Non-fungible tokens, aka NFTs, aka digital works of art traded through blockchain, constitute a new asset class. The trading volumes have grown significantly (with more value traded in the last month than in the entire year before), and they are garnering a huge public attention.

Non-fungible tokens, aka NFTs, aka digital works of art traded through blockchain, constitute a new asset class. The trading volumes have grown significantly (with more value traded in the last month than in the entire year before), and they are garnering a huge public attention.

This article reviews their nature, their legal & regulatory difficulties, pinpoints extreme examples, highlights their volatility and more importantly, asks how a digital economy could be constructed around these loosely regulated assets.

What are NFTs?

Quinn Emmanuel has written an excellent piece on the nature and the legalese around NFTs. This is their nature:

- NFTs or “non-fungible tokens” are digital files on a blockchain.

- The shared object is a digital object: a picture, a song, a video, although shoemakers have started selling digital versions tied to physical objects.

- They are “non-fungible”: their tokens are not exchangeable for another. You can’t exchange a picture from Artist A for a song of artist B, nor even the various tokens of a given piece of art if it has a fractional ownership.

- The original file is available online. It can be seen, but never edited or deleted.

NFTs became instantly famous when the first auctioned NFTs reached incredibly high prices. The overall price for “Beeple, Everydays – The First 5000 Days“, the first NFT sold at Christie’s was $69 million (March 11, 2021).

NFTs became instantly famous when the first auctioned NFTs reached incredibly high prices. The overall price for “Beeple, Everydays – The First 5000 Days“, the first NFT sold at Christie’s was $69 million (March 11, 2021).- NFTs allow individuals to sell their pieces of art, in fractions, and more importantly away from middlemen (art galleries notably).

- Each time a token is sold, the trade is recorded on the chain for eternity in the blockchain, usually Ethereum.

- The transaction may also force the parties to the trade to pay a percentage to the initial creator or seller of the piece.

- Many crypto-millionaires have invested into NFTs.

- Some artists have complained that their art has been tokenized without their consent.

Some NFTs are actually based on (referring to) other artists’ work. For instance, a print from Banksy was burned on camera. The video of the destruction was turned into an NFT, which attracted 10 times the price of Banksy’s print.

Some NFTs are actually based on (referring to) other artists’ work. For instance, a print from Banksy was burned on camera. The video of the destruction was turned into an NFT, which attracted 10 times the price of Banksy’s print.

The legal issues around NFTs

As for the legal issues,

Claims by holders of rights in Underlying works

Many artists don’t appreciate that their work becomes “minted” into NFTs without their consent. Some market places have stopped the trading of such infringement-related pieces, but artists often resort to litigation, as they normally own the copyrights of their work.

Copyright ownership isn’t straightforward. If the artist was commissioned for the piece, the art becomes “work for hire”, and its rights belong to the commissioner. DC Comics has notably forbidden freelancers to sell NFTs on their heroes.

Other legal issues include if minting an NFT a ‘fair use‘, if the NFT is protected by the 1990 Visual Artists Rights Act, and if ‘name-and-likeness‘ rights do apply.

Claims by Buyers of NFTs

Claims by Buyers of NFTs

Here are some of the claims & risks buyers of NFT may be exposed to or consider:

- The scope of rights included in the acquisition of the NFT may not be entirely clear. Others may still be able to download, view, or listen to the work that was minted into the NFT, with or without profit for the holder of the NFT.

- Buyers of NFT do not gain rights to the underlying work.

- Other versions of NFTs related to the same artwork may come at a later date.

- Buyers may have been misled about the nature and limitations of their purchase (fraud, breach of contract).

- Art forgery still exists. If the blockchain technology should protect the NFT owner, the underlying art may be fake. Due diligence on the NFT is still required anyway.

- The NFT market may become exposed to price manipulations (wash trading, pump-and-dump, etc.).

- Like all dematerialized assets, the holder’s account may be hacked, or their access code lost (one user already losing 150k$ of Beeple worth). Insurance may not cover such situations.

Regulatory Issues

Some regulatory framework on NFTs exists already. It will surely grow.

- NFTs are subject to compliance and trade regulations, money laundering, and bribery laws.

- These laws may be American, global or foreign.

- The OFAC has already confirmed in October 2020 that NFTs are covered by their asset freeze, and do not benefit from the IEEPA or TWEA exceptions.

- There are financial reporting rules for the transactions (FINCEN), as well as recordkeeping obligations.

The NFT market is NOT crashing

The recent Beeple $70m sale has attracted a LOT of attention. It is fair to say that there is a craze about NFTs. Naturally, sugar highs are usually followed by some cooling periods, like the one we have seen in the last month.

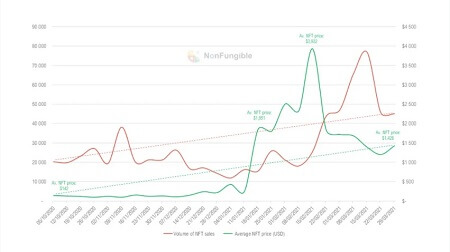

The website NonFungible.com (no doubt unbiased), confirms that the market for NFT may have gone down since the sale of Beeple’s piece, but that NFTs are far from a crash, IF you look at the long-term trend:

I don’t know about art much, but in my modest opinion a 70% plunge of any asset would qualify as a “crash” in financial market terms…

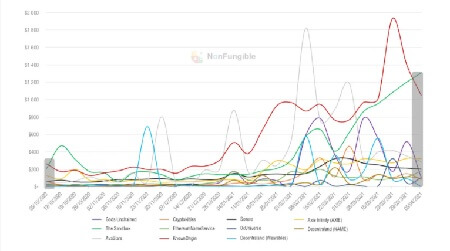

Looking at what the website define as digital art is a bit scary:

“CryptoPunks” are 24 x 24 pixel gifs of punky faces, which were generated algorithmically by Larva Labs. 10,000 of these faces were minted in 2017. Believe it or not, the most expensive is currently worth $7,678,482. At least tulip bulbs had some economic value – you could plant them.

“CryptoPunks” are 24 x 24 pixel gifs of punky faces, which were generated algorithmically by Larva Labs. 10,000 of these faces were minted in 2017. Believe it or not, the most expensive is currently worth $7,678,482. At least tulip bulbs had some economic value – you could plant them.- “SuperRare” is a set of digital and unique pieces. The most expensive is Death Dip, a gif currently valued at $1,733,580. It’s not the most liquid asset… the exchange indicates that the art piece has changed hands only twice in its entire life.

- Cryptokitties are digital cats, which can be bred to create new cats, of mixed genetic patrimony.

- And so the various ‘asset classes’ have their trading volumes, their average price…

- Except that they do not include Christie’s art sale…

I am sorry, but that looks so amateurish, so bubble-y, and so toppish. Considering tiny icons as collectible forms of art? The first such digital documents ever created and minted may get into a museum, but the many thousands invention behind, probably not. It would surely explain why NFTs actually became the butt of the joke in a recent Saturday Night Live sketch.

The NFT market IS crashing

Several articles and art professionals surely perceive that the current correction has a fundamental substance.

Verisart is an exchange where artists can exchange their art against a certificate, which is then minted on Ethereum. The exchange requests that buyers and sellers share a fraction of their trade as royalties to the original author. Robert Norton, one of the co-founders, is the first one to believe that “The froth and excitement wasn’t sustainable at the levels we saw in February and March.” Although art’s new popularity (popularization) is surely a benefit for the public and artists, Mr. Norton is also “concerned that the conversation is less about the art and more about the transaction.”

Verisart is an exchange where artists can exchange their art against a certificate, which is then minted on Ethereum. The exchange requests that buyers and sellers share a fraction of their trade as royalties to the original author. Robert Norton, one of the co-founders, is the first one to believe that “The froth and excitement wasn’t sustainable at the levels we saw in February and March.” Although art’s new popularity (popularization) is surely a benefit for the public and artists, Mr. Norton is also “concerned that the conversation is less about the art and more about the transaction.”- Bloomberg reports that Metapurse, a fund acquiring digital artworks and reselling units of its collection on Ethereum, saw its unit token price drop by 80% since the Beeple auction [Metapurse bought Beeple’s $69m NFT].

- NBA Top Shot, a trading platform for video trading cards, saw the total value of its market punge from $1.85 bn to $1.09 bn from the beginning to the end of March. The firm behind the platform nevertheless announced a $300m round of funding for a new set of assets, which is expected to sell in minutes.

The adult in the room

The adult in the room

The Hifi blog certainly asks some very good points:

- The volumes of NFT sales is likely to continue grow at a rapid pace.

- DeFi or ‘Decentralized finance’ is the financial market growing away from financial intermediaries like brokerages, banks, and exchanges with the use of the blockchain technology. It is probably the future. You can now buy a collection of music albums or domain names as NFTs.

- But you still can’t bring a piece of art NFT as a collateral to a loan. Jewelry, golf club memberships, event tickets, future revenues are accepted, but bitcoins still aren’t. So will there be reduction in the gap between ‘decentralized finance’ and the art asset class?

- The massive audience NFTs attract (just Google NFT news…) is not enough for financial institutions, because these digital assets cannot be valued away from their original exchange of origin. A tangible value obtained from multiple sources is required for collateralization.

- Art may not be the best asset to bring in digital form as collateral, because beauty is subjective by nature, and building a new economy on immaterial value would be the mother of all bubbles.

- At this stage, there is no doubt that “buyers are largely overpaying for the novelty and the exclusivity of owning the NFT. Novelty is hard to appraise.”

- So could there be a convergence between digital art and regulated financial markets?

Hifi’s second article brings good solutions for such a convergence:

- We can put limits on the collateral value,

- The trading community of origin of the asset may have authority and set rules on how an asset should be valued (voting rights?)

- We can implement a process to find liquidity for an asset in its trading community of origin.

Back to reality

Well, these very interesting suggestions actually exists in the world of modern market finance:

- Putting a limit on collateral value is called a “haircut” in financial market parlance.

- The trading community setting up its rules would be the exchange as “Self-Regulated Organizations” and seat holder (originally) having influence on the exchange’s big decisions.

- Finding liquidity among the community is called a liquidation and a closing-out-mechanism it is a process found on all derivatives exchanges to reduce counterparty risk.

To which I will add, that among the reasons exchanges are so successful at eliminating counterparty risk, you will also find:

- the high level of financial capital required from participants,

- margins, and

- the introductions of clearers.

In other words, we can bring the rules and techniques of modern financial markets to the world of decentralized finance. That would be called regulating the NFTs and the cryptocurrencies. But wouldn’t that defeat the agenda of the libertarian supporters of ‘Decentralized Finance”?

And my little finger tells me that it will happen.

References

- Quinn Emanuel Urquhart & Sullivan, in JD Supra, March 25, 2021: NFTs: Legal Risks from “Minting” Art and Collectibles on Blockchain

- HiFi, March 30th, 2021: The path to collateralized digital assets

- Bloomberg, Brandon Kochkodin, March 31st, 2021: NFT Mania Subsides After Breakout Month of Sales

- NonFungible.com, April 6th, 2021: Sorry… No NFT market crash so far!

- ArtNet News, April 13, 2021: ‘It’s Whiplash’: After a Record-Setting Run, NFT Artwork Prices Have Plummeted Nearly 70 Percent in Four Weeks

- Hifi, April 14th, 2021: The path to collateralized digital assets (part 2)

2 Responses

Zoë Roth sells ‘Disaster Girl’ meme as NFT for $500,000

https://www.bbc.com/news/world-us-canada-56948514