We now have an explanation of the XIV mispricing on Volmageddon day of February 5th, 2018.

We now have an explanation of the XIV mispricing on Volmageddon day of February 5th, 2018.

The issue will probably have regulatory consequences for index providers.

What happened then

Our previous white paper, Don’t Touch the VIX! Oops, explains

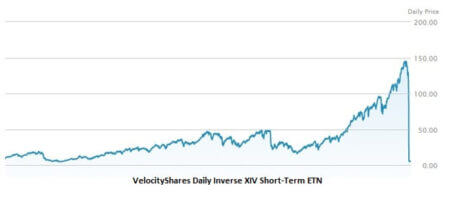

- that reverse ETFs replicate every day the variation of the underlying assets in their daily performance, and are underperforming the asset in the long-term as a reults,

- that the short vol strategy has been very valuable over the last few years, but it was not always the case,

- that the VIX is a poor choice of asset for a reverse ETF because of its large and documented gaps,

- how ETF market-makers rushed to the door on February 5th and created Volmageddon, simply because they all needed to rehedge their book at the same time; the liquidity was not sufficient,

- and how the XIV reverse ETF managed to lose 96% of its value in the space of a few hours as a result:

The miscalculation

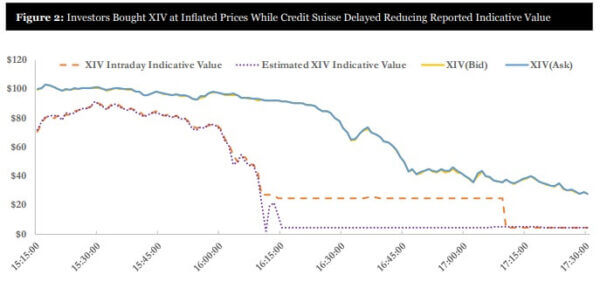

On top of the inherent complexity and risk of the product, there was an additional complication. That day, the value of the ETF was not well calculated, exactly at that critical moment.

SLCG has a good report on the issue. It explains that the ETF calculation was frozen between ~16:00 and 17:09:

Many investors relied on that calculated and published price for their investment decision. The inaccuracies cost some investors millions (literally).

The next day, Credit Suisse redeemed (“accelerated”) the note, preventing investors from ever re-gaining from the VIX retracement, although by its nature, the note would never have regained much (it deleveraged on the close at the same time).

What we have recently learned

Credit Suisse, the issuer and market-maker of the note, was responsible for its published price, but it had delegated that calculation work to an independent professional – S&P Dow Jones Indices.

S&P Dow Jones, like any index provider, calculates thousands of indices, of which the Dow Jones Industrial average and the S&P 500, for a fee. It then distributes the resulting prices to market data disseminators like Bloomberg and Reuters.

S&P Dow Jones, like any index provider, calculates thousands of indices, of which the Dow Jones Industrial average and the S&P 500, for a fee. It then distributes the resulting prices to market data disseminators like Bloomberg and Reuters.

In that function, index providers sustain trillions of derivatives prices. They are ubiquitous in the investment industry.

The SEC has just released a settlement announcement, in which S&P Dow Jones agreed to a $9m no-fault settlement. We have now learned WHY the instrument was not calculated correctly:

- a fail-safe prevented the release of prices if the asset has been moved by ‘too much’.

- that day, that ‘auto-hold’ feature was not released for an hour.

- S&P did not release the ‘auto hold’ mechanism because it was too short-staffed at the time to properly handle all the calculations.

The regulator’s view

One of the SEC commissioners, Ms. Hester Peirce, actually issued a dissenting statement on the settlement, which explains that:

Credit Suisse was not aware of the auto-hold feature. They learned of it during a call with S&P Dow Jones later that day.

Credit Suisse was not aware of the auto-hold feature. They learned of it during a call with S&P Dow Jones later that day.- Credit Suisse had the right to accelerate the note, even if crystalized the investors’ losses.

- S&P was not offering or selling any product to the public, and therefore had far fewer responsibilities.

- It probably should have disclosed teh autohold featire to Credit Suisse before the events, but that is not ‘deception’ as in 17(a)(3).

- The case falls into a situation where nobody is truly at fault. The regulations just didn’t cover that specific situation, and they are not meant to be.

Interestingly, the commissioner makes a suggestion for additional regulation:

This enforcement action may hint at a deeper, unspoken concern that index providers, whose products have become so integral to our securities markets, are not governed by a regulatory framework explicitly tailored to their activities. I am open to exploring the need for and propriety of such a framework. An enforcement action, however, is not a substitute for doing the hard work to determine whether a regulatory framework for index providers is appropriate and, if so, what it should look like.

The pressure for regulation of index providers

In its last article, US regulatory scrutiny of index providers mounts, the Financial Times refers to the mounting pressure for regulation of index providers, as a form of investment advisory. Such rules exists in other jurisdictions (UK), but lacks in the US.

We should mention the excellent research piece, Advisers by Another Name, by Adriana Robertson at the University of Toronto and Paul Mahoney at the University of Virginia on this topic.

The content of this academic piece is actually explained in our own note, Should index providers have oversight? which highlights the issues at stake:

- Index providers have discretion and large market impact on index compositions.

- They indirectly manage trillions of assets through their indices.

- The indices are actually often purpose-built for a portfolio manager‘s specific investment objective.

- There is a potential risk for self-interest decisions, which invites corruption, front-running, insider trading, or pressure by third-parties.

- Some funds are falsely marketing themselves as ‘passive’, while their control on the index calculation actually makes them ‘active’.

- Regulating index providers as Investment Advisors would therefore give more clarity and predictability on the role and responsibilities of the index providers, with minimal compliance costs.

- The acadmic article then explains which piece of regulations would be particularly relevant.

Will we soon see new regulations for index providers? That seems likely.

References

- Navesink International, March 2018: Don’t touch the VIX! Oops.

- SLCG, March 12, 2018: Material Misrepresentations in XIV’s Prospectus Led to $700 Million in Losses

- Virginia Law and Economics Research paper, Paul Mahoney & Adriana Robertson, January 15, 2021: Advisers by Another Name

- Navesink International, February 23rd, 2021: Should index providers have oversight?

- Securities Exchange Commission, May 17, 2021: SEC Charges S&P Dow Jones Indices for Failures Relating to Volatility-Related Index. Credits to Joshua I. Brodsky, Armita S. Cohen, and Daniel L. Koster (Complex Financial Instruments Unit), Matthew O. Koop (Market Abuse Unit), Thomas Bednar and David Misler (Enforcement Division’s Trial Unit) and Jeffrey P. Weiss.

- Hester Peirce, Securities and Exchange Commission, May 17, 2021: Statement on S&P Dow Jones Indices LLC

- Financial Times, May 18, 2021: US regulatory scrutiny of index providers mounts (also below).