The SEC just took Guggenheim to book for the whistleblower restrictive language in its compliance manual.

The SEC just took Guggenheim to book for the whistleblower restrictive language in its compliance manual.

The order scares the financial industry – no whistleblower was prevented from contacting the agency. The fine was applied after the SEC reviewed the firm’s compliance manual.

What happened with Guggenheim

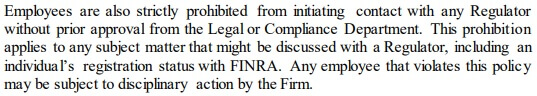

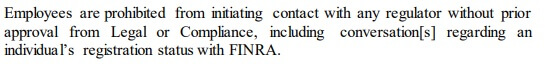

From at least 2016 to 2020, the employee “core compliance” manual from Guggenheim Securities prohibited employees from contacting regulators without prior approval from legal/compliance. It also warned of possible disciplinary actions. Employees had to acknowledge the manual every year.

The manual also contained a ‘no interference’ language. The firm knew exactly what it was doing…

The restriction was further reinforced in compliance training during 2018-19:

Those languages directly and willfully contravened Rule 21F-17 of the Securities Act of 1934 (below).

Without admitting or denying gilt, Guggenheim offered a settlement of $208,912 for those compliance language and training language.

Without admitting or denying gilt, Guggenheim offered a settlement of $208,912 for those compliance language and training language.

The SEC accepted that settlement on June 23rd.

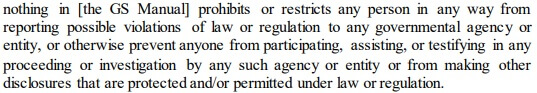

The firm also took remedy, and replaced the previous language in the manual with:

Interestingly enough, the Commission’s enforcement release states that no whistleblower was actually prevented from contacting the SEC, or that Guggenheim has implemented any threat. The enforcement related purely to the compliance manual.

The 21F-17 rule and its history

The SEC adopted the 21F-17 rule in 2011 so as to implement the Dodd-Frank Act, which established the whistleblower programs at both the SEC and at the CFTC.

The rule specifies that:

The first SEC action around that language was in 2015 against KBR. The firm was fined $130,000 for asking employees to inform compliance first. Again, no whistleblower was apparently prevented from communicating with the SEC.

In October 2016, the SEC eventually issued a ‘risk alert‘ to let know all companies that it would review their compliance manuals, employment/severance agreements for the issue.

At least 12 companies were sanctioned for the issue, notably Merrill Lynch, SandRidge Energy, Anheuser-Busch InBev and Blackrock.

The SEC also fined a complaint against Collectors Café for a similar language in an investor agreement. The firm even sued an investor for violating that clause.

What the enforcement means

Dodd-Frank has recognized whistleblowing by as a key tool to fight corporate malfeasance.

Dodd-Frank has recognized whistleblowing by as a key tool to fight corporate malfeasance.

Not only retaliation is prohibited, but this judgement restates that dissuading employees is also strictly forbidden. No restrictive language in employment contracts, NDAs, company policies or separation agreements can prevent employees from talking to regulators.

Moreover, the SEC is taking preemptive actions to enforce that right.

The SEC’s fine restates it clearly: don’t even think of muzzling whistleblowers.