In March, our SPAC, off-the-shelf dream? article explained that SPACs are the new blank check package, as well as their large issuance volume in 2017-21, the regulator’s warnings, and the clouds on the horizons.

In March, our SPAC, off-the-shelf dream? article explained that SPACs are the new blank check package, as well as their large issuance volume in 2017-21, the regulator’s warnings, and the clouds on the horizons.

Bloomberg’s recent article SPAC Wipeout Is Punishing Followers of Chamath Palihapitiya confirms the bad omens – the followers of the big SPAC prophets have a sour aftertaste; the can’s content isn’t as savory as expected. As per the Bloomberg article:

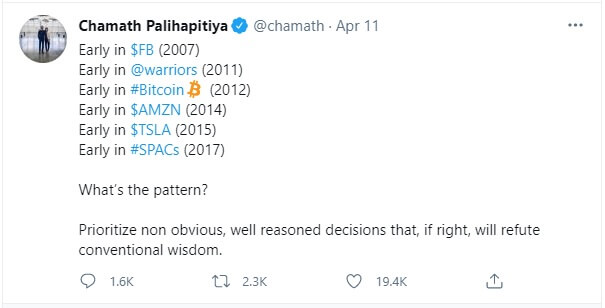

- Chamath Palihapitiya | LinkedIn enjoyed being the face of the SPAC frenzy. He challenged the wisdom of Warren Buffett (has anybody won that challenge? Some have bet and lost millions) with a “Nobody’s going to listen to Buffett” comment. And in all his modesty:

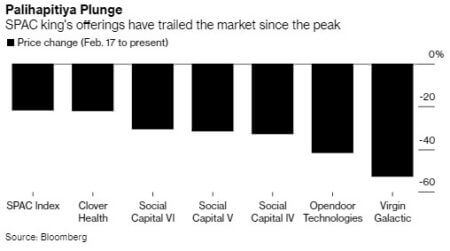

- Well, the last pattern is that all 6 of his SPACs have plunged more than the broader SPAC market.

- Chamath Palihapitiya didn’t respond to Bloomberg’s request for comments…

Credits

Bloomberg, April 17th, 2021, by Brandon Kochkodin : SPAC Wipeout Is Punishing Followers of Chamath Palihapitiya

Past pillar article

- March 11,2021: SPAC, off-the-shelf dream?