plaintiffs. There will be more…

Conclusion

The space SPAC was specious. Seat yourself. There are a lot of billionaires in space these days, and there are many more who dream of reaching zerogravity at any cost.

PS: Hey Redditors, the short interest is large. Anybody wants to buy that SPAC?

Sources:

- Navesink International, March 11, 2021: SPAC, off-the-shelf dream?

- Navesink International, April 19, 2021: SPAC or SPAM, the aftertaste is sour

- SEC, July 13, 2021: SEC Charges SPAC, Sponsor, Merger Target, and CEOs for Misleading Disclosures Ahead of Proposed Business Combination

- SpaceNews, July 13, 2021: Stable Road and Momentus reach SEC settlement over false claims

- The Verge, July 13, 2021: Space startup Momentus charged by SEC with misleading investors

- Reuters, July 14, 2021: Space startup Momentus hires former U.S. defense official as CEO

- Momentus twitter account