Should countries issue digital currencies? Well, it depends.

Should countries issue digital currencies? Well, it depends.

It depends on what you call a digital currency and how you implement it.

The examples of El Salvador and Venezuela

El Salvador has just made Bitcoin the country’s second official currency. It means that in three months, every shop will have to accept the cryptocurrency for payment (with exceptions), although the US dollar will still be the reference for accounting.

El Salvador has just made Bitcoin the country’s second official currency. It means that in three months, every shop will have to accept the cryptocurrency for payment (with exceptions), although the US dollar will still be the reference for accounting.

There are benefits to this. 70% of the population does not have a bank account. Even if not everybody can afford the technology to get internet everywhere, wallets will surely help an under-banked population.

But there are other reasons for this decision:

- El Salvador pegged its Colon to the US dollar in 2001. The dollar has progressively permeated the economy and it now serves as its official currency. Moreover, three tenths of the country’s economy comes from remittances from the US. The Salvadoran economy is now correlated to the US economy, which wasn’t that great during COVID. The new correlation will allow some decorrelation flexibility.

- More importantly, autocratic and corruption charges have strained the country’s relations with the US in recent years. The new cryptocurrency will alleviate future sanctions, should they be instated.

- Meanwhile, the country is looking for lenders to cover its perpetual budget gap. Borrowing in BTC could be considered as a different source of cash, but the FX risk for borrowing could be significant. The country is engaging talks with the IMF for a new financial aid package and the bitcoin roulette is not reassuring international bankers…

- Interestingly enough, the country has a large underused geothermal capacity. The crypto mining industry could lead to an industrial energy success.

- PS: the World Bank has just rejected the request for technical assistance in deploying Bitcoin to meet its 90 day deadline.

Venezuela tried selling the Petro, a cryptocurrency collateralized with the oil reserves of the Atapirire region. The proceeds of the ICO would allow to develop the infrastructure to extract that oil.

Venezuela tried selling the Petro, a cryptocurrency collateralized with the oil reserves of the Atapirire region. The proceeds of the ICO would allow to develop the infrastructure to extract that oil.

- The currency was “pre-mined” and entirely owned by the government. Salaries and pensions would be pegged to the Petro.

- But the currency, created with Russian support, was a also an artefact to circumvent US restriction keeping Venezuela away from financial markets.

- The IMF declared the project “ill-advised”. The United States declared it an extension of credit to Venezuela and forbade US persons to touch it, under penalties. Venezuela’s own parliament declared it unconstitutional.

- Six months later, the currency was still nowhere to be found. It never traded on any exchange and cannot be valued. Its regulator doesn’t have an office. The money, if any was raised, has disappeared. The oil field saw no investment whatsoever. The Petro holders are left hoping. The plan, considered a “desperate scam to raise money”, had failed.

Countries using private cryptocurrencies may not be the best actors, aren’t they?

The examples of Central Bank Digital Currencies

It is important to make the difference between private cryptocurrencies used by countries (like El Salvador) and Central Bank Digital Currencies “CBDCs” . These are very different animals.

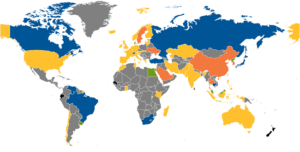

Here are the three main examples of CBDCs: China, Russia and The Bahamas.

China started working on cryptocurrencies in 2014 and is considered the leader on the introduction of a CBDCs.

China started working on cryptocurrencies in 2014 and is considered the leader on the introduction of a CBDCs.

- Beijing has already rolled out a pilot test of digital currencies in 4 cities, in preparation for Beijing’s 2022 Winter Olympics.

- The Digital Currency Electronic Payment will be a legal tender. It bares no interest. It is fungible to regular currency.

- The Deputy Governor of the Chinese Central Bank talked about the benefits of a “controllable anonymity“, where the central bank can catch illegal activities. It will “help combat money laundering, gambling and terror financing caused by standard crypto currencies”. The Uighurs will certainly read between the lines.

- Meanwhile, China has started cracking down on crypto-mining under the argument of its carbon emission target.

- Not only did all cryptocurrencies plunged (30% in a day and 50% in a week), but there was also a plunge in the overall hashrate (the production rate of bitcoin) has followed; 50-65% of all cryptos are mined in China.

- The exodus of miners towards other nations & states with cheap electricity has started; every electricity provider has received the phone calls… Texas is actually a leading contender with its pro-friendly governor and its energy resources (building construction regulations aside).

Russia‘s Crypto Ruble was commissioned in 2017.

Russia‘s Crypto Ruble was commissioned in 2017.

- It will be tested in 2021 and offered to individuals in 2022.

- Issued by the Russian central bank, it will not be mined.

- It will have the same price as the usual Rubble.

- A economic advisor to Putin stated that “this instrument suits us very well for sensitive activity on behalf of the state. We can settle accounts with our counterparties all over the world with no regard for sanctions.” In other words, Russia’s currency, whose transactions are encrypted and untraceable, is constructed to avoid international restrictions.

- In the meantime, crypto-miners must be registered and any ICO must registered (understand ‘only friends will be allowed’). Trading platforms are banned. The use of monetary surrogates can be punished with 6 years of imprisonment.

The Bahamas was in fact the first country to issue a digital currency, the sand dollar, in October 2020. It sounds like a job done well:

- The sand dollar is fungible to the Bahamian dollar.

- In its first phase, it was used only between banks/credit unions, allowing them to strengthen their KYC, compliance checks and multi-factor authentications. It was then offered to individuals in December 2020. The infrastructure will be progressively released until mid-2021.

- Transactions are encrypted for security, but not anonymous.

- Remote islands will now gain access to banking.

- The robust infrastructure will survive hurricanes, and permit a faster reconstruction at the next disaster.

- The Eastern Caribbean Central Bank followed with a similar currency a few weeks later. There are talks of a similar pan-African cryptocurrency.

CBDCs vs. cryptocurrencies

So what are cryptocurrencies? Bitcoin, Ethereum and the other cryptos

- are not methods of payment like Venmo, which transfers cash from one bank account to another.

- But they are not currencies either.

- They are programs, issued by private companies, allowing you to transfer value around the world in minutes.

- Transactions are not maintained in central ledgers, but on distributed ledgers around.

- Miners are competing to add transactions to the ledgers through the mining process.

The drawbacks of that technology are well identified:

- Counterparty risks: To enter the market, you need to deposit cash at an exchange or at a trading application. These entities are loosely regulated; they go bust; their managers may be fraudulent. Good luck then collecting your monies back from Gibraltar. Litigation attorneys in my network receive those desperate calls every week.

- You may lose the encryption key to access to your wallet. How do they call a book which is not at its proper place in a library again? A lost book. Same concept. At the current valuation, memory loss can be really expensive.

- Worse, fraudsters accessing your phone through SIM theft or phishing gain also access to your wallet. Say goodbye to your crypto assets.

- They are volatile – typically 80% annualized vol for BTC. That is partially due to the lack of fundamental value, which means that sentiments and ‘people’ guide their price. The volatility is surely not encouraging users.

- Cryptos are supposedly untraceable (despite the FBI’s recent Colonial Pipeline recovery). That particularity makes it a funding boon to fraudsters, ransom-seekers and terrorists.

- The lack of sovereignty and supervision is actually the purpose of the “DeFi” (decentralized Finance) movement…

- Needless to say, pumps-and-dumps and manipulations abound. Enforcement divisions have a tough time enforcing discipline in a world both unregulated and decentralized… It is a jungle out there.

The pressure for Central Banks to issue digital currencies.

The US Federal Reserve is also building and testing a hypothetical design. It would again be an electronic version of the existing dollar, with different means of transfer.

The US Federal Reserve is also building and testing a hypothetical design. It would again be an electronic version of the existing dollar, with different means of transfer.

There are some important economic considerations that comes with a digital dollar. The main one is that the money would implicitly be deposited at the Fed. This is significant, because

- It would shun financial institutions from depositors,

- therefore reduce the impact of monetary policies onto financial institutions.

- Meanwhile, these banks and savings institutions could lose a significant part of their funding.

But besides bad actors evading sanctions, there are good reasons for Central Banks to issue their own digital currencies:

- The government would not need middlemen to reach out to individuals – like to make a covid stimulus payment. That doesn’t reassure everybody…

- Individuals know that their savings, stored at the Central bank, are safe. No credit risk.

- The patchwork of programs to settle and transfer money could be replaced with a centralized and cheaper infrastructure.

- The government would have a better understanding of the overall economy.

- Money-laundering, terrorist financing and bad actors would be hindered.

- Banking would become possible for the poorest.

- But banking institutions would be less necessary too…

- If the central bank pays interest to the depositors, its economic policies will actually have a better effectiveness onto consumers and companies.

But if central banks do nothing and cryptocurrencies gain in popularity, the assets will eat the the power held by central banks.

Should countries issue digital currencies?

So, should countries issue digital currencies? Probably. But not all for the same reasons. Bad countries jump at digital currencies to escape the friction met by their unsavory goals. Wise countries can take advantage of a system well-built. It just has to be done properly.

Mr. Jerome Powell has stated that “we do think it is more important to get it right than to be the first.”

Indeed.

References

- Financial Times, January 1, 2018: Putin considers ‘cryptorouble’ as Moscow seeks to evade sanctions

- Coindesk, Jan 2, 2018: Putin Investigating ‘Cryptorouble’ as Way to Avoid Western Sanctions

- Wall Street Journal, February 20, 2018: Look Out Bitcoin: Venezuela Launches its Own Cryptocurrency

- Reuters, August 30, 2018: Special Report: In Venezuela, new cryptocurrency is nowhere to be found

- Wall Street Journal, April 20, 2020: China Rolls Out Pilot Test of Digital Currency – WSJ

- Wall Street Journal, October 19, 2020: Fed Takes Cautious Approach to Possibly Issuing Digital Currency

- Wall Street Journal, October 21, 2020: Why Central Banks Want to Create Their Own Digital Currencies Like Bitcoin

- Wall Street Journal, June 9th, 2021: El Salvador Becomes First Country to Approve Bitcoin as Legal Tender

- The Verge, June 9, 2021: Bitcoin will soon be an official currency in El Salvador

- Eurasianet, July 2, 2020: Perspectives | Why Moscow is embracing decentralized tech

- Coindesk, September 25, 2020: The Bahamas Reveal Details, October Date of Landmark Central Bank Digital Currency Debut

- Coindesk, October 21, 2020: Central Bank of Bahamas Launches Landmark ‘Sand Dollar’ Digital Currency

- Wall Street Journal, October 21, 2020: Why Central Banks Want to Create Their Own Digital Currencies Like Bitcoin

- CNBC, March 4, 2021: China has given away millions in its digital yuan trials. This is how it works

- CNBC, June 15, 2021: China’s bitcoin miner exodus

- BBC, June 17th, 2021: World Bank rejects El Salvador request for Bitcoin help