PwC released its annual Crypto Hedge Fund report, which contains numerous interesting statistics – fees, size, investor source, strategies, liquidity, performance…

PwC released its annual Crypto Hedge Fund report, which contains numerous interesting statistics – fees, size, investor source, strategies, liquidity, performance…

Here are the main takes:

- There are ~200 crypto hedge funds, managing $3.8 bn of crypto assets. The typical fund has $20 AUM and 23 investors.

- The investors are 85% UHNW/FamOff, with a typical ticket size of $0.5-1 m. Fund of funds are a distant 4%.

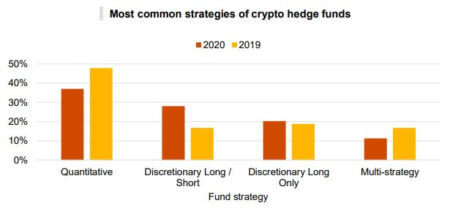

- The most common approaches are

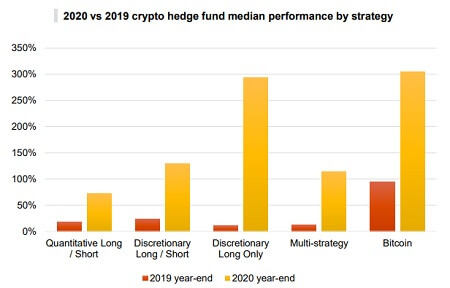

- As of year-end 2020, the performances (very dependent on crypto levels) are

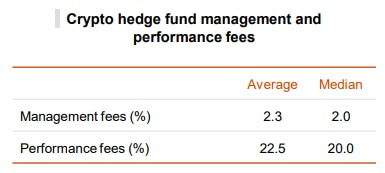

- The fees are above 2 & 20%, well above today’s HF industry averages, but still insufficient to make most fund viable, considering the small AUMs:

- The fees are above 2 & 20%, well above today’s HF industry averages, but still insufficient to make most fund viable, considering the small AUMs:

- Most funds are involved in Staking, Lending & Borrowing cryptos.

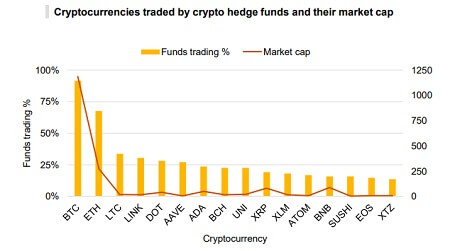

- The trading is concentrated in few currencies. To a few exceptions, most of these have trading volumes way larger than their market caps.

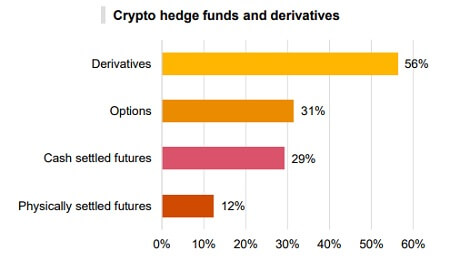

- Most funds now use derivatives:

- Half the funds (51%) are using leverage.

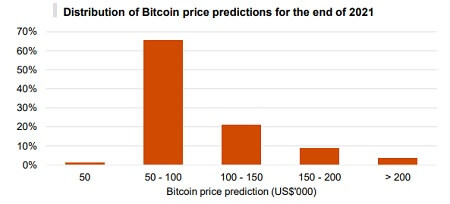

- As of December 2020, BTC was hovering around $29k. Most HF managers were targeting a price of $50-100k for Dec 2021, if not much higher. As of now BTC is worth ~35k.

- Crypto hedge funds typically have a team of 6-8 people.

- Most funds (81%) have a separate custodian, 88% use and independent fund administrator, but only 38% have an independent director on their board. 38% use independent third-party research.

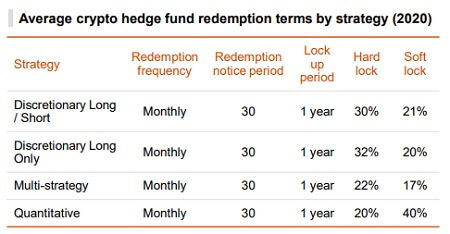

- Most of the funds offer monthly liquidity, but lock-ups are frequent:

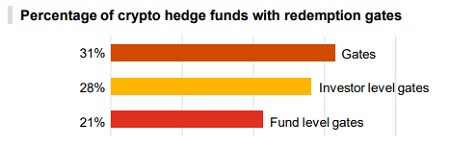

- And so are gates (liquidity restrictions at the aggregate fund or investor levels):

- Crypto hedge funds have all the tax issues met by hedge funds, but crypto have specificities, notably the diversity of jurisdictions and tax exposures (different strategies have different taxations).

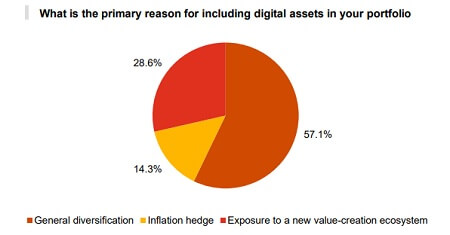

- Hedge funds invest in crypto for diversification first.

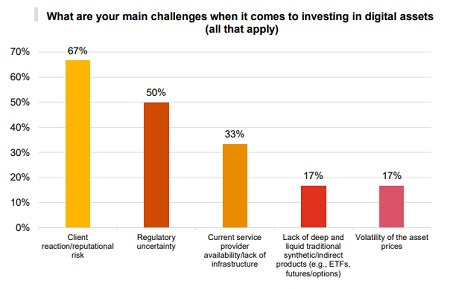

- The main challenges for the industry remain the reputational risk, the regulatory uncertainty and the lack of service providers.

- 80% of hedge funds surveyed do NOT invest in crypto currencies. And 75% of those are waiting for the class to become more mature. 57% do not foresee any investment in crypto in the next 3 years.

Reference:

- PwC/Elwood partners, May 2021: 3rd Annual Global Crypto Hedge Fund Report 2021